TLDR;

- Strong direct sales model ensuring product authenticity.

- Robust logistics network.

- Proven ability to expand margins.

- Strong performance in electronics and appliances categories.

- Recent weak revenue growth.

- Dependence on Chinese market conditions.

- Potential benefits from government consumption stimulus.

- Trade-in programs for consumer durable goods.

- Expansion into new product categories or services.

JD.com Q3 FY24 Results:

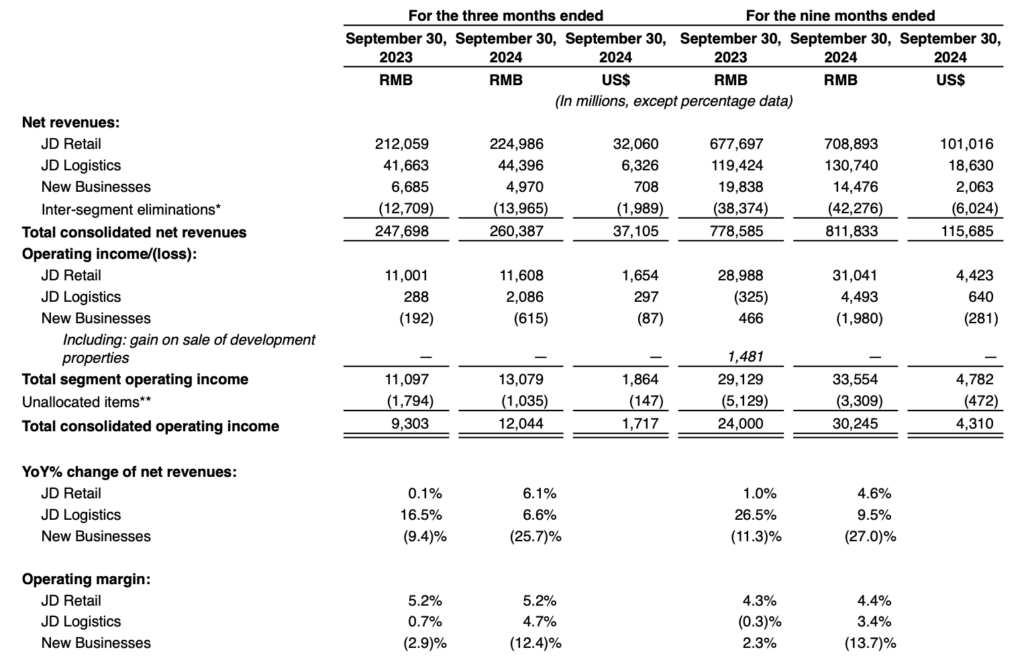

- Revenue: +5.1% Y/Y to RMB 260.4B (~$37.1B)

- Net Income: +47.8% Y/Y to RMB 11.7B (~$1.7B)

- Operating Margin: Increased to 4.6% (from 3.8%)

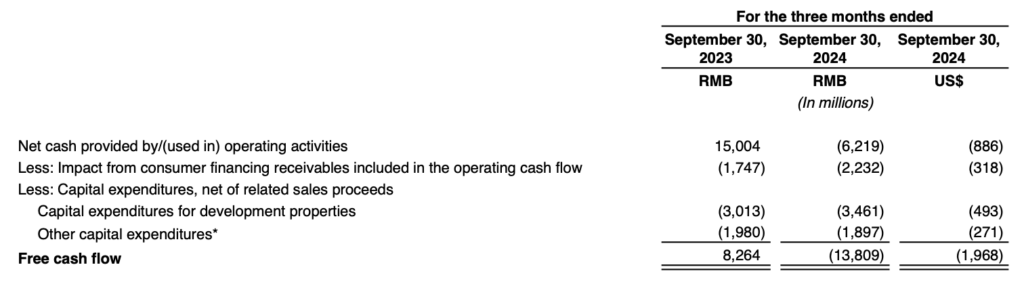

- Cash Flow: Negative free cash flow of RMB 13.8B, impacted by payment timings and inventory buildup.

- Share Buyback: Completed $390M in share repurchases during Q3 2024.

- New $5B share buyback program through 2027

- Growth in general merchandise (+8% Y/Y) and electronics/home appliances (+2.7% Y/Y)

- Success in government-backed trade-in programs

- Robust Singles Day promotion and luxury brand expansion

JD Retail

Government-Backed Trade-In Programs

- Launched trade-in programs in over 20 provinces, where customers can benefit from seamless services like delivery, installation, dismantling, and cleaning.

- To remain competitive, JD.com has adopted a low price strategy, to compete with Pinduoduo PDD.

Expansion into Apparel and Accessories

- JD.com is focusing on becoming a top destination for stylish fashion, enhancing product variety and shopping experience.

- French luxury brands BALENCIAGA and SAINT LAURENT opened their flagship stores on JD.com in Q3 2024.

JD Health

- JD Health enabled online payments via medical insurance accounts in 10 cities during Q3 2024.

- Services now available in 12 cities, including Guangzhou, Shenzhen, and Chengdu.

- Covers nearly 2,000 medical insurance-designated pharmacies.

- Benefits a population of over 100 million as of September 30, 2024.

JD Logistics

- JD Logistics partnered with Taobao and Tmall Group to integrate systems in Oct 2024.

- Many Taobao and Tmall merchants now use JD Logistics services.

- Users can track JD Logistics shipments directly in Taobao and Tmall apps.

- JD has also partnered with AutoCore.ai to develop end-to-end autonomous driving systems for logistics.

Risk Analysis

- Anti-monopoly guidelines introduced in 2021 increased scrutiny on firms like JD.com and Alibaba.

- Heavy fines have been imposed, e.g., Alibaba was fined $2.8B.

- JD.com may benefit short-term as stricter rules curb competitors’ pressure tactics.

- Balancing regulation to prevent monopolies while fostering growth is crucial in China’s context.

- Economic slowdown affecting consumer spending.

- Expanding globally adds complexity and may impact returns due to geopolitical tensions and supply chain risks.

- Focusing on Asia and Europe, with added emphasis on India, could drive stronger growth than pursuing the U.S. market.

2029 Valuation

Assumptions :

- LTM Revenue: $154.58B (assuming USD/CNY = 7.15)

- 5Y Revenue CAGR: 5%

- 2029 Profit Margin: 4.25%

- 2029 PE Ratio: 12

- Shares outstanding: 1.546B

- Shares reduction: 6%/year

Valuation :

- Q2 2029 JD SHARE PRICE = 154.58 * (1.05)^5 * 0.0425 * 12 / [1.546 * (0.94)^5] = $89

- Using discount rate for JD as 12%.

- CURRENT SHARE PRICE: $35

- DISCOUNT RATE: 12%

- FAIR VALUE: $89 / (1.12)^5 = $50

- POTENTIAL UPSIDE: (($50 – $35) / $35) × 100% = 43%

- EXPECTED RETURNS: ((($89 / $35)^(1/5)) – 1) × 100% ≈ 10%/year

- DIVIDEND YIELD: 1.77%

- MY RATING: STRONG BUY ✅ | Accumulate slowly on red days.