The Reality of Tariffs

- Nearly $6 trillion was wiped from markets in 2 days.

- Tariffs’ Impact: It has only lasting influence on market in a healthy economy(Which we don’t have).

- Current Economy: Complex web of fiscal policies, not a healthy economy.

- Currency Debasement: In our economy value of currency is being steadily eroded.

- Hence tariff threats are negotiation tactic to get better deals with other countries.

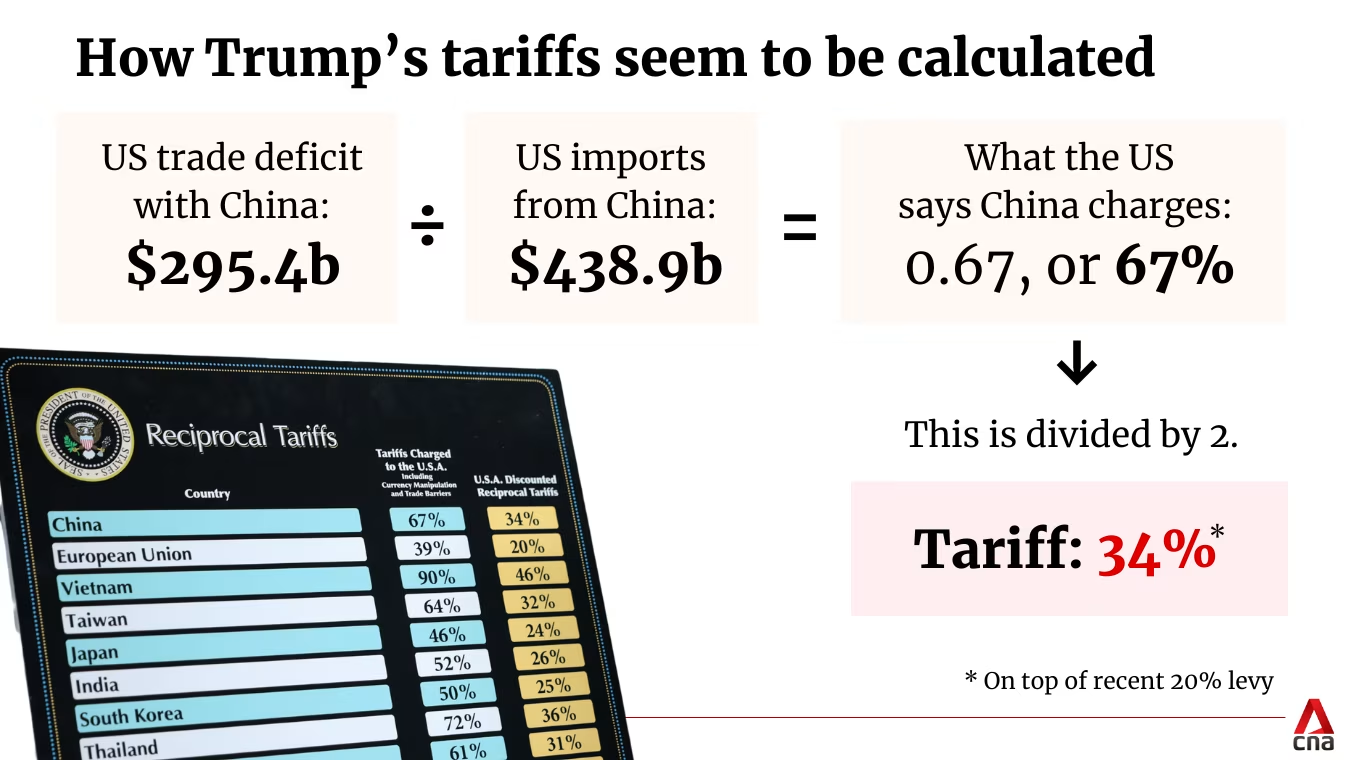

How Trump’s tariff is calculated ?

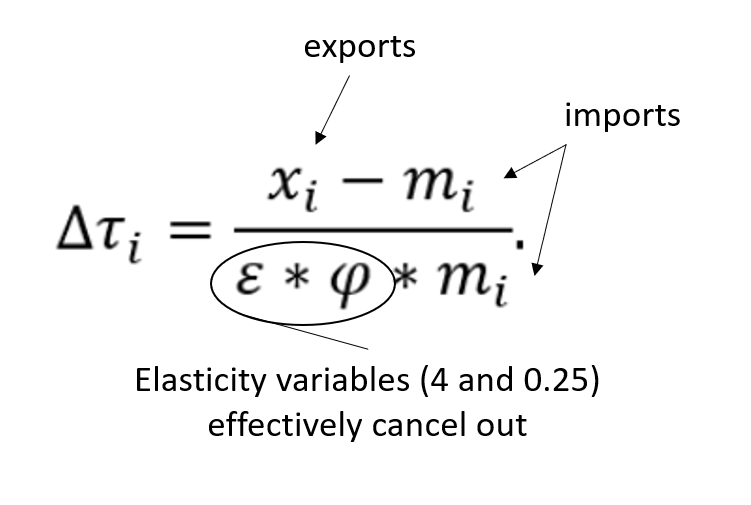

- Formula for “reciprocal” tariffs doesn’t consider a country’s tariffs at all, it just uses a country’s trade balance and assumes any imbalance is the result of a trade barrier….. Economist crying in corner

- English translation of formula :

- Trade Deficit with other country * 100 / US Imports from other country

- Trade Deficit with other country = (US Exports to other country – US Imports from other country)

- (4 × 0.25) = 1

- Example Calculation for China :

You think we have seen the worse?

- Wait until the EU also retaliates and then Trump retaliates against retaliations…

- Yes this was just the first step.

- The shakeout continues until the tariffs are settled.

- Could be months….. I believe Trump wants to get market sentiment positive again by late fall.

- Otherwise he’s at risk of losing seats in the 2026 midterm elections.

- So the turbulence could go for a few months more.

Situation

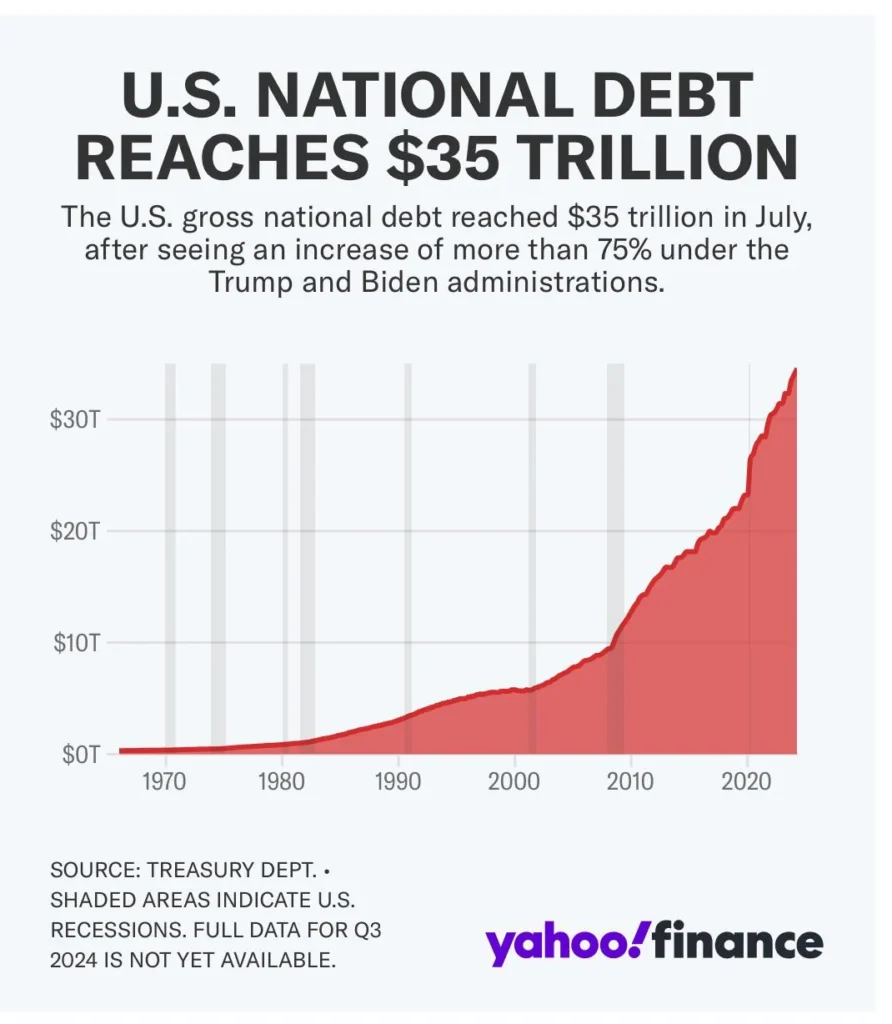

- The U.S. is $36.6 trillion in debt.

- $9.2T of that $36 trillion needs to either be refinanced or paid this year.

- Let’s examine both options and see how all roads lead to higher stock prices.

Option 1: Tax citizens to pay it off

- The government collected ~$5 trillion in taxes last year.

- Which means we’re still $4 trillion short.

- Plus, Trump is preaching zero income taxes.

- So raising taxes to collect $4 trillion more? Political suicide.

- Paying off the $9.2 trillion with taxes is off the table.

Option 2: Cut government spending and reallocate funds.

- Government can cut spending and reallocate funds such as the military, federal programs, etc.

- But that wouldn’t work either.

- Military = $900B

- Social Security = 1.4T

- Medicaid and other health insurance programs = $1.6T

- Even if I tally up all government expenditures, it still doesn’t pay off the debt.

Option 3: Print money (Quantitative Easing)

- The Federal Reserve will perform quantitative easing.

- Which is a fancy-pants way of saying they’ll print money out of thin air.

- This money will be used to purchase bonds from the US Treasury.

- This directly injects cash into the financial system.

- If the Fed creates $9.2 trillion, it’s practically impossible for stocks not to rise.

Option 4: Refinancing the debt at new interest rates

- The problem with refinancing at new rates is that interest rates are relatively high right now.

- And the US is already paying ~$1.2T in yearly interest.

- If we refinance $9.2T at current rates, that $1.2T in yearly interest would soar. Not good.

Near future probable step

- Fed will cut interest rates leading to more lending.

- Lending with low interest is how smaller banks effectively create money.

- The Short term PLAN

- Crash market on purpose

- Pressure FED to bring interest rates below 3% (Current 4.50%)

- Refinance debt ($9.2T)

- Quantitative easing (Print Money)

- Set 10% tariffs hard cap for other countries (Current 50% Reciprocal tariff)

- Market strong

- Crypto strong

- America is back humming on to an age of prosperity

- So no matter what happens, more money will be printed. Which means your assets will rise.

Real bear market

- If you’re wondering when a genuine bear market could take place….

- The most likely answer is 2026.

- We live in a global economy with 4-year debt cycles.

- The year of quantitative tightening and rate hikes worldwide is most likely 2026.

- Until then, enjoy this monumental buying opportunity.

What do I do?

- If your panicking, and thinking “what do I do?” Chances are you:

- 1. Don’t have an emergency fund.

- 2. Overexposed to equity (wrong asset allocation).

- 3. Don’t have a plan.

- 4. Don’t know what you are invested in.

- It’s okay if that’s the case, but you need to start re-evaluating and addressing it.