TLDR;

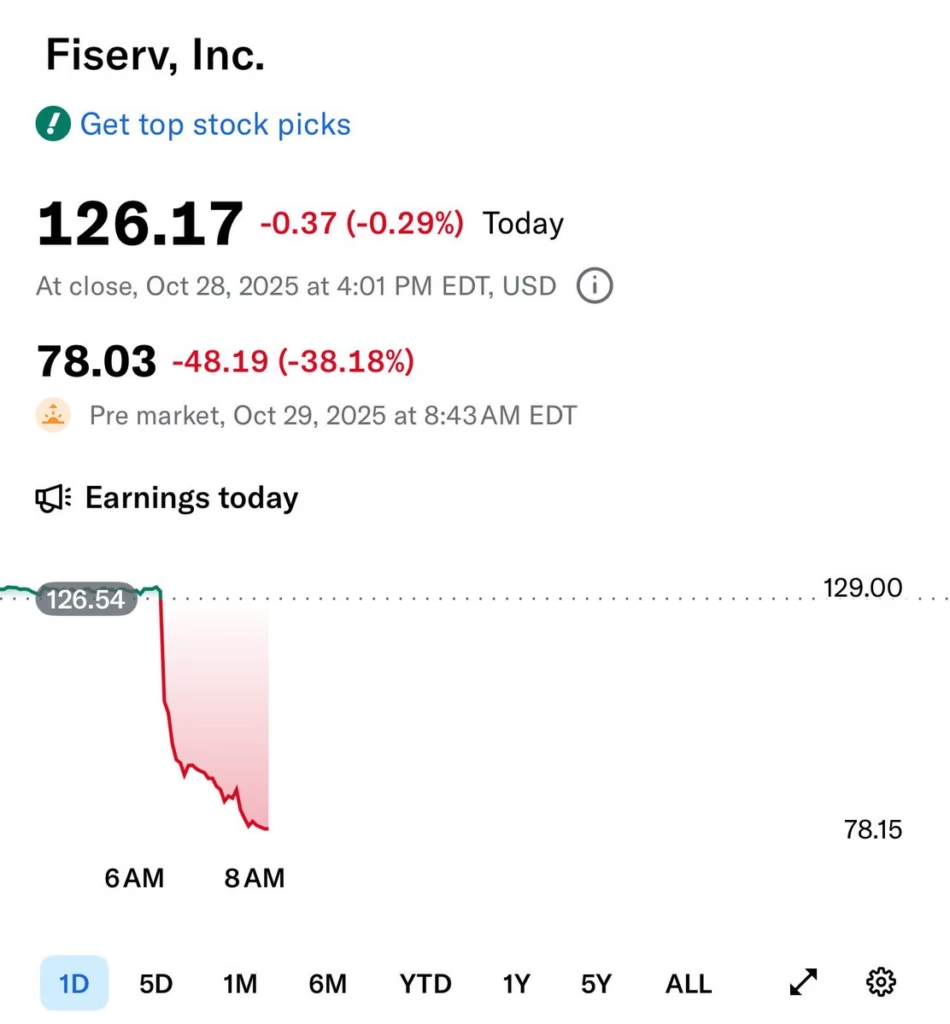

- Federal lawsuit alleges inflated growth metrics and forced Payeezy-to-Clover migrations.

- Full-year EPS guidance slashed from $10.30 to $8.60 (16.4% cut).

- Slowing growth in the Clover payments platform, a key business unit.

- Not all debt is bad debt : $4.1B is receivables – do need to keep an eye on upcoming Qtrs.

- Buying back significant amount of shares.

- Massive upside if management regains trust and executes turnaround.

- Current stock price: $66.4

- Rating: Buy ✅ | Recommended for accumulation, allocate only 3-3.5% of portfolio -high risk high reward play.

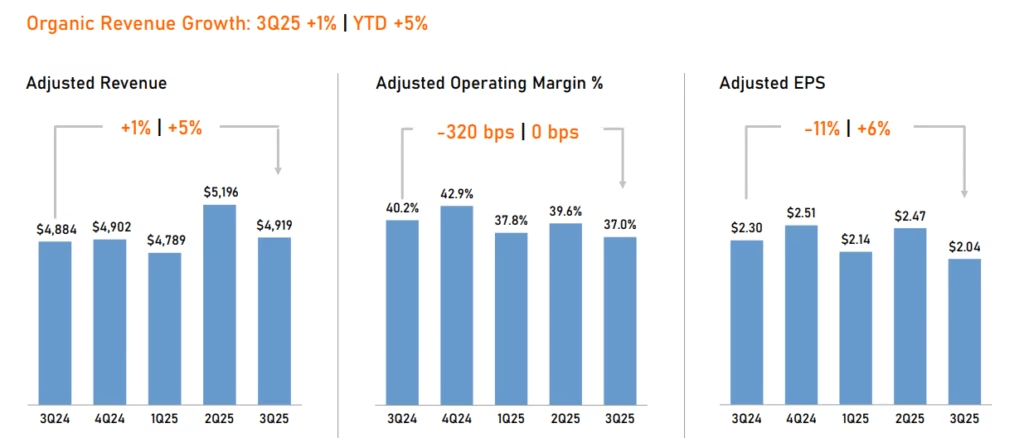

FI Q3 FY25 Results:

- Revenue: $5.26B (+1% YoY)

- Net Income: $799M (+39.9% YoY)

- Net Margin: 15.2% (+4.3% YoY)

- Free Cash Flow (9 months): $2.88B (-13.8% YoY vs. $3.34B in 2024)

- Free Cash Flow (Q3): $1.3B (-31.6% YoY vs. $1.9B in Q3 2024)

- Free Cash Flow Margin (Q3): 24.7%

- Cash Position: $1.24B

- Share Buybacks: Repurchased worth $1B

- Total Debt: $29.6B

Why is the stock in freefall?

1. Earnings Miss & Guidance Cut:

- Q3 adjusted EPS: $2.04, missing analyst expectations of $2.65.

- Revenue: $4.92B, below the expected $5.36B.

- Full-year EPS guidance slashed from $10.30 to $8.60 (16.4% cut).

- Organic revenue growth forecast reduced from 10% to 4% (60% reduction).

3. Clover Platform Concerns:

- Slowing growth in the Clover payments platform, a key business unit.

- Allegations of inflated growth figures and forced migrations from older platforms (Payeezy) to Clover, now under scrutiny in a federal class-action lawsuit.

4. Leadership Shakeup:

- CEO Mike Lyons acknowledged underperformance.

- New co-presidents and CFO appointed.

- “One Fiserv” action plan launched to reset strategy and improve execution.

How do they make money?

- Fiserv provides payments and financial services technology solutions to banks, credit unions and merchants.

- Mission: To deliver superior value for clients through leading technology, targeted innovation, and excellence in everything they do.

- Core Strategies:

- Enterprise penetration – Drive deeper relationships with Fortune 500 banks and large merchants, focusing on cross-selling multiple products across the platform.

- Clover expansion – Build the leading small business platform by growing Clover POS ecosystem and merchant base.

- Digital transformation – Help financial institutions modernize core banking and payment infrastructure with cloud-based solutions.

- One Fiserv initiative – Recently launched action plan to enhance client focus, improve execution, and prioritize high-quality sustainable growth.

- Product Suite :

- Clover – All-in-one POS system for small to medium businesses.

- Carat – Enterprise-level omnichannel commerce platform for large merchants.

- Finxact – Cloud-native, real-time core banking platform (Core-as-a-Service).

- Optis – Proprietary credit card account processing platform for issuers of all sizes.

- First Vision – Multi-currency card issuing &account management platform for credit, debit, & prepaid cards.

- One Fiserv – Cross-platform integration strategy to unify products and services across merchant and financial institution segments.

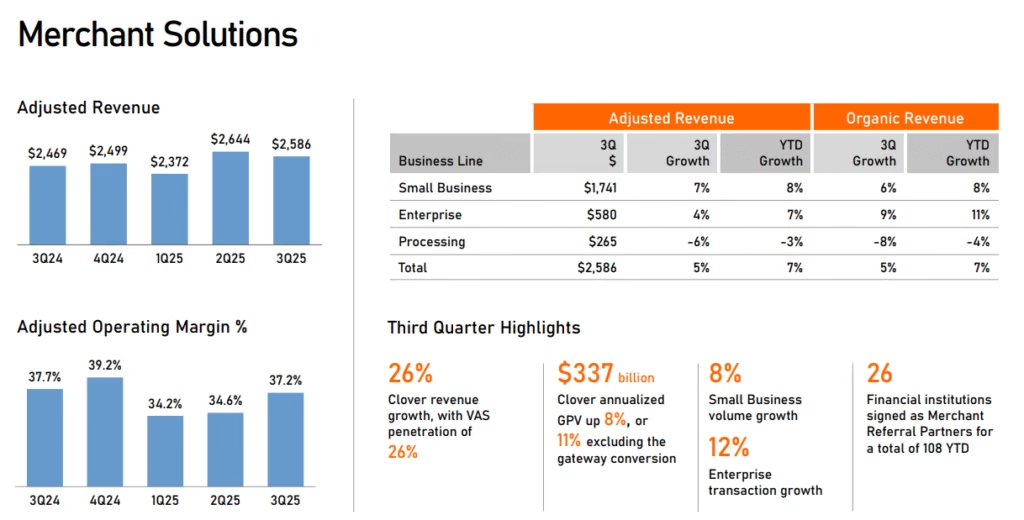

1. Merchant Solutions (Processing & Services)

- How it works: Transaction-based fees charged per payment processed, plus monthly subscription fees for Clover POS devices and software.

- Q3 2025 revenue : $2.59B (+5% YoY)

- Competitive Edge :

- Integrated Clover ecosystem with 150+ app marketplace creates high customer stickiness.

- Omnichannel unified commerce across in-store, online, and mobile channels.

- Challenges :

- Forced Payeezy-to-Clover migrations allegedly inflated growth.

- Customer backlash against fee increases caused slowdown.

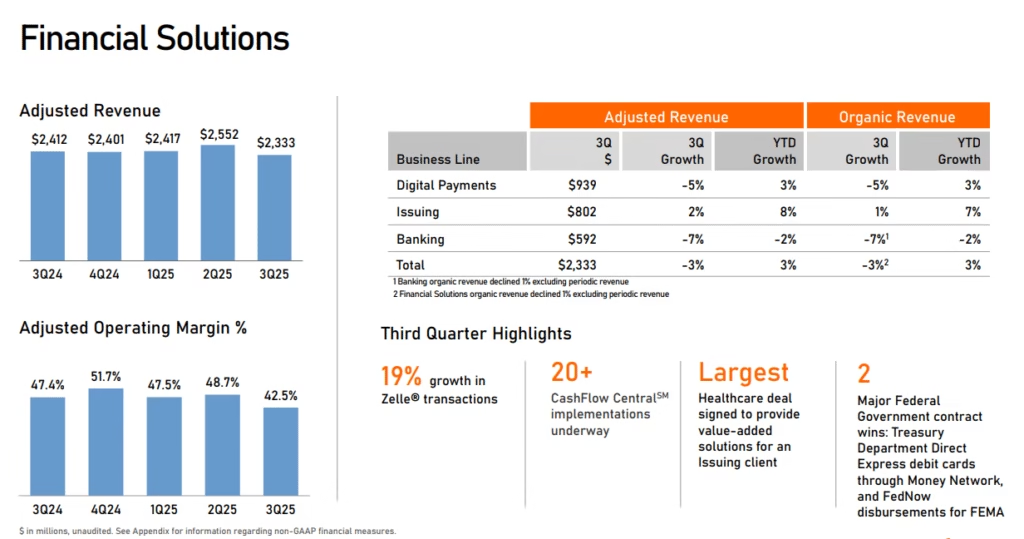

2. Financial Solutions (Software & Services)

- How it works: Recurring subscription fees for core banking software, digital banking platforms, and payment processing services sold to financial institutions.

- Annual/monthly SaaS subscriptions for banking software platforms.

- Per-account fees for core banking processing.

- Card issuance and processing fees.

- Q3 2025 revenue : Declined -3% YoY

- Competitive Edge :

- Embedded client base – Core banking systems are mission-critical and extremely sticky; switching costs are prohibitively high for banks.

- Scale and reliability – Processing billions of transactions daily with 99.99%+ uptime builds trust with regulated institutions.

- Challenges :

- Revenue decline in Q3 2025.

- Argentina operations significantly impacted by peso crisis and economic downturn.

Competitor Risk Analysis

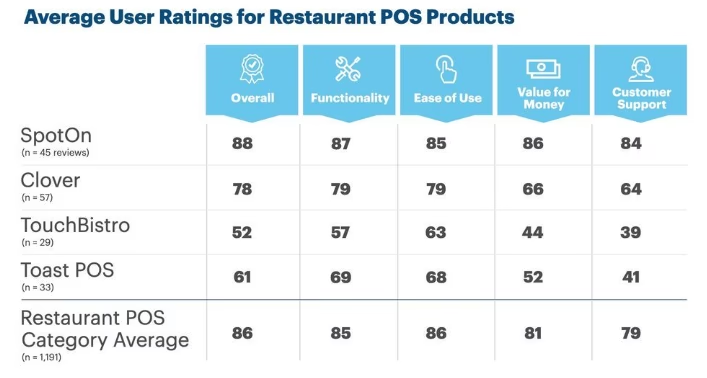

- Clover (SMB Point-of-Sale)

- Key competitors: Square (Block) & Toast

- Net profit margin:

- Risks:

- Tension points:

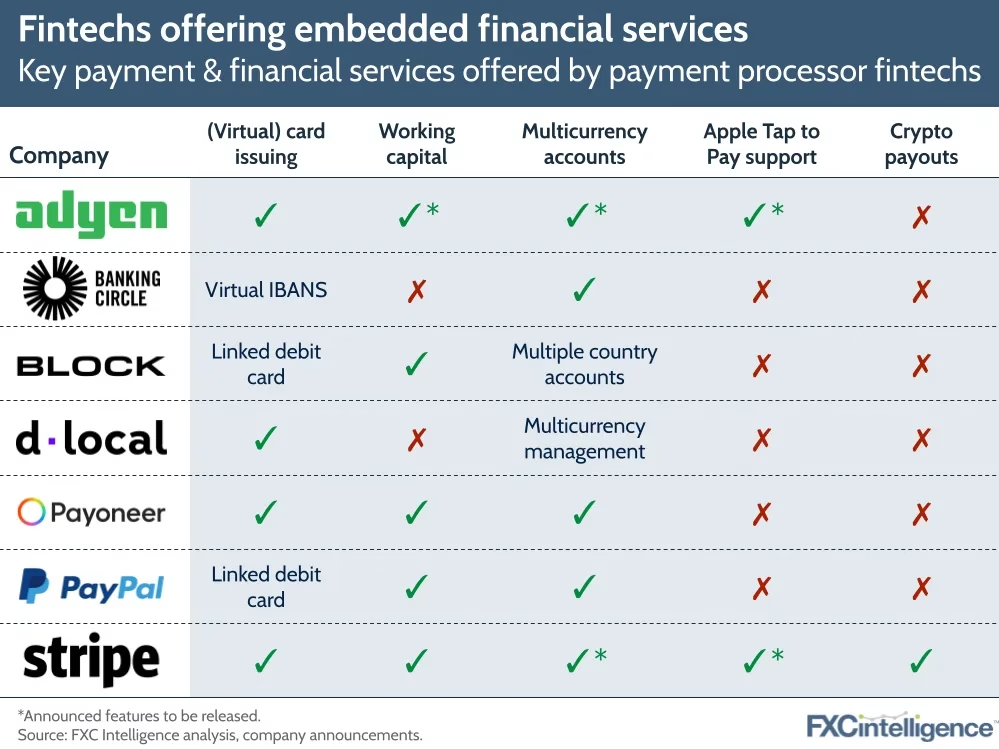

- Carat (Enterprise Omnichannel)

- Key competitors: Stripe & Adyen

- Net profit margin:

- Risks:

- Tension points:

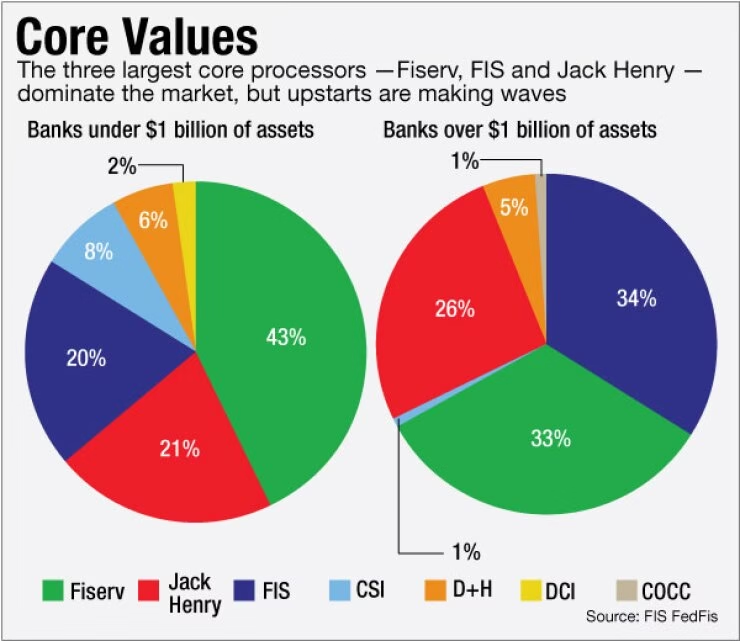

- Core Banking Platforms (DNA/Premier/Finxact)

- Key competitors: FIS & Jack Henry

- Net profit margin:

- Risks:

- Tension points:

- Card Processing (First Vision/Optis)

- Key competitors: TSYS (Global Payments) & Galileo (SoFi)

- Net profit margin:

- Risks:

- Tension points: