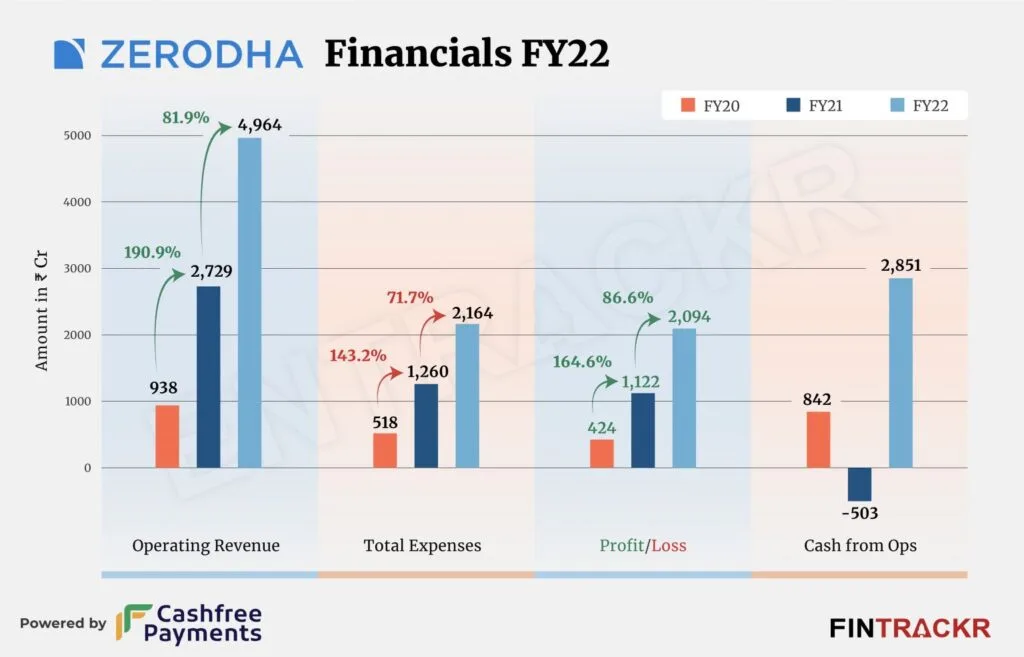

Fair warning if you are an Indian fintech company or stock brokerage. You might feel extreme envy after reading the next several sentences. Zerodha, a self-funded stockbroking company, maintained its growing velocity in the fiscal year that ends in March 2022; its operating scale was getting close to Rs 5,000 crore. During FY22, however, its profit increased 86%.

In FY22, Zerodha’s operating revenue increased 82% to Rs 4,964 crore from Rs 2,729 crore, as reported in its consolidated annual financial statements filed with the Registrar of Companies (RoC).

According to the NSE, Zerodha’s daily average turnover is ₹2000 crores.

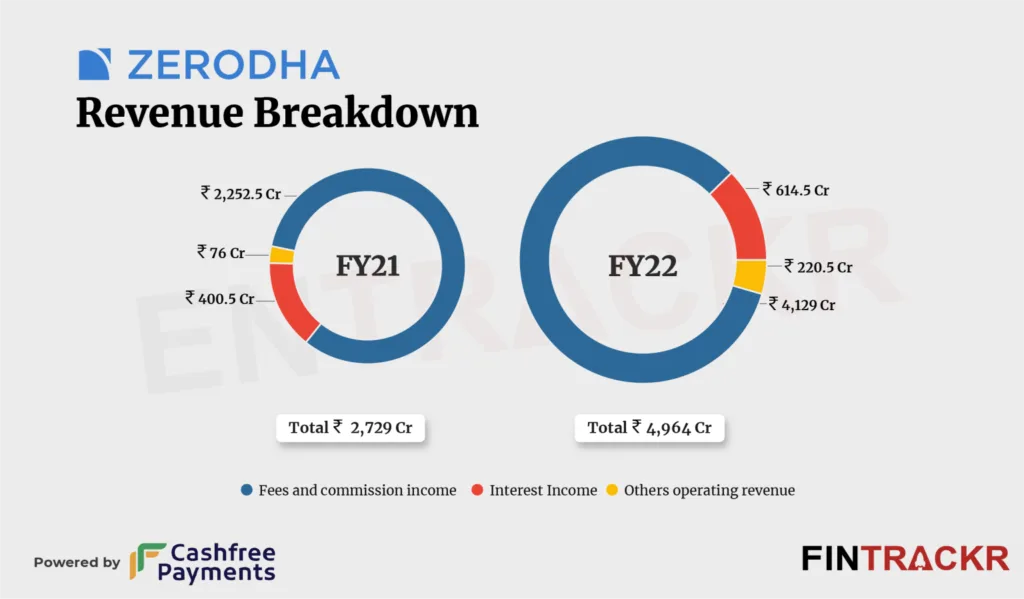

Brokerage commissions, the sale of its high-end tech products like Kite Connect API, user onboarding fees, and exchange transaction fees that are collected from customers on behalf of several stock exchanges are all ways that Zerodha generates revenue. From Rs 2,252.5 crore in FY21 to Rs 4,129 crore in FY22, revenue from these services increased by 83.3%.

In FY22, the company’s interest revenue increased by 43.4% to Rs 614.5 crore, and it also brought in Rs 220.5 crore from other operations, including dividend income and net gain on fair value adjustments.

Zerodha is a debt-free. Unlike other large brokers, Zerodha offers broking services only.

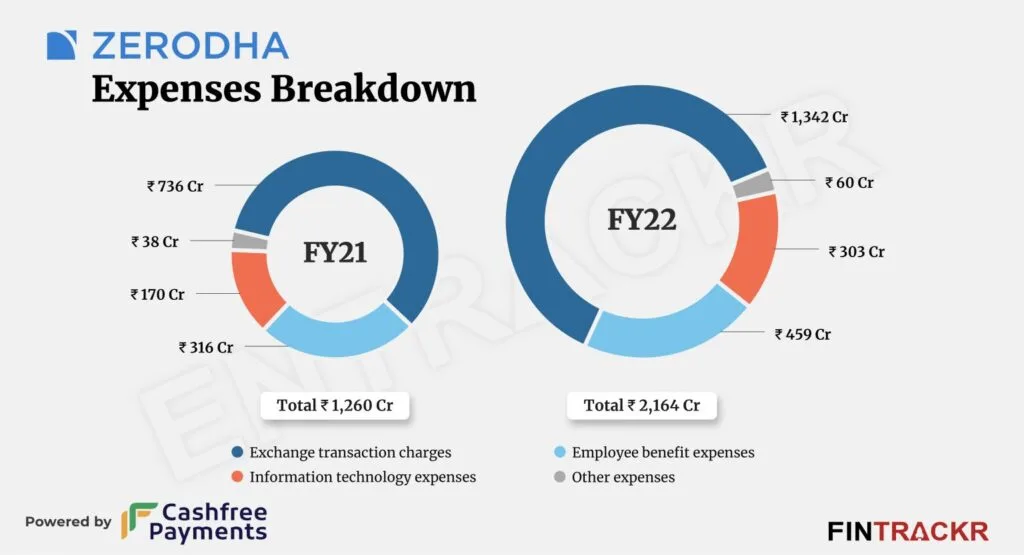

When a trade is executed through its brokerage platform, Zerodha collects exchange translation shares from its customers and pays them to the appropriate stock exchanges. In FY22, these payments increased 82.3% to Rs 1,342 crore, or 62% of the total expenditure.

Over 21% of total expenses were spent on employee benefits, which increased 45.3% to Rs 459 crore in FY22. Employee share-based compensation totaling Rs 77.5 crore is also included in this expense. Recall that Zerodha had self-assessed an ESOP buyback of Rs 200 crore at $2 billion during FY22. It purchased an ESOP of Rs 65 crore from its employees in FY21.

Costs associated with information technology (IT) grew 78.2% in FY22 to reach Rs 303 crore. In the end, compared to FY21, when it had total expenditures of Rs 1,260 crore, they had increased by 71.7% to Rs 2,164 crore in FY22.

The company’s profits increased 86.6% to Rs 2,094 crore in FY22 from Rs 1,122 crore in FY21, which is comparable to its size. At the conclusion of FY22, Zerodha’s total reserves increased to Rs 3,657 crore.

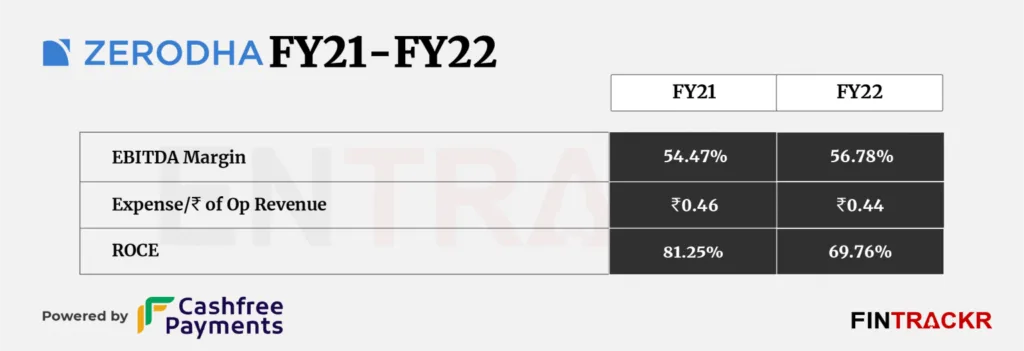

The net cash flows from activities for Zerodha totaled Rs 2,851 crore. Its EBITDA margin increased to 56.78% while doing so, up by 231 BPS. Zerodha invested Re 0.44 per unit to generate a rupee of operating income.

The business model of Zerodha works on a Low margin and high-volume model.

A rise in IPOs during FY22 was accompanied by an increase in Zerodha’s daily average users. The company will develop slowly since there won’t be as many initial public offerings during the next six months, said chief executive Nithin Kamath.

According to the EY (Ernest & Young) report, there were 138 Indian initial public offerings (IPOs), raising a total of $7.5 billion. However, from $17.3 billion in 2021, the total proceeds fell by 56%. Along with the worldwide IPO market fall, startup IPOs also fell, from 11 in 2021 to only two in 2022. Zerodha had 6.2 million active users and a user base of almost 9 million during FY22. One of the rivals, Upstox, reached the milestone of 10 million users in May 2022. Five million members, or 50%, were active users, according to the corporation.

In contrast to other businesses in the nation, Zerodha has made headlines for being a breakout firm that bootstrapped its way to profitability. In addition to sound business methods, the pandemic significantly increased the amount of money in the company’s coffers because more young Indians were turning to public markets for investment. Indeed, Kamath asserted that the company’s earnings had increased 5X since March 2022 in a December statement. According to Kamath, additional factors like e-KYC, digital signatures, and UPI, which all make it simpler to buy stocks online, have also contributed to this development.

In addition to overseeing a clearly well-run and intelligent company, Kamath is renowned for being significantly cautious when it comes to projections, which the company then goes on to soundly surpass. In his case, Zerodha’s real stats will continue to draw people wanting to perform as well, or perhaps a little less, if the words are supposed to make investors stop before throwing money at competitors. When it comes to the startup ecosystem, the company continues to be one of the major success stories of the past ten years. It is the disruptor who will not tolerate any disruption.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.

Hey people!!!!!

Good mood and good luck to everyone!!!!!

Hello every one, here every person is sharing such knowledge, thus

it’s fastidious to read this web site, and I used to pay a quick visit this website every day.

Also visit my web blog; John E. Snyder

Основы строительной экспертизы, Полезные советы по выбору компании для экспертизы, перспективы сотрудничества, Какие услуги включает строительная экспертиза, какие перспективы, чьи знания пригодятся

Строительная экспертиза Московская область помогает жителям Подмосковья оценить качество строительства. http://a-aspect.ru/expertise/stroitelno-tehnicheskie-ekspertizy/stroitelnaya-ekspertiza/ .

Может ли филлер мигрировать в другую часть лица? – Да, филлеры могут мигрировать, но это случается редко и обычно связано с неправильной техникой инъекции или особенностями организма.

Can fillers migrate to another part of the face? – Yes, fillers can migrate, but this is rare and usually related to improper injection technique or individual body characteristics.

клиника эстетики и качества жизни gmtclinic https://www.gmtclinic.ru .

Большой ассортимент техники Microsoft, который удовлетворит все ваши потребности.

миграция microsoft 365 между тенантами https://best-lip-filler.com .

Where to order quality double glazed windows in Melbournebest replacement windows https://bestnosefiller.com/replacement-melbourne/ .

New Lineage 2 servers for beginners

L2 H5 servers L2 H5 servers .

Why do people keep pets, why domestic animals have become so popular.

tips for choosing a pet, popular pet breeds.How to properly care for pets, how to ensure the health of your pet.what you didn’t know about pets, why pets are so amazing.How to teach pets commands, how to teach a dog to fetch.

domestic animals bengali meaning http://www.petstorepetsupply.com/index.php/2024/06/08/dealing-with-common-garden-pests/ .

You’ve crafted something truly timeless here — writing that will continue to resonate with readers for years to come.