TLDR;

- CELH Q3 FY24 Results: Revenue down 31% YoY, Net Income down 92% YoY, but International Sales up 37% YoY.

- Business Overview: Functional energy drink brand targeting fitness enthusiasts with low-calorie, no-sugar drinks.

- Competitors: CELH has 3% market share, vs. MNST (35%), Red Bull (25%), and Rockstar Energy (14%).

- Valuation: CELH’s FCF margin is 16.5%, with potential to reach 20%. Trading at 23-24x FCF multiple, with 4% yield and potential 14% long-term return.

CELH Q3 FY24 Results:

- Revenue: $265.7 million (-31% YoY)

- Net Income: $6.4 million (-92% YoY)

- International Sales: $18.6 million (+37% YoY)

- Free Cash Flow: $11.4 million, down 80% YoY

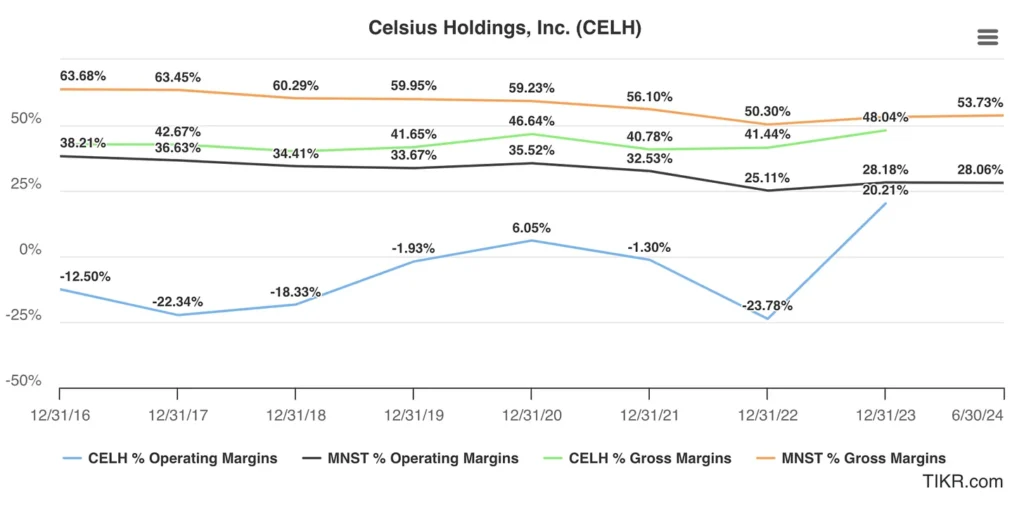

- Gross Margin: 46.0% (-440bps YoY)

- Net Margin: 2.4%, down 12.6% YoY

- Acquisition: Big Beverages Contract Manufacturing

Who is $CELH, and what are they selling?

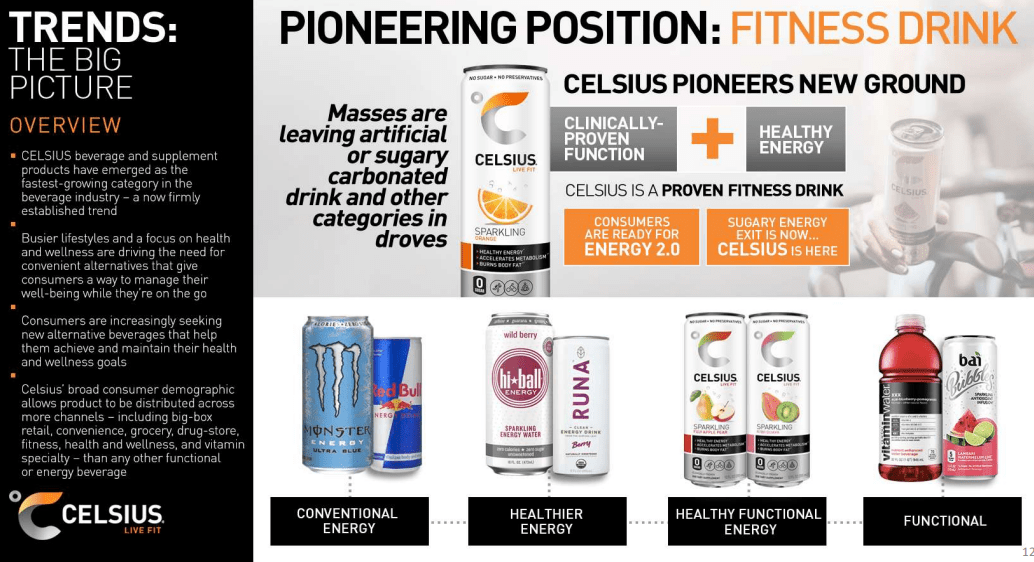

- Functional energy drink brand targeting the fitness industry.

- Offers low-calorie, no-sugar drinks.

- Differentiates from legacy energy drinks (RedBull, Monster) by targeting fitness enthusiasts.

- Taps into growing demand for healthy energy drinks.

- Has gained a cult following, driving growth with minimal marketing expenses.

- Unique customer value proposition: healthy, energy-boosting drinks for fitness enthusiasts.

Celsius Moat

- Regularly launches new products to broaden portfolio and grow customer base.

- Partnered with Pepsi for distribution, enabling rapid growth, shelf space, and cost savings.

- Growth driven primarily by US success (95% of revenue from North America).

- North American revenue grew 90% YoY.

- European revenue accounts for 4% of total revenue and is growing 35% YoY.

- After just 2 years, 47% of Celsius’s revenue comes from Pepsi distribution.

- Amazon’s sales are at 11% and quite important as they are driven by word of mouth.

- Costco’s share remains grew to 15%.

Competitors Analysis

- Monster Beverage (MNST): 35% market share, $4.2B revenue, 26.2% net margin.

- Red Bull: 25% market share, $7.4B revenue, 17.6% net margin.

- Rockstar Energy (PepsiCo): 14% market share, $2.3B revenue, 23.5% net margin.

- Bang Energy (Vital Pharmaceuticals): 5% market share, $1.2B revenue, 16.8% net margin.

- Celsius Holdings (CELH): 3% market share, $822M revenue, 2.8% net margin.

Valuation Analysis

- Current FCF Margin: 16.5%

- Room for Improvement: Significant, compared to Monster Beverage’s 28% FCF margin.

- Potential FCF Margin: 20%

- FCF Multiple: 23-24x on current market cap.

- Yield: 4%

- Growth rate required: 10% in free cash flow.

- Potential Long-term Return: 14-25% per annum, beating the market.

2029 Valuation

Assumptions :

- LTM Revenue: $1.371B

- 5Y Revenue CAGR: 30%

- 2029 Profit Margin: 10%

- 2029 PE Ratio: 30

- Shares outstanding: 0.235B

- Shares reduction: 8%/year

Valuation :

- Q3 2029 CELH SHARE PRICE = 1.371 * (1.30)^5 * 0.10 * 30 / [0.235 * (0.92)^5] = $73.78

- Using discount rate for CELH as 9%.

- CURRENT SHARE PRICE: $28.45

- DISCOUNT RATE: 9%

- FAIR VALUE: $73.78 / (1.09)^5 = $47.93

- POTENTIAL UPSIDE: (($47.93 – $28.45) / $28.45) × 100% = 68.5%

- EXPECTED RETURNS: ((($73.78 / $28.45)^(1/5)) – 1) × 100% ≈ 21%/year

- DIVIDEND YIELD: NA

- MY RATING: BUY ✅ | Accumulate only on red days.