TLDR;

- When it was cheap to get loans (3.6% Interest), company borrowed a lot of money for growth to open up more stores across globe, which was great a move.

- Global avg ticket size : Starbucks($7.85), Dunkin'($4.22), McDonald’s($5.20) and Luckin Coffee($2.17)

- High interest environment is restricting consumers with discretionary spends.

- Diversify more stores outside US.

- 60% of morning business is done via app, and often loyal customer add item to cart but do not checkout due long wait time.

Traditional Metrics

- 30% discounted from its top in Apr 2023

- P/E = 22x, Industry P/E = 16.87x

- Operating cash flow of $2.890B, 22.41% increase YoY.

- A 15% miss on EPS and a 6.4% miss on revenue in Q2 2024

- Starbucks Rewards Membership was 32.8Mn, up 6% YoY

- Store sales down by 4% as compared to +12% last year.

- Coffee prices up by 20% this year.

Q2 Guidance Headwind Reaction

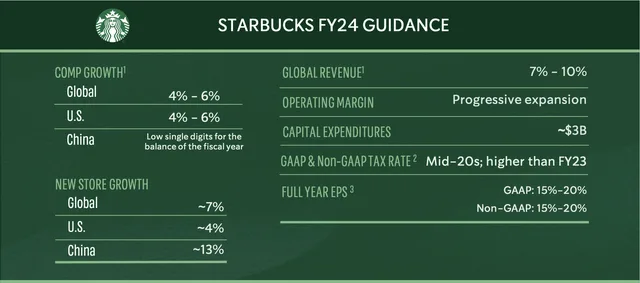

- Sales growth : low single digit from 4-6%.

- Global unit store growth : Now 6%, previous 7%

- Revenue : Now low single digits, previous 7-10%

- Earnings per share: Now low single digits, previous 15%

- Share price dropped 18% after Q2 new guidance.

The China Play

- The company opened 364 new stores in Q2, leaving a total of 38,951, where 61% (16,600) are in U.S. and 18.21% (7,093) stores in China.

- China again led the revenues down by 5% to $1.8 billion, reflecting a 5% unfavorable impact from foreign currency translation.

- Average ticket size fell by 4%.

- Chinese store foot fall dropped by 8% & avg ticket size fell by 4% as rivals put more efforts through promotions and aggressive pricing tactics.

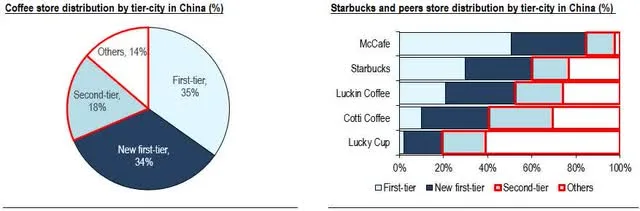

- Luckin Coffee : Doubled its outlets (18,590) in china, with ChaPanda operating 8000 stores.

- Young Chinese customers naturally gravitate towards Boba tea shops.

Economic Moat

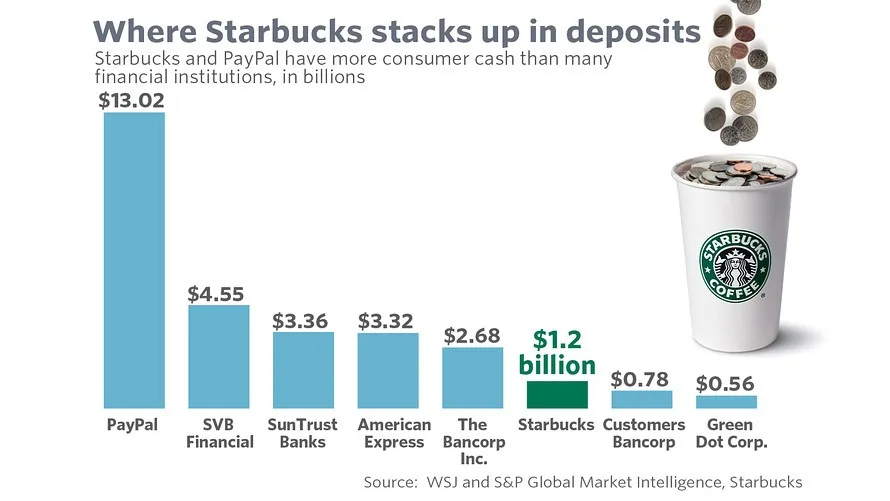

- Acts as a bank, as through its Starbuck loyalty card program it earns money before providing any services to consumers.

- In 2019 users held $1.5Bn as cash in their Starbucks card, this money provides Starbucks a 0% interest loan, which they can invest to earn bond yield or use it for store expansion program.

- Lower marketing cost advantage: Starbucks (1.1% of sales), McDonald’s (4% of sales) and Dunkin’s (5% of sales).

- Loyalty app users spends average 2-3x more compared to one time consumer, providing volumes of data to increase promotion efficacy across geographies.

- Increased transactions via Mobile Order & Pay (MOP) accounting for 31% sales in 2Q24, as of 14% in 2018.

- More demand on cold beverages, which accounted for ~70% of sales in 2023, compared to ~47% in 2018.

Risk

- Due to high interest rate environment consumer spending has tightened due to heightened prices.

- Coffee bean prices skyrocketing in last 2-3 quarters.

- Legislators in California increased the min wages to $20/hr compared to current avg. min Starbucks wage of $17/hr, this directly affects companies operational costs.

- Challenge meeting their peak morning demand.

Multifaceted Plan

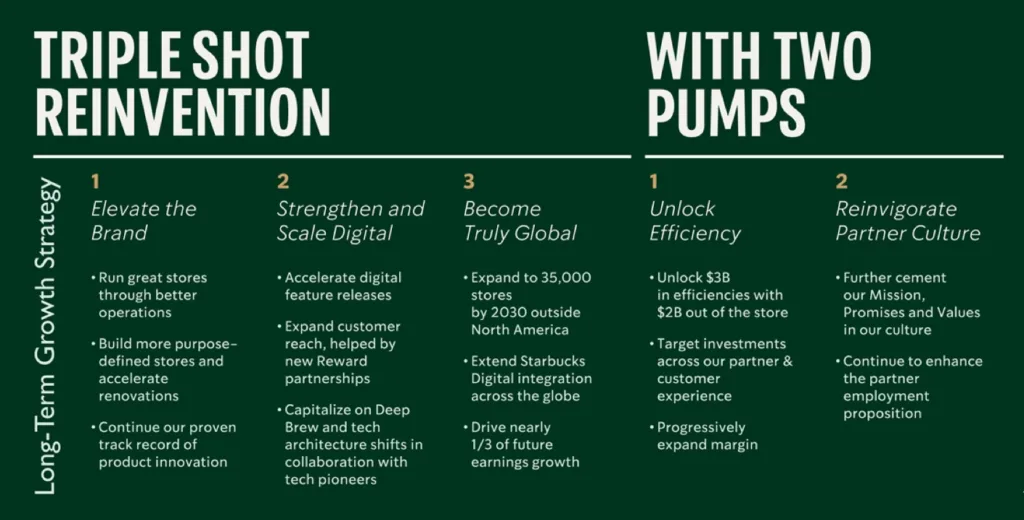

- New store formats (i.e. drive thru, walk up, pick up only etc.) by investing $600mn over 3 years.

- Enhance connection with occasional and non-Starbucks rewards customers by giving exclusive offers in app.

- Target lower tier cities in China, and capitalise on rising middle class.

2029 Valuation

ASSUMPTIONS :

- LTM Revenue: $36.53B

- 5Y Revenue CAGR: 7%

- 2029 Net Profit Margin: 13%

- 2029 PE Ratio: 20

- Shares outstanding: 1.135B

- Shares reduction: 2%/year

VALUATION :

- Q1 2029 SHARE PRICE = 36.53 * (1.07)^5 * 0.13 * 20 / [1.135 * (0.98)^5] = $130

- Using discount rate for Starbucks as 9%.

- CURRENT SHARE PRICE: $72

- DISCOUNT RATE: 9%.

- FAIR VALUE: $130 / (1.09)^5 = $84

- POTENTIAL UPSIDE: 17%

- EXPECTED RETURNS: 12.5%/year

- DIVIDEND YIELD: 3.13%

- MY RATING: Conservative buy with 3% of portfolio, with room for DCA.