TLDR;

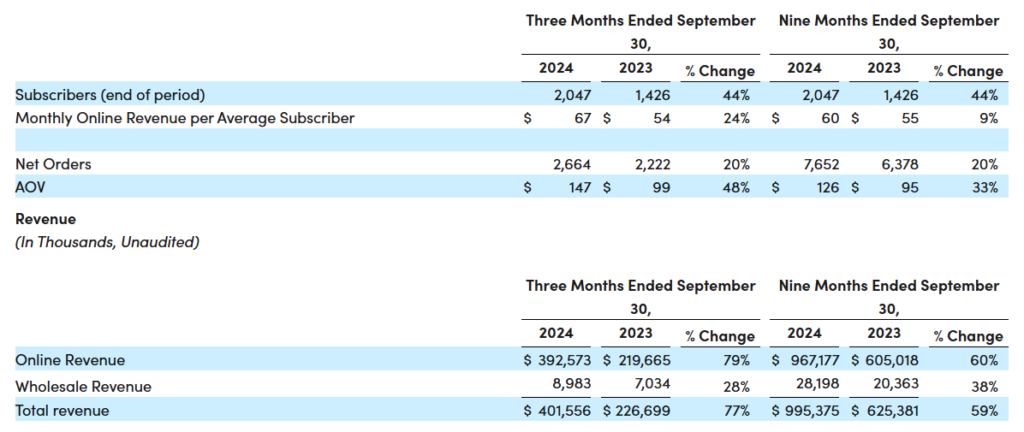

- Subscribers: 1.9 million, up 43% YoY growth.

- Personalized subscribers: 42% of subscribers (up 19% YoY).

- Monthly revenue per subscriber: $67, up 24% YoY growth.

- D2C allows $HIMS to directly connect with its customers.

- Higher scale, lower the price $HIMS can offer.

- Current PE : 70 – Not justified.

- Wait and watch.

HIMS Q3 FY24 Results:

- Payback period: Target is under 1 year.

- Total net orders: 10 million, up 20% YoY growth.

- Average Order Value (AOV): $147, up 48% YoY growth.

- Revenue: $401.6M, up 77% YoY.

- Gross Margin: 79% (down from 83% YoY).

- Net Income: $75.6M (vs. net loss of $7.6M YoY).

- Free Cash Flow: $79.4M, up from $19.3M YoY.

What do they do?

Hims & Hers is a telehealth platform offering online consultations and personalized prescriptions delivered to your doorstep.

- 👨 Hims: Telehealth platform for men’s health.

- 👩 Hers: Telehealth platform for women’s health.

- 💊 Online pharmacy: Fulfillment and delivery of medications.

- 🧴 Skincare and wellness products: A range of branded products.

- 🧪 Personalized plans: Customized plans based on individual needs.

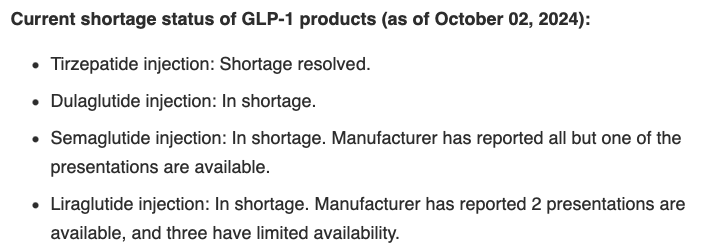

HIMS GLP-1s Fiasco

What is it?: Glucagon-like peptide-1 (GLP-1) – A medication for weight management and type 2 diabetes treatment.

- GLP-1s are still less than 10% of the business today.

- FDA Approval: Not FDA-approved; using FDA loophole for compounded drugs.

- Safety Concerns: FDA has expressed concerns about safety and efficacy.

- Compounded Version: Selling compounded semaglutide, a GLP-1 receptor agonist.

- Adverse Events: Reports of adverse events and dosing errors.

- Sales: Priced at $199/month, significantly cheaper than Nestlé’s Vital Pursuit, Ozempic (Novo Nordisk), Wegovy (Novo Nordisk) and Mounjaro (Eli Lilly).

- Supplier Concerns: Supplier, BPI Labs, has a questionable history with ties to fraud and bankruptcy.

2029 Valuation

Assumptions :

- LTM Revenue: $1.24B

- 5Y Revenue CAGR: 39.22%

- 2029 Profit Margin: 8%

- 2029 PE Ratio: 30

- Shares outstanding: 0.218B

- Shares reduction: 10%/year

Valuation :

- Q3 2029 HIMS SHARE PRICE = 1.24 * (1.39)^5 * 0.08 * 30 / [0.218 * (0.90)^5] = $117

- Using discount rate for HIMS as 9%.

- CURRENT SHARE PRICE: $31.35

- DISCOUNT RATE: 9%

- FAIR VALUE: $117 / (1.09)^5 = $76.09

- POTENTIAL UPSIDE: (($76.09 – $31.35) / $31.35) × 100% = 142.8%

- EXPECTED RETURNS: ((($117 / $31.35)^(1/5)) – 1) × 100% ≈ 9%/year

- DIVIDEND YIELD: NA

- MY RATING: HOLD 🟡 | Wait and watch.

- Current share price surge is due to resolved shortage of tirzepatide (Ingredient for GLP-1s)