TLDR;

- 3 consecutive quarters of positive FCF – Added $500 million to cash balances in last Q.

- Became GAAP profitable last quarter.

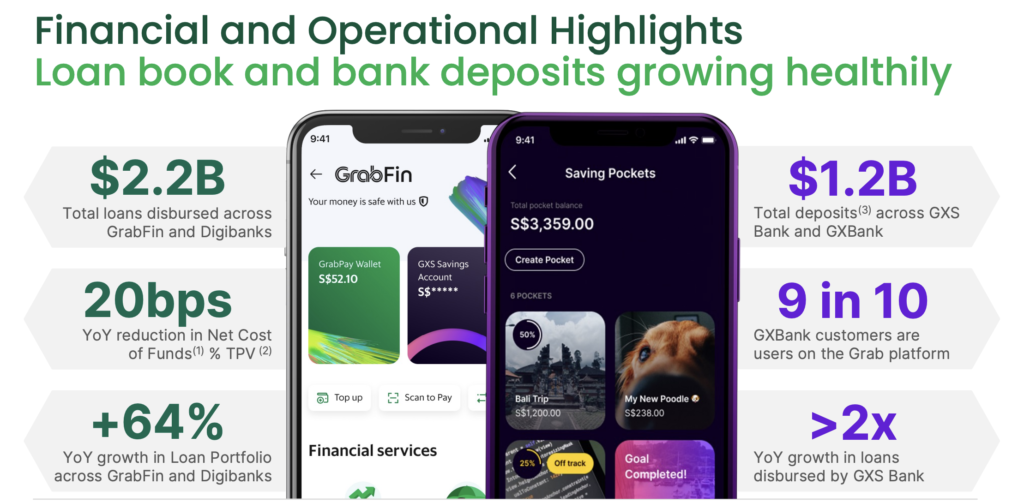

- Expanding digital banking presence across Singapore, Malaysia, and Indonesia

- Cross-Selling Opportunities & Reduced Customer Acquisition Costs for new services.

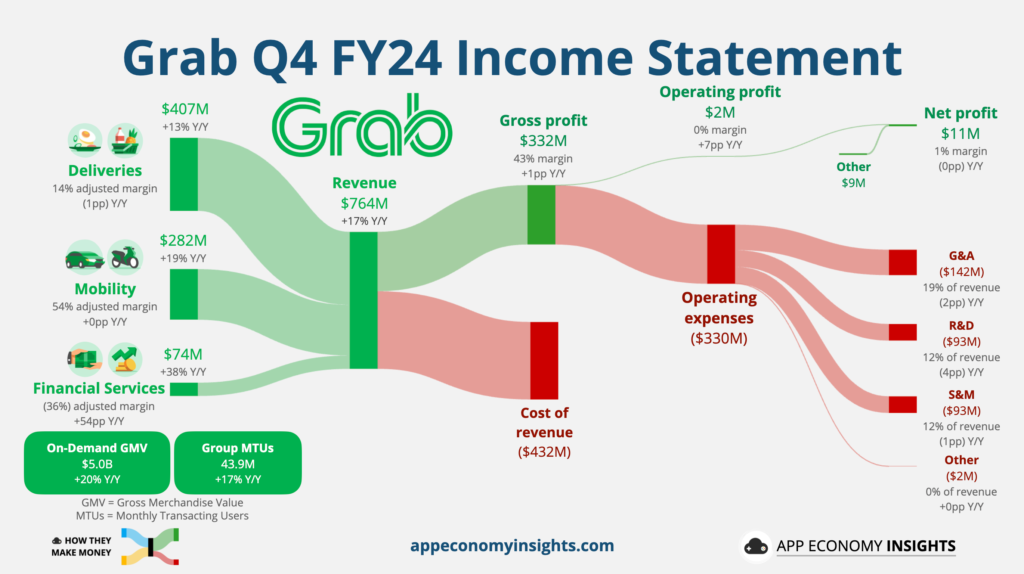

GRAB Q4 FY24 Results:

- Revenue: $764M (+17% YoY)

- Net Income: $11M

- Net Margin: 1.4%

- Mobility Gross Bookings: Part of $5.028B On-Demand GMV (+20% YoY)

- Free Cash Flow: $61M (Adjusted Free Cash Flow)

- Free Cash Flow Margin: 8.0%

- Share Repurchases: $37.1M in Q4 (4.9% of revenue)

- Monthly Active Platform Consumers (MAPCs): 43.9 million, up 17% YoY

- Cash Position: $6.1B

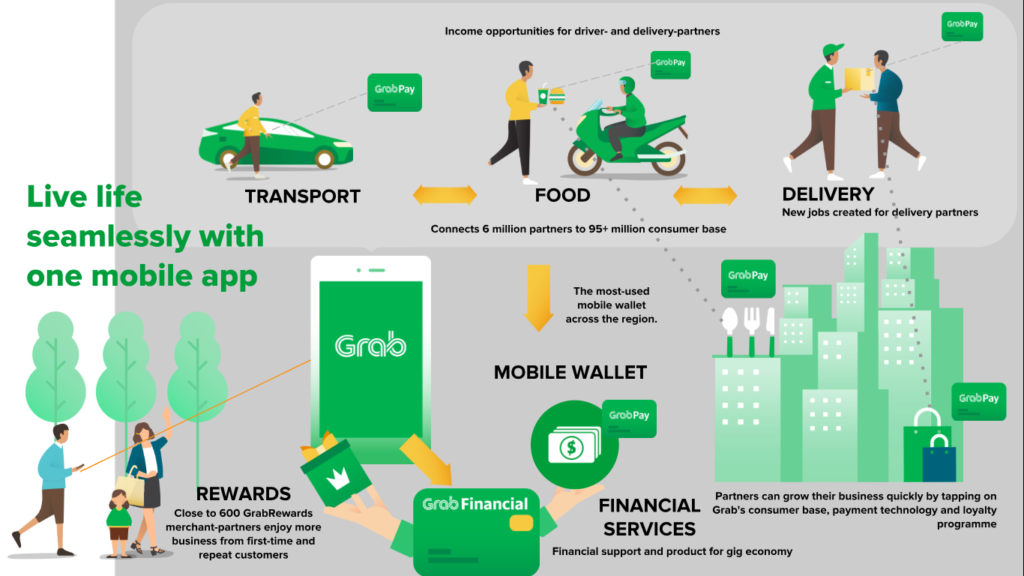

How do they make money?

- Grab is a super-app in Southeast Asia. Think PayPal, Shopify, Uber and Doordash combined.

- Based on 3 main segments:

- Delivery (Food and Groceries): $407 million (53.3% of total revenue)

- Mobility (Ride-sharing): $282 million (36.9% of total revenue)

- Financial Services: $74 million (9.7% of total revenue)

- Generates revenue through commissions

- For food delivery (GrabFood) – 25-30%

- For ride-hailing (GrabCar/GrabBike) – 20-25%

- Acts as a middleman between supply and demand sides.

Mobility (Ride-Hailing)

- GMV Growth: +20% YoY

- Revenue Growth: +17% YoY

- Business Model: Commission-based revenue from connecting riders with drivers

- Market Position: Dominant player in Southeast Asia after Uber’s exit from the region in 2018

Deliveries

- GMV Growth: +12% YoY

- Revenue Growth: +13% YoY

- Business Model: Commission from food and grocery deliveries, plus advertising revenue from merchants

- Merchant Benefits: Self-serve advertising platform where merchants only pay when deliveries are completed

- Strategic Expansion: Recent acquisition of Nham24 in Cambodia to strengthen regional presence

Financial Services

- Revenue Growth: +34% YoY

- Loan Portfolio Growth: +64% YoY

- Deposit Growth: +50% QoQ, +300% YoY

- Total Deposits: Over $1.2 Billion

- Banking Presence: Operating through GXS Bank (Singapore), GXBank (Malaysia), and Superbank (Indonesia)

- User Adoption: GXBank recorded 892,000 deposit customers in Malaysia, GXS Bank over 100,000 deposit customers in Singapore, and Superbank reached 2 million users in Indonesia

Regional Market Opportunity

- SEA Population: Approximately 700 million people.

- Current User Base: 43 million monthly transacting users (only 6% penetration).

- Smartphone Penetration: Expected to reach 85% by 2030.

- Economic Growth: Average GDP growth of 5.1% across the top 6 countries in SEA region.

- Tourism Potential: Increasing tourism provides additional growth tailwinds.

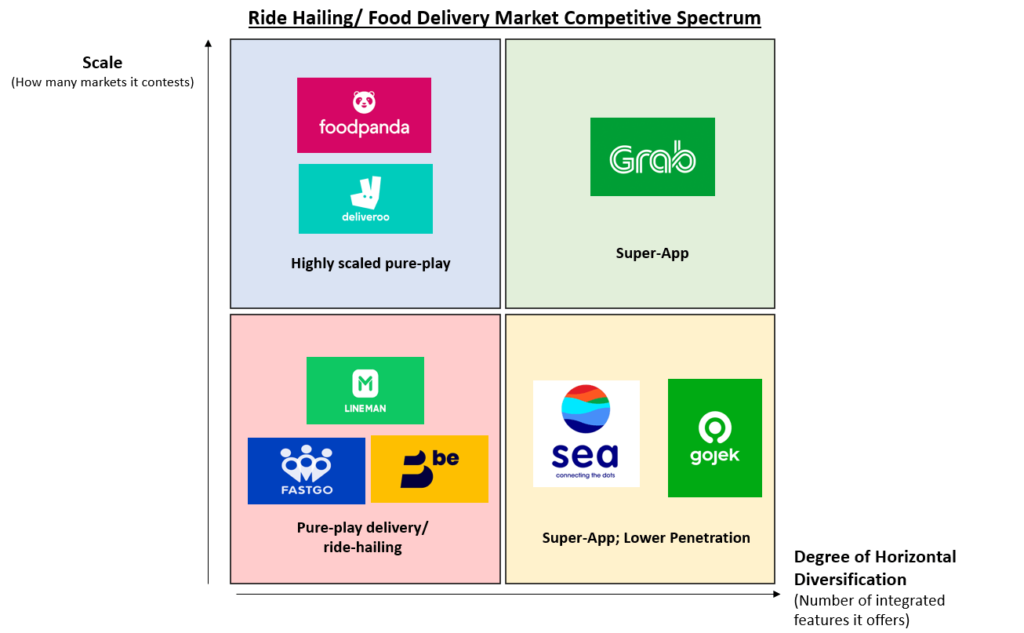

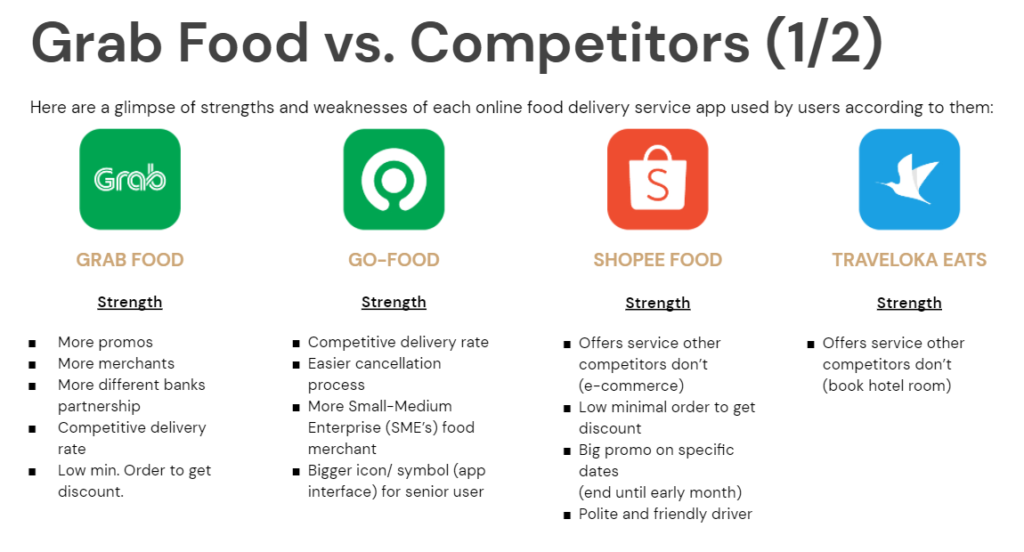

Competitor Risk Analysis

GoTo Group (Gojek-Tokopedia)

- Controls approximately 55% of Indonesia’s ride-hailing market versus Grab’s 45%.

- Maintains strong local brand loyalty in Indonesia, Southeast Asia’s largest economy

Sea Limited (ShopeeFood)

- ShopeeFood holding 47% market share in Thailand versus GrabFood’s 48%.

- Expanding rapidly in financial services with SeaMoney’s loan book growing 70% YoY to $4.6B versus Grab’s 64% growth to $536M.

- Leverages cross-selling opportunities through its e-commerce platform with 15-19% projected GMV growth.

Local Competitors

- Market-specific players like Be and Xanh SM in Vietnam gaining traction after Gojek’s exit.

- Specialised fintech startups challenging Grab’s financial services expansion.

2030 Valuation (Updated on 5th April 2025)

Assumptions :

- LTM Revenue: $2.80B

- 5Y Revenue CAGR: 40%

- 2030 Profit Margin: 5%

- 2030 PE Ratio: 60

- Shares outstanding: 3.93B

- Shares reduction: 2%/year

Valuation :

- Q4 2030 GRAB SHARE PRICE = 2.80 * (1.40)^5 * 0.05 * 60.00 / [3.93 * (0.98)^5] = $12.71

- Using discount rate for GRAB as 9%.

- CURRENT SHARE PRICE: $3.73

- DISCOUNT RATE: 9%

- FAIR VALUE: $12.71 / (1.09)^5 = $8.26

- POTENTIAL UPSIDE: (($8.26 – $3.73) / $3.73) × 100% ≈ 121.45%

- EXPECTED RETURNS: ((($12.71/ $3.73)^(1/5)) – 1) × 100% ≈ 27.78%/year

- DIVIDEND YIELD: NA

- MY RATING : BUY ✅ | Accumulate only on red days while Trump is going crazy on tariffs.