TLDR;

- 47% free cash flow margin proves Atlassian prints money faster than competitors burn it.

- Jira Service Management at $600M ARR (+30% YoY) is Atlassian’s enterprise Trojan horse.

- 1.5M AI Rovo users in one quarter shows AI can drive both stickiness and pricing power.

- Microsoft’s 36% margin vs. Atlassian’s 19% means the bundling war just got more expensive.

- Atlassian owns the “collaborative development” category, but risks losing pieces to specialized players.

- Data Center customers pay premium prices while Atlassian guides them toward higher-LTV Cloud subscriptions.

- Buy ✅ Rating: Recommended for accumulation, particularly on market dips.

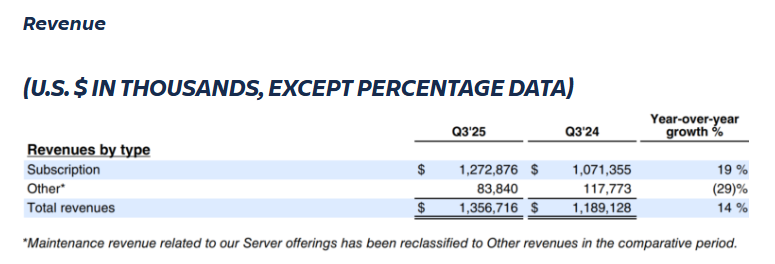

TEAM Q3 FY25 Results:

- Revenue: $1.35B (+14% YoY)

- Net Income: $261M (+12.5% YoY)

- Net Margin: 19% (+1.06% YoY)

- Free Cash Flow: $638M (+15% YoY)

- Free Cash Flow Margin: 47%

- Monthly Active Users (MAU): 1.5M

- Cash Position: $3B

How do they make money?

- Atlassian products help software, IT, and business teams plan, build, operate, and collaborate on work.

- Mission : To unleash the potential of every team

- Core Strategies:

- Product Suite :

- Jira Software – project and issue-tracking backbone for agile development.

- Confluence – workspace for creating and sharing documentation.

- Jira Service Management – IT service-desk and operations platform.

- Bitbucket, Bamboo, Compass – code repository, CI/CD, and developer experience tools.

- Trello – lightweight visual task boards for any team.

- Rovo AI – generative-AI assistants embedded across the suite.

- Marketplace – >5,000 third-party apps that extend core products.

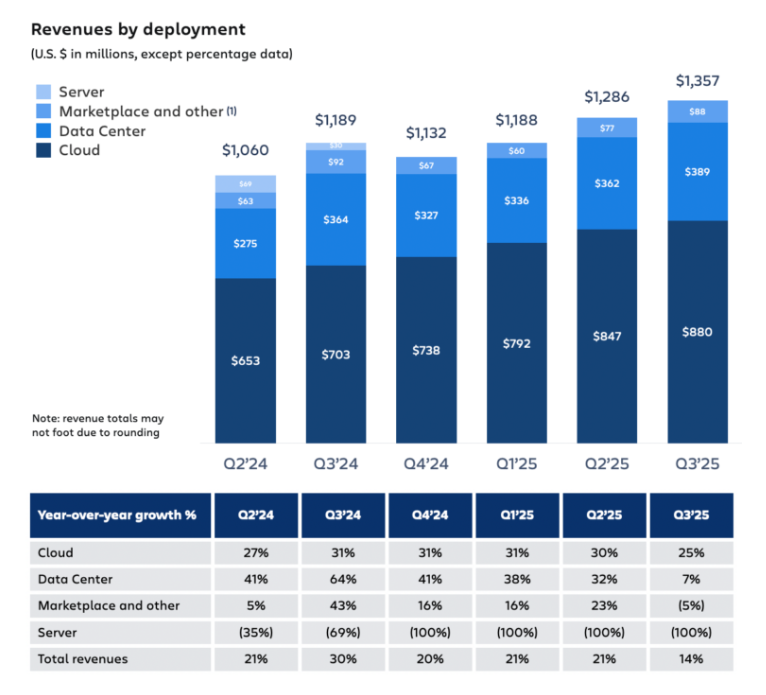

1. Cloud subscriptions

- How it works: Per-user and tier-based SaaS fees for Jira, Confluence, Trello, Jira Service Management, Bitbucket and emerging AI features (Rovo).

- Customers pay monthly or annually.

- Jira Service Management ARR: >$600 M, fastest-growing product (+30% YoY)

- Q3 2025 revenue : $1.27B (+19% YoY)

- Competitive Edge: – Deep product integration on a single platform (Teamwork Graph) lowers admin overhead.

– “Land-and-expand” model—freemium tiers and low-touch sales let seats grow virally.

– Best-in-class price-to-value versus ServiceNow and Monday.com, especially for ITSM.

2. Data Center Subscriptions

- How it works: Annual license plus maintenance for self-managed clusters, favored by regulated and very-large enterprises.

- Provides hybrid-path flexibility: customers can run DC while planning phased cloud move.

- Data center customer count : ≈38,000

- Annual term license: Up-front license plus 12-month maintenance & support.

- Q3 2025 revenue : $270M (+7% YoY)

- Competitive Edge: – Hybrid option for customers not yet ready for public cloud.

- Allows upsell to Cloud through migration incentives; keeps competitors (e.g., Micro Focus ALM, Broadcom Rally) from displacing legacy workloads.

- Migration path: Cloud Migration Assistants and dual-licensing credits enable gradual move without double-paying.

3. Marketplace & Other

- How it works: 85% commission on third-party app sales plus training/consulting services.

- Top paid categories: ITSM extensions, Reporting/BI, Automation bots

- Paying customers buying ≥1 app: ≈130,000

- Flywheel: More apps → higher product stickiness → seat expansion → bigger GMV → attracts more developers.

- Q3 2025 revenue : $82M (+5% YoY)

- Competitive Edge: – Two-sided marketplace with >5,300 apps creates lock-in and incremental ARR.

- Low-capital revenue stream (~86% gross margin).

- Low platform tax (5–15%) undercuts Apple, Salesforce, and Microsoft, positioning Marketplace as the best ROI outlet for B2B devs.

Competitor Risk Analysis

- Confluence (team wiki / knowledge base)

- Key competitor : Notion & Microsoft SharePoint Online

- Net profit margin :

- Notion still privately held (loss-making; est. −20%)

- Microsoft FY25 Q3: 36%

- Risks :

- Notion’s viral adoption siphons SMB seats.

- SharePoint remains standard in large Office 365 contracts.

- Tension points :

- Notion’s freemium + AI docs > faster land.

- SharePoint “already paid for” inside E3/E5 bundles.

- Risk of price compression on Confluence Standard.

- Jira Service Management (JSM) (ITSM / ESM)

- Key competitor : ServiceNow & Freshservice (Freshworks)

- Net profit margin :

- ServiceNow FY25 Q2: 18%

- Freshworks FY25 Q1: 7%

- Risks :

- ServiceNow dominates upper-enterprise accounts with deeper ITIL scope.

- Freshservice wins cost-sensitive mid-market.

- Tension points :

- ServiceNow expanding “Creator Workflows” into agile teams.

- Freshservice undercuts JSM pricing by ~40%.

- Rising AI-led ticket deflection narrows JSM differentiation.

- Bitbucket (git repo & CI/CD)

- Key competitor : GitHub (Microsoft) & GitLab

- Net profit margin :

- Microsoft FY25 Q3: 36%

- GitLab FY25 Q1: −4%

- Risks :

- GitHub’s network effects and Copilot AI make Bitbucket less compelling

- GitLab offers integrated DevSecOps in one SKU.

- Tension points :

- GitHub Actions + Copilot drop developer churn.

- GitLab “one-platform” pitch resonates with security buyers.

- Atlassian must maintain parity on AI code suggestions.

- Trello (visual task boards)

- Key competitor : Monday.com & Asana

- Net profit margin :

- Monday.com FY25 Q1: 9%

- Asana FY25 Q1: −5%

- Risks :

- Monday’s rapid feature velocity and enterprise push threaten Trello’s stickiness.

- Asana’s workflow automation outpaces power-ups.

- Tension points :

- Monday adds portfolio views, edges into Jira Core turf.

- Asana’s AI “work graph” touts smarter dependencies.

- Freemium overlap drives seat churn to rivals’ trials.