TLDR;

- Jordan Brand was 17% of Nike’s overall revenue in FY24, growing 6% Y/Y.

- In 2023, Nike footwear sales were greater than Adidas, Under Armour and Puma combined.

- NKE has a forward P/E of 22.15x, well below the average 5 year P/E of 35.60x.

- FY25 revenue guidance down to single digit.

- Shares price down by ~30% YTD.

Traditional Metrics

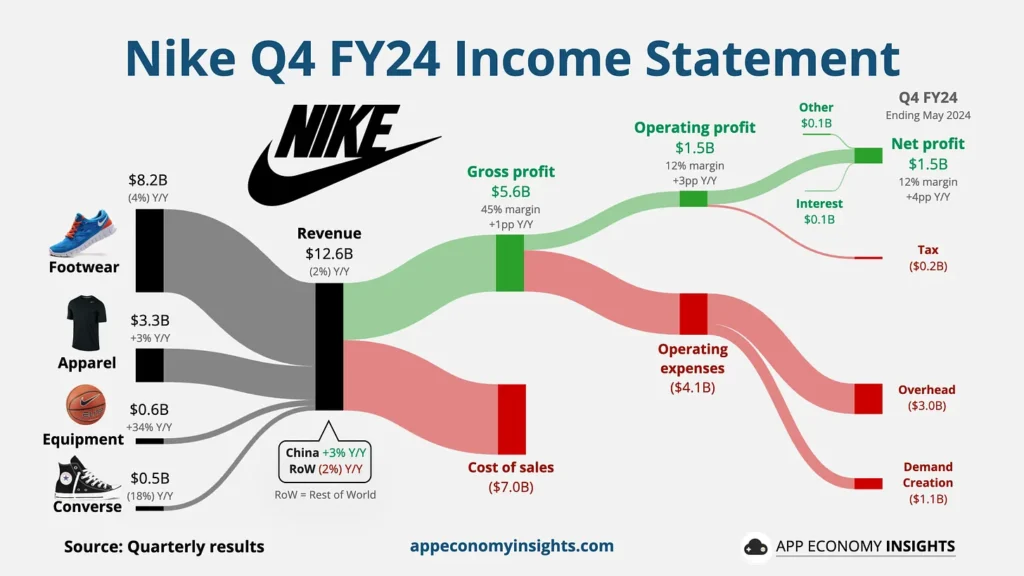

- Revenue -2% Y/Y to $12.6B ($250M miss).

- Non-GAAP EPS $1.01 ($0.17 beat).

- Inventory -11% Y/Y to $7.5B.

- Wholesales +5% Y/Y to $7.1B.

- Direct sales -8% Y/Y to $5.1B.

- Gross margin = 44.7%

- Selling and administrative expenses fell 7% YoY ($4.1B).

- Operating income +39% Y/Y ($1.7B).

- Net income +45% Y/Y ($1.5B).

- Cash and equivalents were $11.6B in Q4, up $0.9B from last year.

Still A Top Dog

- The company’s debt is rated AA-, a high investment grade rating.

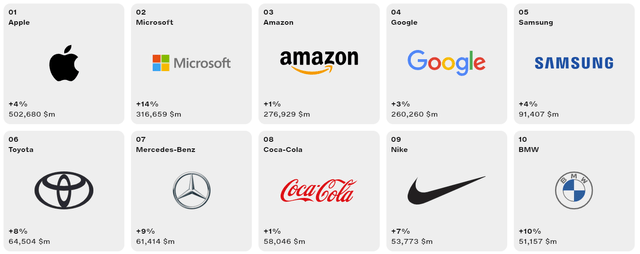

- Nike is well-positioned to succeed in the sports industry in the long term because of its brand power which is unmatched (world’s 9th valuable brand).

- Nike’s focus lies on accelerating its pace for innovation and scaling new products in their portfolio.

- Olympics in Paris is a big opportunity for Nike to showcase its innovations and make its brand different from its competitors by telling stories through their products.

- Nike has also managed to save money by minimizing the costs associated with fulfilling orders, uniting vendors, and updating technology.

What led to Nike’s fall?

- Forward outlook of double-digit revenue drop in Q1 this fiscal year.

- Nike’s overestimation of consumer’s willingness to pay a premium for direct purchases have exposed vulnerabilities in its business model.

- D2C channel, including digital, underperformed due to softer traffic and lower sales of classic footwear franchises.

- Consumers are gravitating towards newer brands like On and Hoka, which is impacting Nike’s market share, particularly in the lifestyle segment.

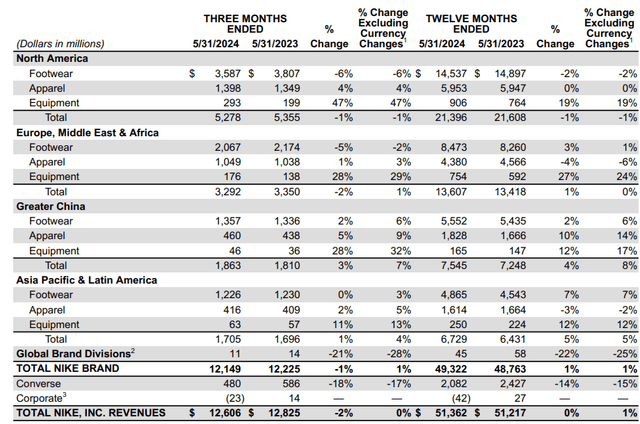

- Uneven consumer trends in key markets like China and EMEA, along with unfavorable foreign exchange rates, contributed to the revenue shortfall.

2029 Valuation

Assumptions :

- 2023 Revenue: $51.36B

- 5Y Revenue CAGR: 2%

- 2029 Profit Margin: 12%

- 2029 PE Ratio: 23

- Shares outstanding: 1.517B

- Shares reduction: 2%/year

Valuation :

- Q2 2029 NIKE SHARE PRICE = 51.36 * (1.02)^5 * 0.12 * 23 / [1.517 * (0.98)^5] = $114

- Using discount rate for Nike as 9%.

- CURRENT SHARE PRICE: $76

- DISCOUNT RATE: 9%

- FAIR VALUE: $114 / (1.09)^5 = $74

- POTENTIAL DOWNSIDE: 6%

- EXPECTED RETURNS: 7.6%/year

- DIVIDEND YIELD: 1.9%

- MY RATING: HOLD, for conservative buyers : SELL

Хрумер Обучение

Kwork Overview

Обучаю делать ссылочную массу на сайт или социальную сеть програмным обеспечением XRumer.

В обучение входит Настройка Xрумера для работы в режиме постинг

Покажу сайты где брать прокси, VPS сервис

Свожу баланс (оптимизирую) хрумер, ксевил и сервер, для эффективной работы.

Работаю на 6-й версии ксевила

План такой!

Устанавливаем XRumer на удалённый сервер (личный компьютер не подходит для работы)

Показываю настройки для работы и составление проекта

Постинг будет производиться в блоги и коментарии, форумы не использую по причине модерации и жалоб от модераторов, поэтому настройку почты не делаю

Сбор базы в обучение не входит.