TLDR;

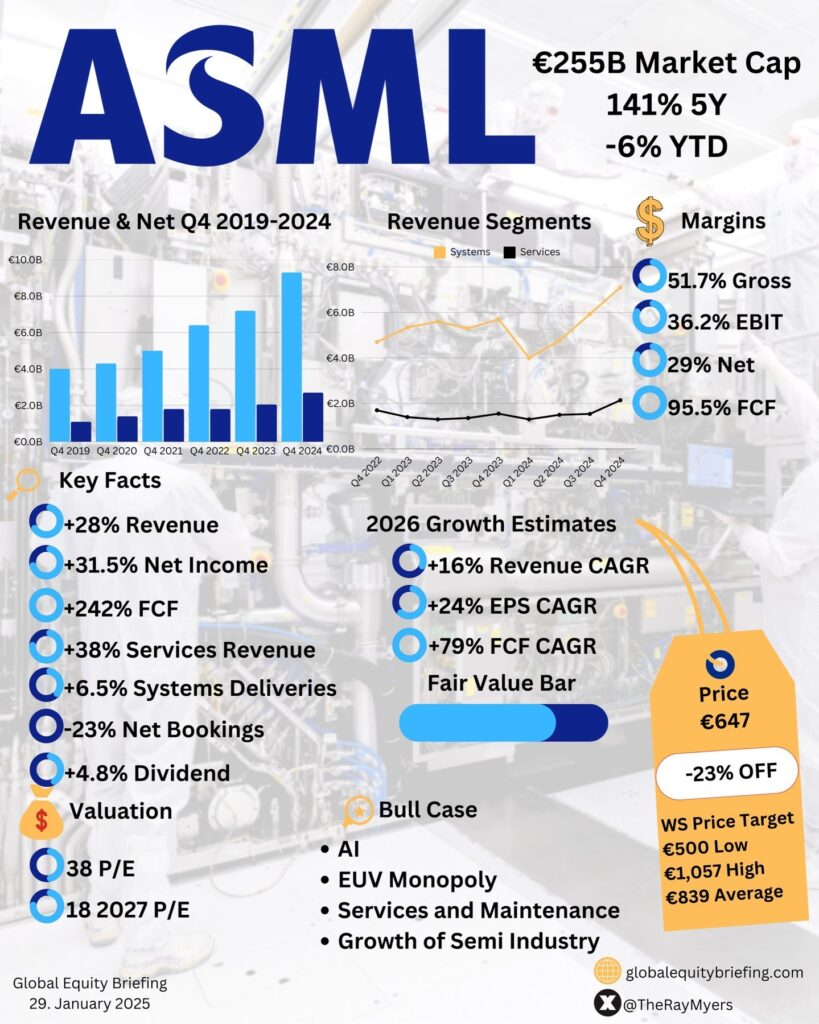

- ASML’s Q4 FY24 results: €9.3B revenue (+28% YoY), €2.7B net income (+31.5% YoY).

- Monopoly on EUV machines with huge moat due to complexity.

- Risk of sanction and supply chain issues.

- Expected 61% net income growth and 255% FCF growth by 2026.

- Fair value: €894.41, potential upside: 23.75%, expected returns: 9.02%/year.

- Hold rating due to reasonable valuation but limited upside.

ASML Q4 FY24 Results:

- Revenue: €9.3B (+28% YoY)

- Net Income: €2.7B (+31.5% YoY)

- Gross Margin: 51.7%

- Net Margin: 29%

- Free Cash Flow: €8.9B (+242% YoY)

- Free Cash Flow Margin: 14.2%

- Share Repurchases: $375M (3.4% of revenue)

How incredible $ASML technology is?

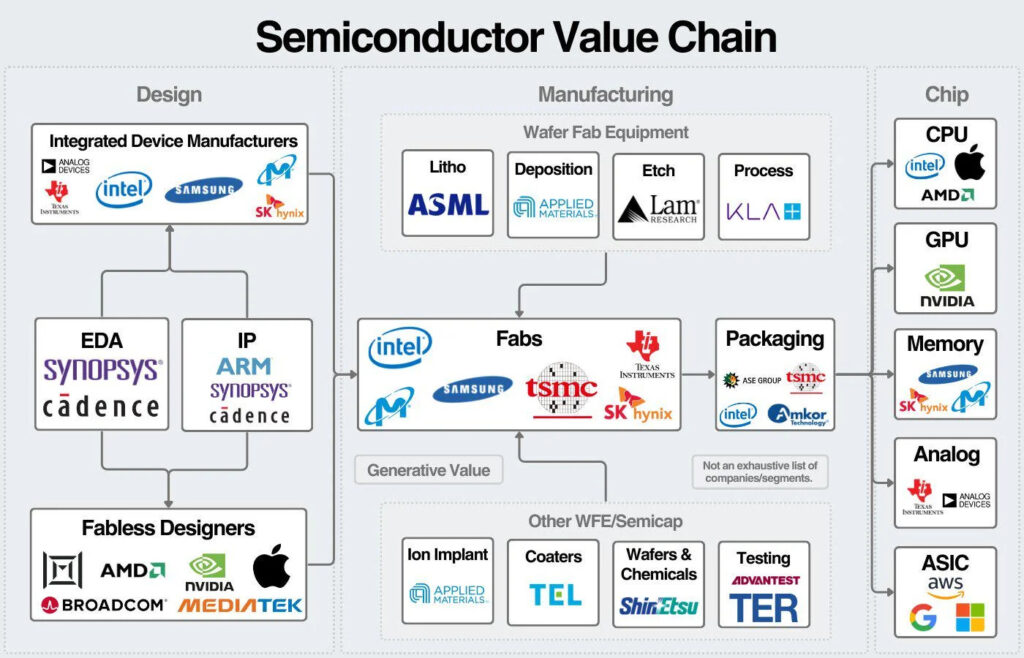

- $ASML is the sole global supplier of Extreme Ultraviolet (EUV) lithography machines.

- EUV machines are crucial for producing advanced semiconductor chips.

Extreme Precision of ASML

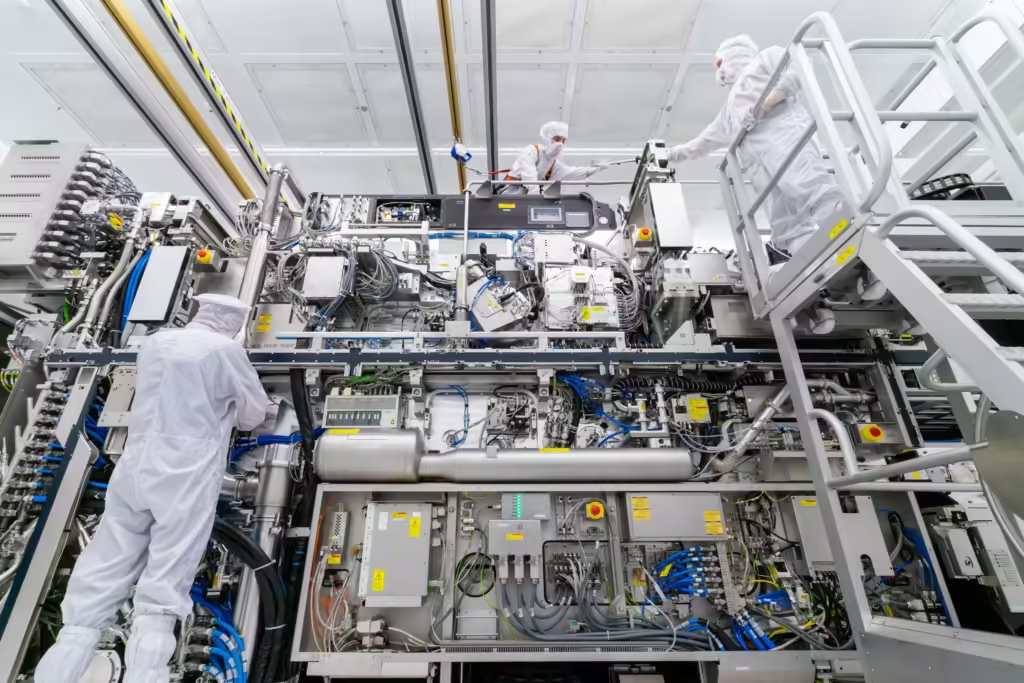

- ASML’s machines enable incredible precision, almost impossible to imagine.

- One machine costs $250 million and needs 40 containers, 20 trucks, and 3 jets to transport.

The Lithography Process

- The process involves shooting a laser at tiny tin droplets.

- The droplets are vaporized, creating plasma, which requires heat 40 times hotter than the sun’s surface.

- This process happens 50,000 times per second.

Mirrors for EUV Machines

- ASML’s mirrors are incredibly smooth, with imperfections smaller than a millimeter.

- If the mirror were the size of Germany, the largest imperfection would still be less than a millimeter.

Importance of ASML

- ASML’s advancements are crucial for Moore’s Law, which drives semiconductor progress.

- Improved semiconductors enable more complex algorithms and advancements in chip technology.

Why $ASML is a Unique Company

- Pricing Power: $ASML has a monopoly on EUV machines, allowing it to increase prices and boost margins.

- Huge Moat: $ASML’s EUV machines operate at an atomic level, making them extremely difficult to replicate.

Key Clients and Demand

- Top Clients: $TSMC, $NVDA, $MSFT, $AMZN, $GOOG, and $META rely on $ASML’s machines.

- Unparalleled Demand: The semiconductor market is expected to grow 7.64% annually to reach $1.14T by 2033.

Financial Performance

- Explosive Sales Growth: Sales have quadrupled in the last decade to EUR 28B.

- Services Revenue: Services revenue has grown 504% to EUR 5.6B, accounting for 20% of total revenue.

- Profitability and Cash Flow: $ASML earned EUR 6.9B in profits and EUR 2.9B in free cash flow (FCF) in the last 12 months.

Future Outlook

- Expected Growth: Net Income is expected to reach EUR 11.2B in 2026, up 61% from today.

- FCF Growth: FCF is expected to grow 255% to EUR 10.2B in 2026.

Geopolitical Risks for $ASML

- Key Markets: China and Taiwan are $ASML’s most important markets, accounting for 55% of revenue.

- Major Customer: $TSMC is $ASML’s largest customer.

- Geopolitical Tensions: $ASML is heavily exposed to tensions between China, Taiwan, and the US.

Risks:

- A Chinese invasion of Taiwan would be catastrophic.

- New sanctions or tariffs could increase costs and reduce sales.

- Current P/E: $ASML trades at a P/E of 38, despite a 19% drop in the last 6 months.

- Future Growth Expectations: Strong growth expectations bring the 2026 P/E down to 23.

- Reasonable Valuation: A P/E of 23 is considered reasonable for a monopoly with a long growth runway.

2030 Valuation

Assumptions :

- LTM Revenue: €28.26B

- 5Y Revenue CAGR: 15%

- 2029 Profit Margin: 30%

- 2029 PE Ratio: 30

- Shares outstanding: 0.390B

- Shares reduction: 1%/year

Valuation :

- Q4 2030 ASMLSHARE PRICE = 28.26 * (1.15)^5 * 0.30 * 30 / [0.390 * (0.99)^5] = €1376.31

- Using discount rate for ASML as 9%.

- CURRENT SHARE PRICE: €722.70

- DISCOUNT RATE: 9%

- FAIR VALUE: €1376.31 / (1.09)^5 = €894.41

- POTENTIAL UPSIDE: ((€894.41 – €722.70) / €722.70) × 100% = 23.75%

- EXPECTED RETURNS: (((€1376.31 / €722.70)^(1/5)) – 1) × 100% ≈ 9.02%/year

- DIVIDEND YIELD: 0.88%

- MY RATING: HOLD 🟡 | Not much lucrative risk to reward.