TLDR;

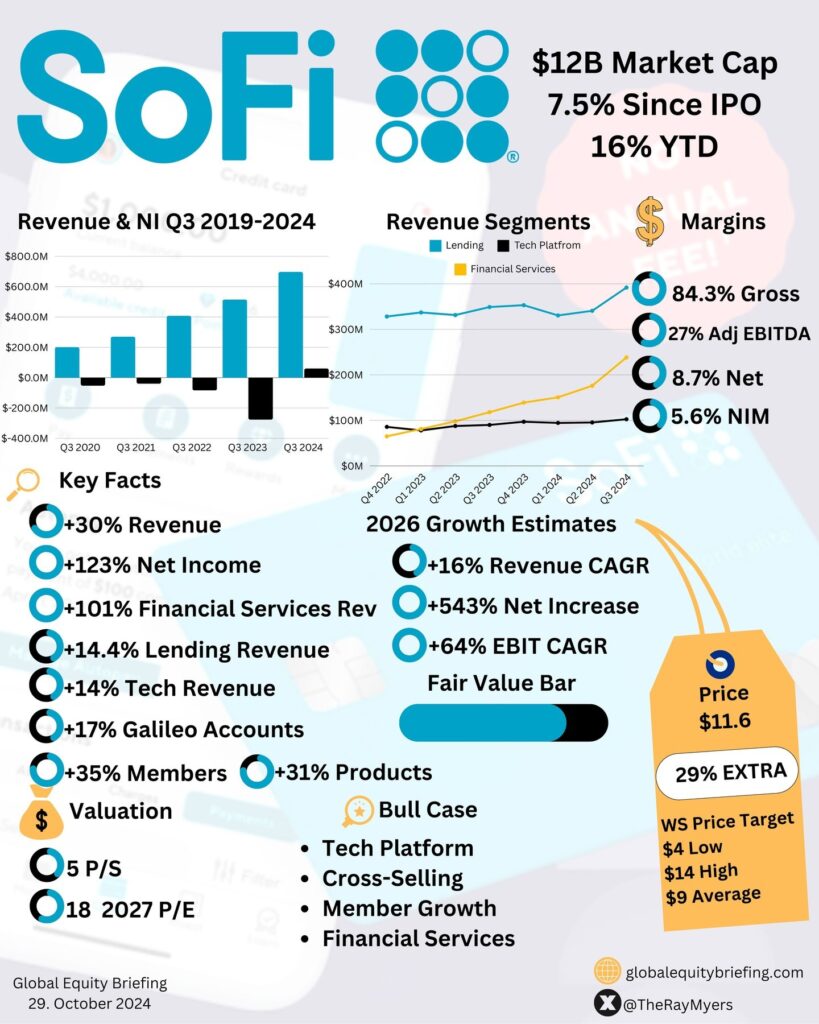

- $689M Revenue +30%

- $61M Net Income +123%

- Inflecting Profitability

- Supreme Financial Services Growth

- Amazing Member and Products Growth

- Reasonable Valuation

SoFi Q3 FY24 Results:

- Membership Growth: 750,000 new members added, reaching 9.4M (35% YoY growth).

- Product Expansion: 1.1M new products added, totaling 13.7M (31% YoY growth).

- Tech Revenue: 14% YoY growth, contributing $30M to operating income.

- Financial Services: Revenue doubled YoY to $238M from $118M.

- Net Interest Income: $431M (+25% YoY).

- Average Interest-Earning Assets: +35% YoY.

- Average Yields: -44 basis points YoY.

- Net Interest Margin: 5.57% (vs. 5.99% YoY).

Q3 Product Highlights

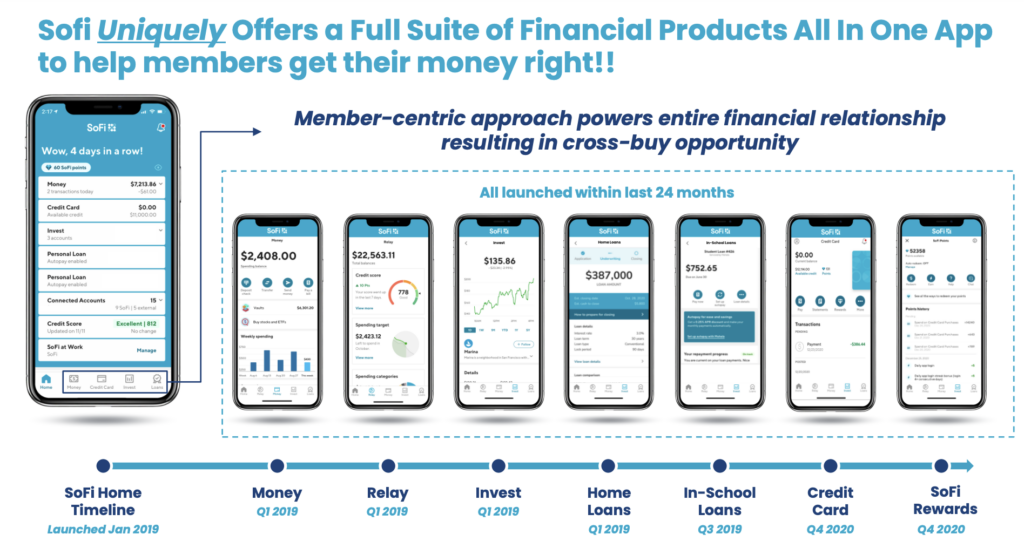

- SoFi Money: Record accounts, deposits, and direct deposit members.

- SoFi Invest: Strong engagement driven by new investment products.

- SoFi Credit Card: Launched Everyday Cash Rewards and Essential cards.

- Loan Platform: $1B personal loan volume, record results.

- Tech Platform: New partnerships, fraud protection, and secured credit offerings.

- Home Loans: Best refinancing quarter since Q2 2022 (+23% sequentially).

- Credit Performance: Improved delinquencies (57bps) and net charge-offs (3.52%).

- Brand Awareness: +40% YoY, highest ever average unaided awareness.

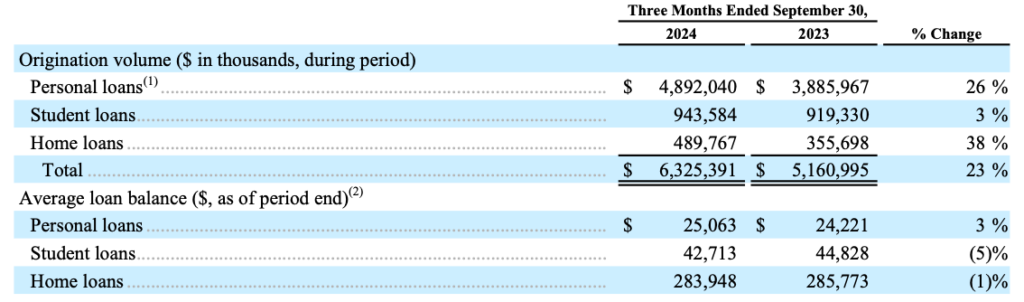

SoFi’s Strong Loan Portfolio

- Borrower Profile: Average income $150,000+, average FICO score 740+.

- SoFi’s Creditworthiness rule: Minimum FICO score 680 for lending.

- Charge-off Rate: 2.7% (Q1 2023).

- Expected Loan Losses: 4.5% (portfolio life).

- Personal Loans Originated: $1B (on behalf of third parties).

- Servicing Cash Flow: $5.5M.

- Adjusted Net Revenue Contribution: $61.1M.

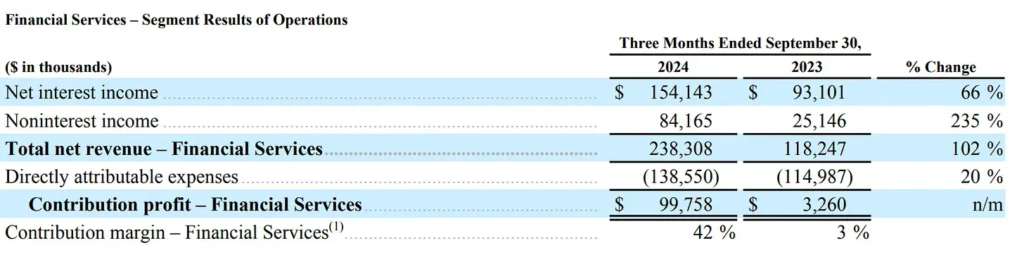

Financial Services Segment

- Revenue Growth: $238M (+66% YoY).

- Non-Interest Income: $84M (35% of revenue).

- Expense Growth: 20% (despite revenue doubling).

- Contribution Margin: 42% (up from 3% YoY).

- Operating Leverage: Significant improvement.

- Transition to fee based revenue streams brings significant operating leverage

2029 Valuation

Assumptions :

- LTM Revenue: $3.52B

- 5Y Revenue CAGR: 55.34%

- 2029 Profit Margin: 5.07%

- 2029 PE Ratio: 10

- Shares outstanding: 1.104B

- Shares reduction: 10%/year

Valuation :

- Q3 2029 SoFi SHARE PRICE = 3.52 * (1.55)^5 * 0.0507 * 12 / [1.104 * (0.90)^5] = $25

- Using discount rate for SoFi as 9%.

- CURRENT SHARE PRICE: $14.61

- DISCOUNT RATE: 9%

- FAIR VALUE: $25 / (1.09)^5 = $16.27

- POTENTIAL UPSIDE: (($16.27 – $14.61) / $14.61) × 100% = 11.37%

- EXPECTED RETURNS: ((($25 / $14.61)^(1/5)) – 1) × 100% ≈ 9%/year

- DIVIDEND YIELD: NA

- MY RATING: BUY ✅ | Accumulate only on red days.