TLDR;

- Customer Retention: Retention rate above 95% for 10th consecutive year.

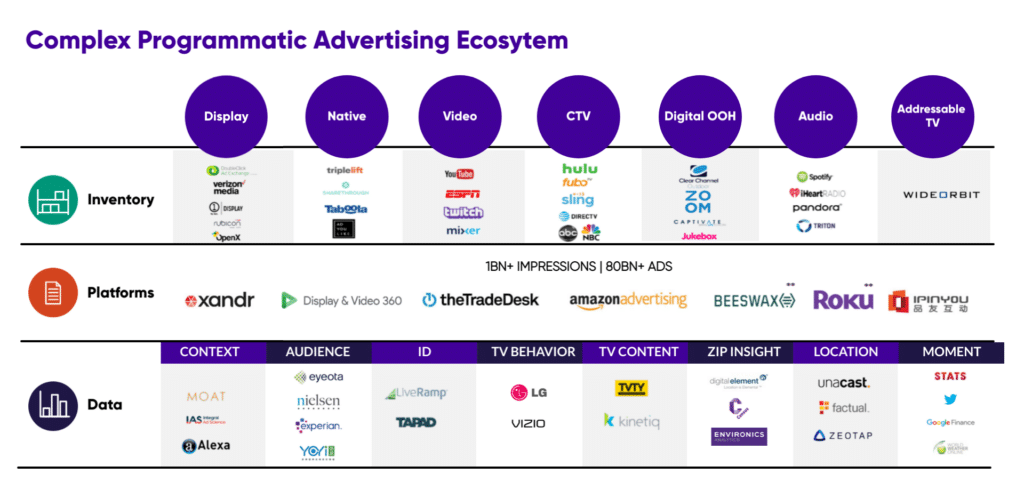

- Connected TV (CTV) Growth: largest and fastest-growing channel, with video ads comprising nearly 50% of the business.

- Unified ID 2.0 Partnerships: Expanded collaborations, including with Spotify and Roku, to enhance user privacy and advertising relevance.

- Slower rollout of TTD’s Kokai platform, impacted short-term performance

$TTD Q4 FY24 Results:

- Revenue: $741 million (+22% YoY)

- Net Income: $182 million (+88% YoY)

- Quarter Net Margin: 25%

- Cash Reserves: $1.36 B (+53% YoY).

- Share Repurchases: Authorized an additional $1 billion for future repurchases.

$TTD’s Business Model

1. Core Business: Open Internet Advertising

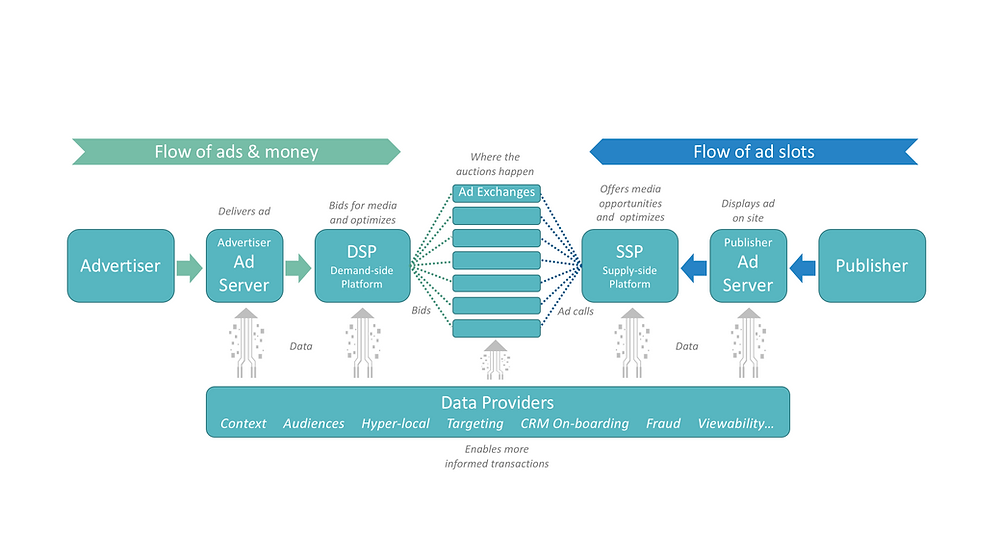

- Operates as a Demand-Side Platform (DSP), helping advertisers buy digital ad space efficiently.

- Competes against walled gardens (Google, Amazon, Meta) by supporting independent publishers.

2. Ad Buying Process

- Publishers list ad slots on Supply-Side Platforms (SSPs) → SSPs push inventory to Ad Exchanges.

- TTD’s DSP connects to these exchanges, bidding on behalf of advertisers in real time.

- The highest bid wins, securing the ad placement.

3. Revenue Model

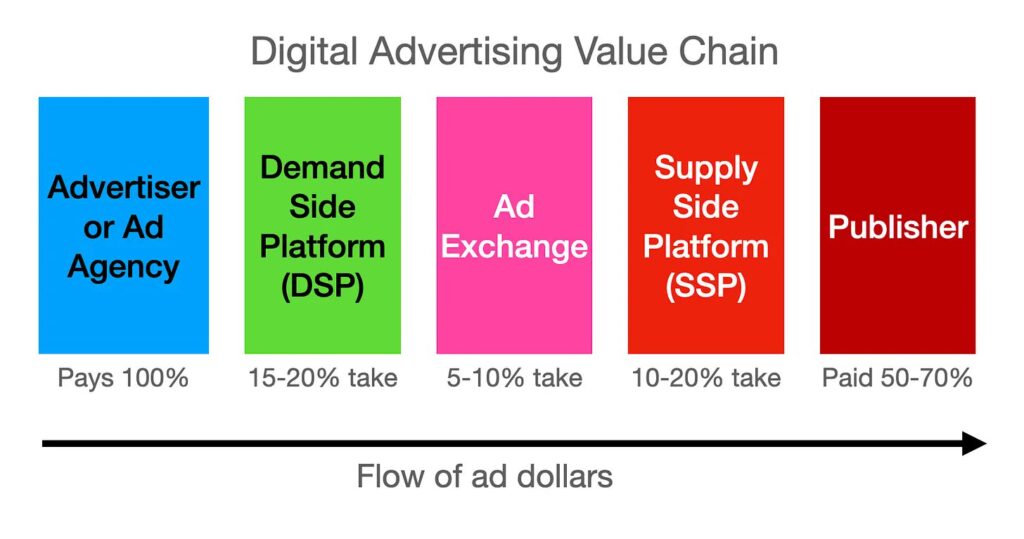

- Commission-Based Earnings: Takes a cut from advertisers’ total ad spend.

- Positioned closest to advertisers in the ad supply chain, controlling significant budget flows.

- DSPs located closest to the money side in this chain:

4. Growth & Market Valuation

- Market undervalues its growth potential despite a 30x forward earnings valuation.

- Expanding into Connected TV (CTV) and privacy-focused ad solutions (UID 2.0) to stay competitive.

TTD’s Moat

- TTD Dominance: Third-largest demand-side platform (DSP) in open internet with 2% market share, offering long-term growth potential.

- Rapid Revenue Growth: 30% average annual revenue growth over 5 years, outpacing digital advertising industry.

- Strong Financials: Yearly 16% net margin, $1 billion net cash, and $2.9 billion equity provide financial stability.

- Superior Capital Allocation: 27% return on investment (ROI) exceeds industry average, driving profitable growth.

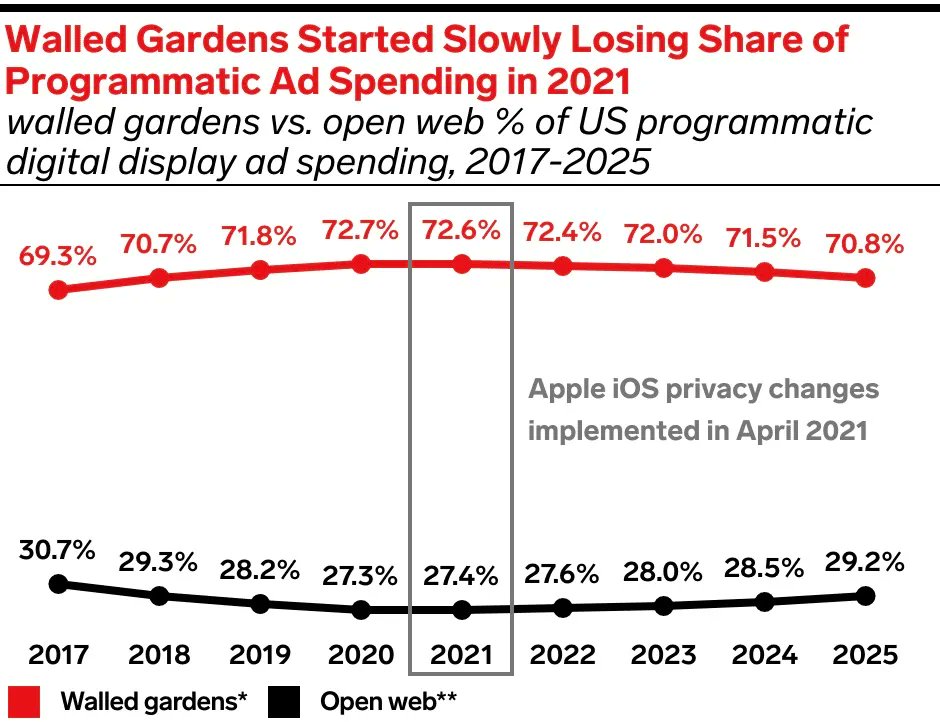

- Giant Opportunity Ahead: Walled gardens’ (Google, Meta, Amazon) declining market share and AI-driven traffic shift create $100 billion+ total addressable market (TAM) potential.

Competitor analysis

1. Growing Threat of Walled Gardens

- Google and Amazon dominate the digital ad space, leveraging vast data and integrated ecosystems.

- Amazon DSP (ADSP) is gaining traction in Connected TV (CTV) with lower tech fees than TTD.

- YouTube’s rise in CTV advertising further intensifies the competition.

2. Rising Competition from Applovin

- Applovin excels in in-app and in-game advertising, signaling alternative growth opportunities.

- Though it does not compete directly with TTD’s open-web focus, it attracts investor attention.

3. Internal Operational Challenges

- Slow adoption and criticism of TTD’s new Kokai interface due to UX issues and missing features.

- March 12, 2025: Sonos terminated its partnership for a TV stick powered by Ventura OS, derailing a key CTV initiative.

4. Strategic and Reputation Risks

- TTD’s OpenPath initiative bypassing SSPs raises concerns among publishers and advertisers.

- Criticism over TTD disregarding publisher-set price floors in ad bidding.

- UID 2.0, TTD’s single sign-on solution, struggles to gain adoption.

2030 Valuation (Updated on 5th April 2025)

Assumptions :

- LTM Revenue: $2.44B

- 5Y Revenue CAGR: 30%

- 2029 Profit Margin: 35%

- 2029 PE Ratio: 30

- Shares outstanding: 0.496B

- Shares reduction: 2%/year

Valuation :

- Q4 2030 TTD SHARE PRICE = 2.44* (1.30)^5 * 0.35 * 30 / [0.496 * (0.98)^5] = $212.17

- Using discount rate for TTD as 9%.

- CURRENT SHARE PRICE: $46.24

- DISCOUNT RATE: 9%

- FAIR VALUE: $212.17 / (1.09)^5 = $137.90

- POTENTIAL UPSIDE: (($137.90 – $46.24) / $46.24) × 100% = 198.23%

- EXPECTED RETURNS: ((($212.17 / $46.24)^(1/5)) – 1) × 100% ≈ 35.8%/year

- DIVIDEND YIELD: NA

- MY RATING: BUY ✅ | Accumulate only on red days while Trump is going crazy on tariffs.