Lakshmi Vilas Bank Tier-2 bonds issue.

Sequence of Events

- March 2014-June 2017: Lakshmi Vilas Bank issues three tranches of unsecured non-convertible redeemable fully paid-up Basel-III compliant Tier-2 subordinated bonds worth ₹318.20 crore.

- High coupon rate, ranging between 10.70% and 11.80%

- Quarter ended March 2018: The bank starts incurring continuous losses.

- September 30 2020: The bank’s net worth becomes negative, and it breaches prompt corrective action (PCA) thresholds for capital, asset quality, profitability, and leverage.

- Lakshmi Vilas Bank failed to raise capital despite several attempts, leading to a liquidity crisis.

- To protect depositors’ interests, the RBI invoked Section 45 of the Banking Regulation Act.

- This section allows the RBI to take control of a bank’s operations and make decisions to prevent its failure, including amalgamation or reconstruction.

- November 17, 2020: RBI imposes a 30-day moratorium on LVB, restricting cash withdrawals at ₹25,000 per depositor.

- November 26, 2020: RBI advises LVB to write down Tier-2 bonds worth ₹318.20 crore before its amalgamation with DBS Bank India Ltd.

- November 27, 2020: The amalgamation of LVB with DBS Bank India comes into effect, and all branches of LVB start functioning as branches of DBIL.

- 2024-25: The Tier-2 subordinated bonds are set to mature, but investors are unlikely to receive any money due to the write-down.

The RBI’s decision to write down the Tier-2 bonds was triggered by the bank’s deteriorating financial health and its amalgamation with DBS Bank India Ltd.

Yes Bank AT1 bonds issue

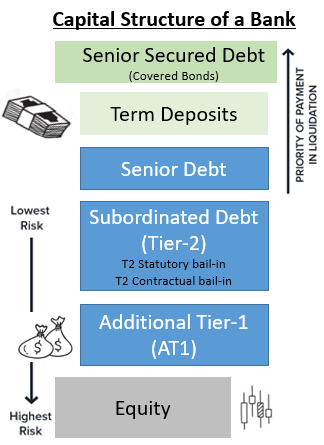

- What are AT1 bonds?: Additional Tier 1 bonds are a type of perpetual debt instrument issued by banks to shore up their Tier 1 capital. They have no maturity date and are considered riskier than traditional bonds.

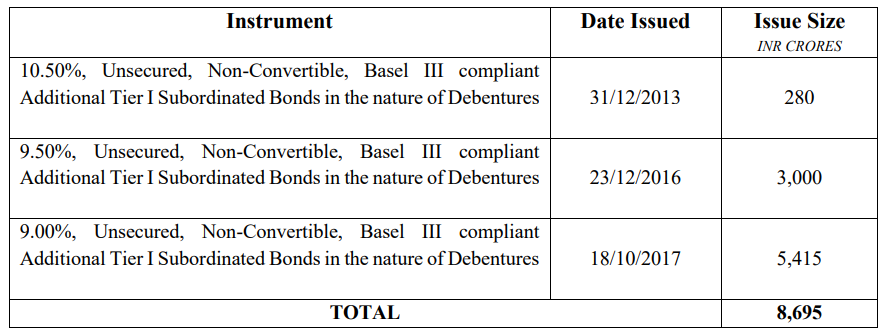

- Yes Bank’s AT1 bond issue: Yes Bank issued AT1 bonds in 2016 and 2017, which were written off in March 2020 worth Rs 8,300 crore as part of the bank’s restructuring.

- However, the Bombay High Court has now quashed this decision, potentially requiring Yes Bank to repay the bondholders.

- On 14 March 2020, the Bank wrote down only the two bonds worth INR 3,000 crores and INR 5,415 crores.

- The AT1 Bond carrying 10.50% coupon rate, worth INR 280 crore, was still outstanding as per the regulatory filing made by the Bank on 6 May 2020.18

- Implications: The court’s verdict may impact Yes Bank’s earnings, and the bank has six weeks to appeal the decision in the Supreme Court. If the verdict is upheld, Yes Bank will be liable to repay the bondholders.

Sequence of events

- AT1 bonds’ risks: These bonds are riskier than traditional bonds due to their perpetual nature and the bank’s discretion to skip interest payouts or write off the principal. They are considered unsuitable for retail investors.

- AT1 bonds are high quality capital which can act as a fail-safe in case of a bad financial situation for banks. Such bonds also carry higher yields than comparable debt instruments.

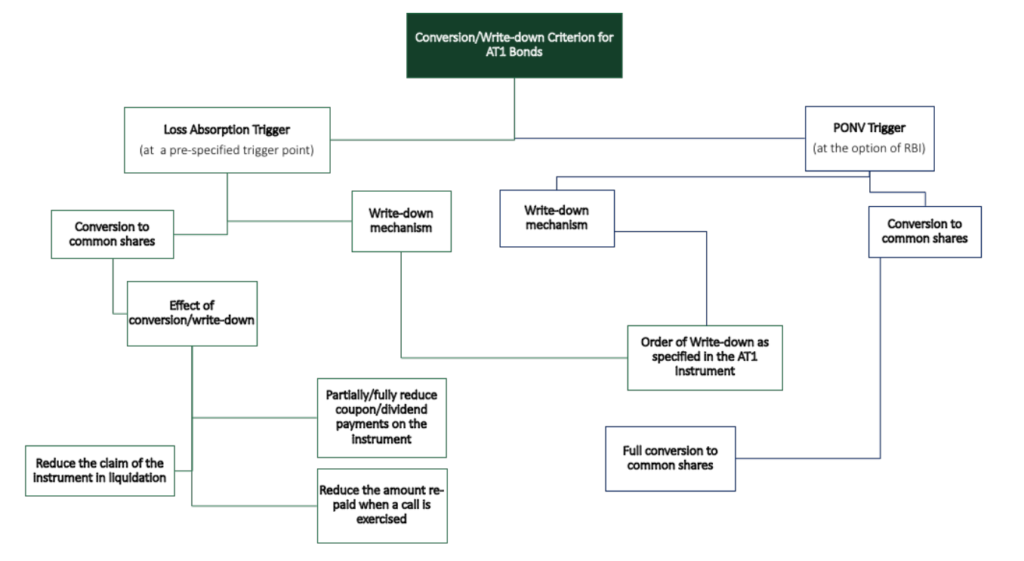

RBI’s Conversion / Write-down mechanism as per Basel III Capital Regulations