TLDR;

- $15.93B one-time new tax charge crushed reported EPS to $1.05 vs. $6.68 expected (-84% miss).

- Net income collapsed 83% YoY to $2.71B from $15.69B in Q3 2024.

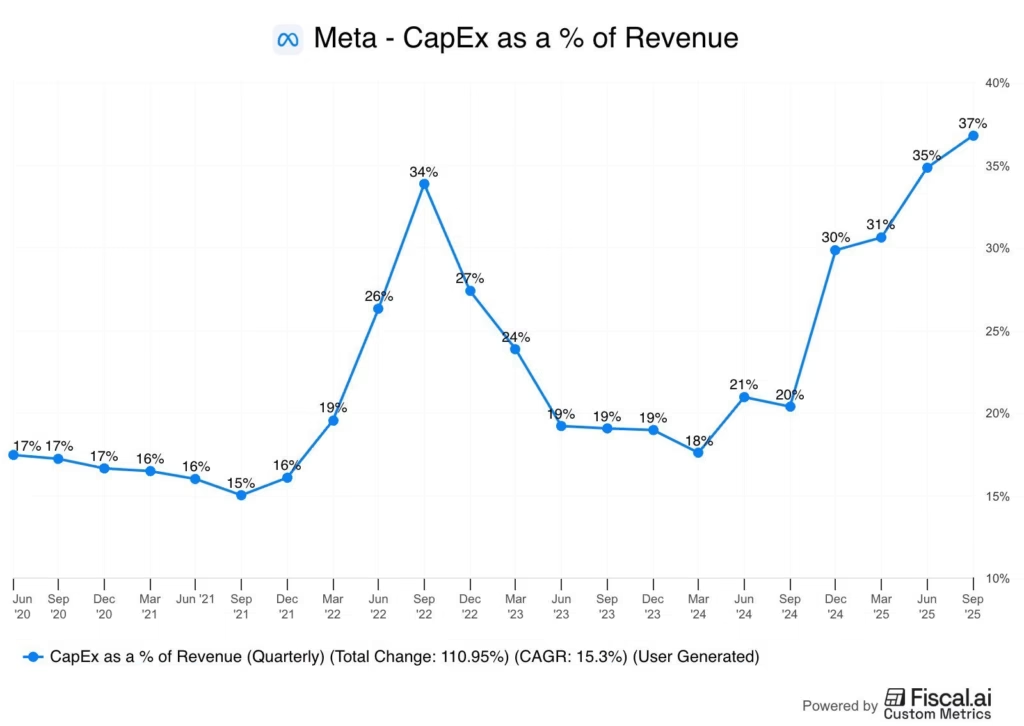

- 2025 CapEx raised to $70-$72B (Q3 alone: $19.4B, +111% YoY).

- Forward 2026 P/E of ~21-22x for 26% revenue growth rate = Cheap.

- Heavy AI investment (long-term pro/ short-term con).

- Meta’s internal compute is maxed out—spending to meet actual demand, not speculation.

- Winner-Takes-All AI Race – Must front-run opportunity to prevent playing catch-up.

- Meta is great but the anchoring bias is something to consider.

- Current stock price: $648.35 (1 Nov 2025)

- Buy ✅ Rating: Recommended for accumulation, with conservative target of $1000/Share (54% upside).

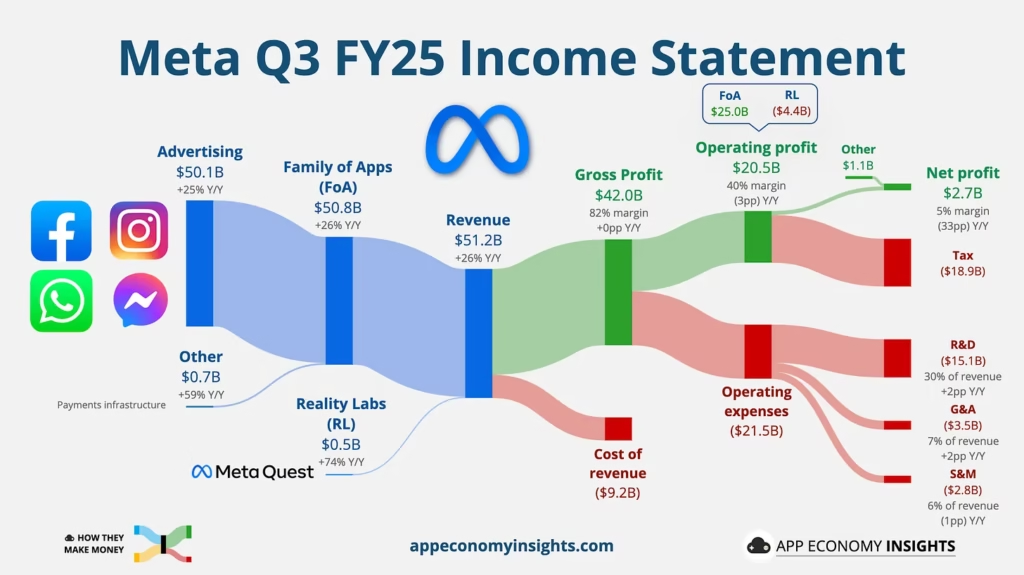

META Q3 FY25 Results:

- Revenue: $51.24B (+26% YoY)

- Net Profit: $2.71B (-83% YoY)

- Net Margin: 5.3%

- Operating Margin: 40% (-3% YoY vs. 43% in Q3 2024)

- Free Cash Flow (Q3): $10.6B (-32% YoY)

- Operating Cash Flow (9 months): $91.3B

- Cash & Securities Position: $44.4B

- Total Debt: $28.8B

- Ad Revenue: $50.1B (+26% YoY, representing 98% of total revenue)

- Daily Active People: 3.54B (+8% YoY)

- Ad Impressions: +14% YoY

- Average Price Per Ad: +10% YoY

- 5% more time on Facebook, 10% on Threads, 30% on Instagram Video

Zuckerberg’s AI Bet Backfires? The truth behind Meta’s stock drop.

Massive One-Time Tax Hit

- Stock plunged 11% on October 30, 2025 – worst single-day decline in 3 years.

- $15.93B one-time tax charge under “One Big Beautiful Bill Act” (CAMT provisions).

- Reported EPS: $1.05 vs $6.68-$6.72 expected (-84% miss).

- Net income crashed 83% YoY to $2.71B from $15.69B in Q3 2024.

Exploding AI Capital Expenditures

- 2025 CapEx guidance raised to $70-$72B (up from $66-$72B).

- Q3 CapEx: $19.4B – more than doubled from $9.2B in Q3 2024 (+111% YoY).

- Management warned 2026 CapEx will be “significantly larger” than 2025.

Margin Compression

- Operating margin: 40% – down 3 percentage points from 43% in Q3 2024.

- Margins declining despite strong revenue growth, raising profitability concerns.

Reality Labs Continuous Losses

- Q3 Reality Labs operating loss: $4.4B.

- Division has lost over $70 billion since 2020 with no clear profitability path.

- Revenue of only $470M vs. $4.4B loss (nearly 10:1 loss-to-revenue ratio).

Why META is now cheapest Mag 7 stock?

Explosive Ad Revenue Growth Momentum

- Predictable, compounding revenues, guided by an experienced, calculated and world-class management team.

- Ad revenue accelerated 26% YoY to $51.24B – massive growth tailwind in core business.

- Dual revenue drivers firing simultaneously: Ad impressions +14% YoY AND average price per ad +10% YoY.

- Daily Active People: 3.54 billion (+8% YoY) – engagement accelerating across Family of Apps ecosystem.

Addressing Real Bottlenecks, Not Speculative Building

- Meta’s internal compute capacity is maxed out – CapEx addresses actual infrastructure constraints, not speculative future demand.

- Visible floor unlike Metaverse spending – AI investments directly benefit core ad algorithms, engagement, and recommendations today with measurable impact.

- 5% more time on Facebook, 10% more on Threads, 30% more on Instagram Video.

- Reels reached $50B annual run rate – direct monetization from AI-powered content delivery.

- ScaleAI partnership ensures high-quality training data – avoids synthetic data trap that plagues competitors.

Smart Capital Structure Management

- $25B bond issuance at favorable rates (~1% above treasury equivalents) – accessing cheap capital with 5-40 year maturity horizons

- Only second major debt offering since 2022 – not establishing pattern of excessive leverage or concerning debt cycles

Strategic Necessity for Competitive Position

- Super intelligence = winner-takes-all market dynamics – Meta cannot afford to play catch-up in foundational AI race.

- Social landscape shifting to LLM-based interaction – defensive spending to prevent losing social engagement vertical as users talk to AI.

- Front-running opportunity for competitive moat – early AI leadership drives advantages in coding, products, roadmaps, market share.

- Free Cash Flow: $10.6B in Q3 alone – core business generates massive cash despite heavy AI spending.