TLDR;

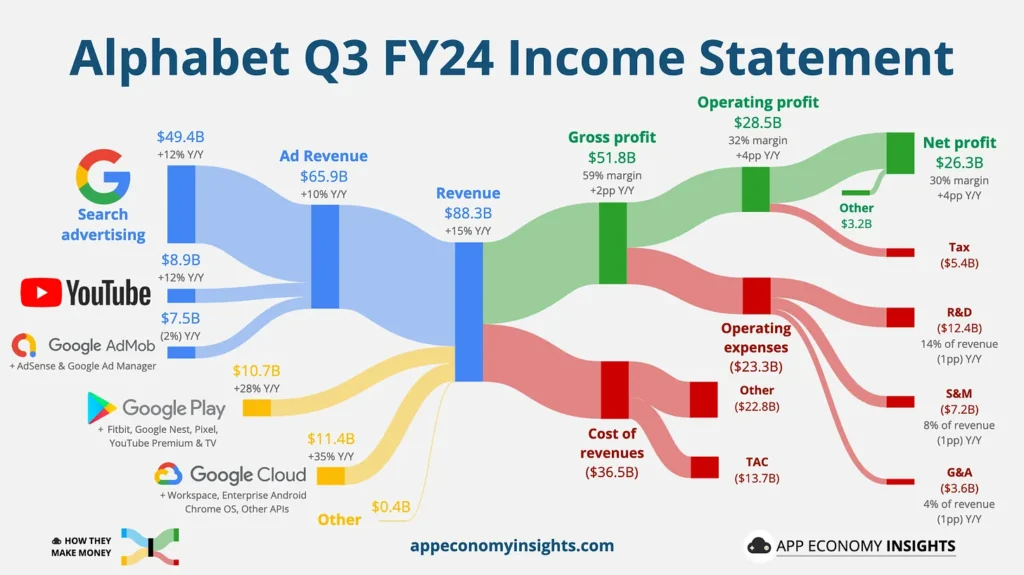

- Advertising: $65.9 billion (+10%, down from +11% in Q2).

- Search: $49.4 billion (+12%).

- YouTube ads: $8.9 billion (+12%).

- Network: $7.5 billion (-2%).

- Subscriptions, platforms, and devices: $10.7 billion (+28%).

- Cloud: $11.4 billion (+35%, accelerating from +29% in Q2).

- Small Buyback Increase.

- Cheap Valuation.

Google’s Q3 FY24 Results:

- Revenue grew +15% Y/Y to $88.3 billion ($2.0 billion beat).

- Gross margin was 59% (+2pp Y/Y).

- Earnings per share (EPS) was $2.12 ($0.27 beat).

- Operating cash flow was $30.7 billion (35% margin, -5pp Y/Y).

- Free cash flow was $17.6 billion (20% margin, -10pp Y/Y).

- Long-term debt: $13 billion.

Google Services Segment:

- Q3 revenue: $76.5 billion (87% of Alphabet’s total)

- Year-over-year growth: 12.5%

- Operating margin: 40.3% (up from 35.2% YoY)

Advertising Revenue:

- Total: $65.9 billion (75% of total revenue)

- Year-over-year growth: 10.4%

- Breakdown:

- Search: +12.2%

- YouTube Ads: +12.2%

- Google Network: declined 2% (9th consecutive quarter)

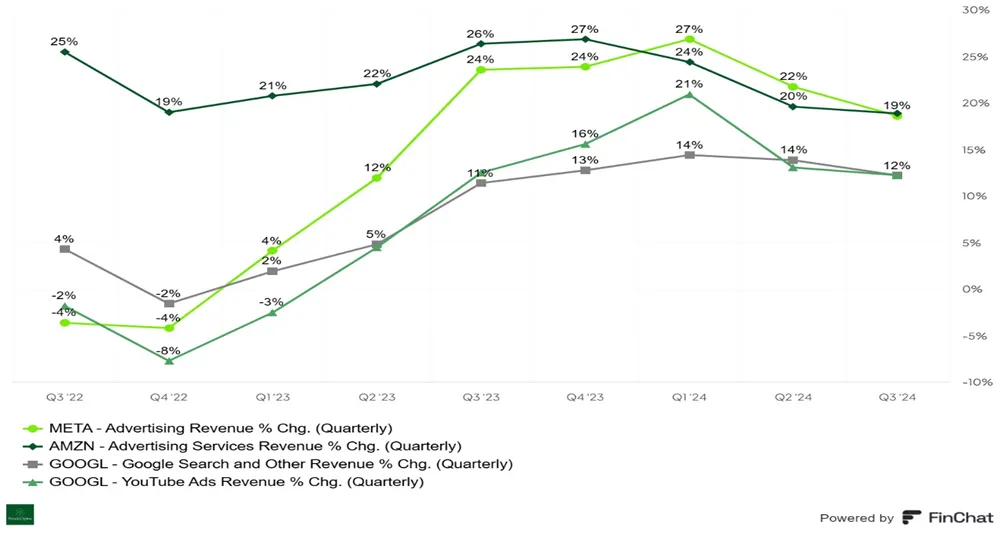

Competitive Landscape:

- Amazon’s ad revenue: $14.3 billion (+19% YoY)

- Meta’s ad revenue: $39.9 billion (+19% YoY)

- Intensifying competition for Google in digital ad spend.

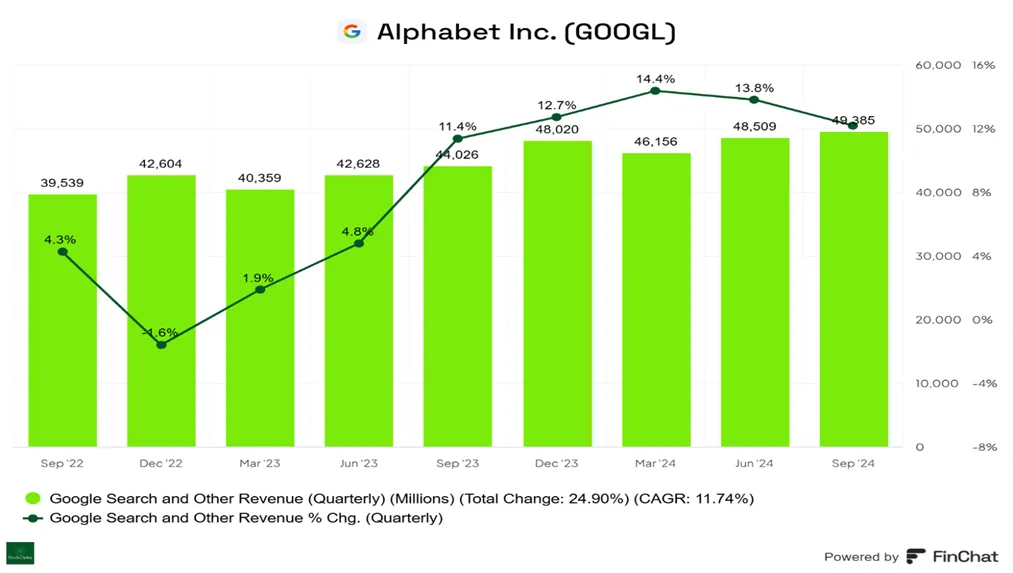

Google Search Segment:

- Q3 2024 revenue: $49.4 billion

- Year-over-year growth: 12.2%

- Market share: 89.3% (down from 91.6% in Oct 2023)

Competitive Landscape:

- Microsoft Bing:

- Market share: 4.15% (up from 3.1% in Oct 2023)

- Modest gains, but still lagging behind Google

- Google vs. Bing:

- Google outperforms Bing in search revenue growth over the past 6 quarters.

- Google Search remains dominant despite generative AI concerns.

Positives:

- A strong first-mover advantage with Waymo.

- Cloud & enterprise products

- Consumer data – Android, maps, Gmail, Office docs

- Cash position and buybacks

- It has a near monopoly in Search

- Market leadership in media with YouTube.

Negatives:

- DoJ lawsuit & many other govs (e.g. EU) targeting the company.

- Declining search stats , direct impact on ad-revenues.

- In consumer products area – no new ‘wow’ product since 10 years.

- Lower FCF Due to higher Capex.

2029 Valuation

Assumptions :

- LTM Revenue: $328.284B

- 5Y Revenue CAGR: 9%

- 2029 Profit Margin: 28%

- 2029 PE Ratio: 22

- Shares outstanding: 12.581B

- Shares reduction: 2.5%/year

Valuation :

- Q2 2029 GOOGLE SHARE PRICE = 328.284 * (1.09)^5 * 0.28 * 22 / [12.581 * (0.975)^5] = $281

- Using discount rate for Google as 9%.

- CURRENT SHARE PRICE: $172

- DISCOUNT RATE: 6%

- FAIR VALUE: $281 / (1.06)^5 = $210

- POTENTIAL UPSIDE: (($210 – $172) / $172) × 100% = 22%

- EXPECTED RETURNS: ((($281 / $172)^(1/5)) – 1) × 100% ≈ 6.5%/year

- DIVIDEND YIELD: 0.53%

- MY RATING: Wait for consolidation 🟡 (~$150)|, for conservative buyers : Accumulate on red days.