TLDR;

- From money loosing to free cash flow of $2.1B(+133% YoY)

- Good growth in existing mature markets.

- Expansion in new markets (Japan, Spain, Argentina, Germany, South Korea, Italy)

- Uber has smart strategic partnerships with its competitors.

- Uber owns a 27.5% stake in Grab (Southeast Asian Uber)

- If Waymo and Tesla dominate the US market, they might not need Uber as a platform.

- Good short term trade with target of $74.(23.3% Upside)

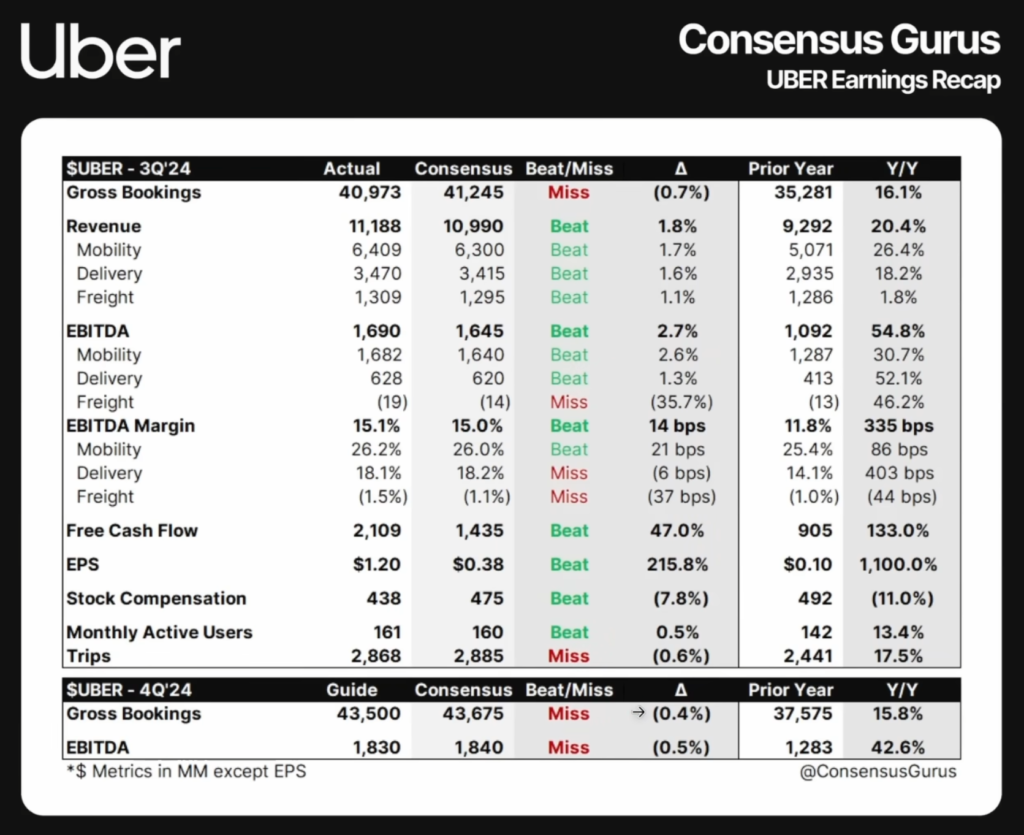

UBER Q3 FY24 Results:

- Revenue: $11.2B (+20% YoY)

- Net Income: $2.6B

- Gross Margin: 33%

- Net Margin: 10%

- Trips: 2.9B (+17% YoY)

- Mobility Gross Bookings: $21.0B (+17% YoY)

- Delivery Gross Bookings: $18.7B (+16% YoY)

- Free Cash Flow: $2.1B

- Free Cash Flow Margin: 14.2%

- Share Repurchases: $375M (3.4% of revenue)

- Monthly Active Platform Consumers (MAPCs): 161 million, up 13% YoY

How do they make money?

- Based on 3 main segments: Mobility, Delivery, and Freight

- Mobility (Ride-sharing): 55% of total revenue

- Delivery (Food and Groceries): 32% of total revenue

- Freight (Logistics): 13% of total revenue

- Generates revenue through commissions (take rate: 25-30%)

- Acts as a middleman between supply and demand sides

Market Share:

- Ride-hailing Market Share (US): Uber has a 77% market share, while Lyft has 23%.

- Food Delivery Market Share (US): Uber Eats has a 24% market share, while DoorDash leads with 65%.

- Global Ride-hailing Market Share: Uber’s global market share is around 68%, with other players like Didi Chuxing, Grab, and Bolt making up the rest.

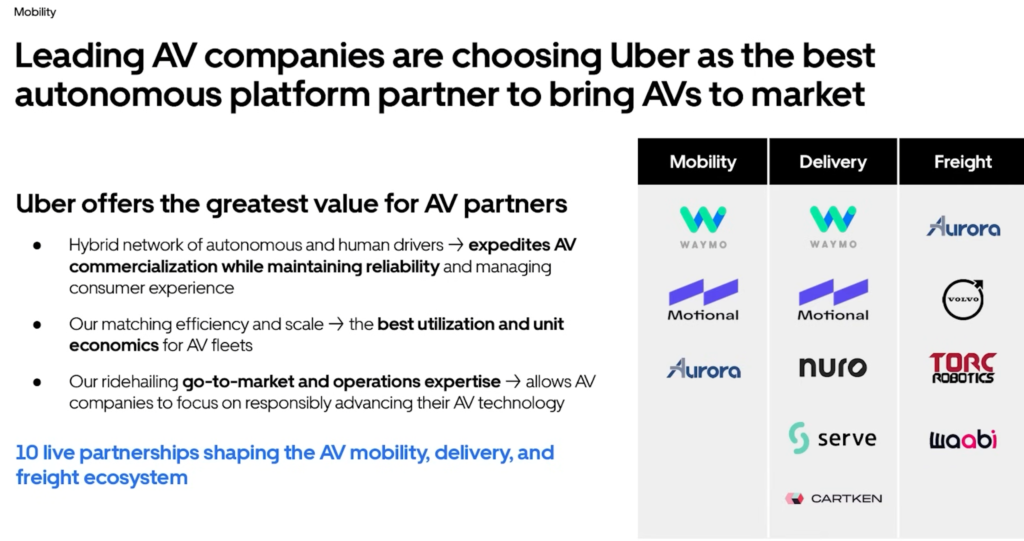

Uber’s AV/Robotaxi Revolution:

- Uber is well-positioned to be enabler of the AV revolution.

- Partnerships with AV players to offer autonomous rides through the Uber app.

- 14 AV partnerships, including Waymo, Cruise, and Avride and expanded global AV offering.

- Notable deals with Waymo and Cruise to deploy autonomous vehicles on the Uber platform.

Competitive Advantage:

- Uber’s platform and network effects provide a significant moat.

- Limited responsibilities but earns billions through partnerships.

- Highly recognized platform with 150+ million users.

- Potential to improve take rate with the push into AVs.

- Significant portions of revenue will still go to Uber, even with AV partnerships.

Uber’s AV Partnerships

- Waymo Partnership: Uber to offer driverless Waymo robotaxis in Austin and Atlanta from 2025, exclusively via the Uber app.

- Cruise (GM) Partnership: Uber and Cruise to launch commercial AV service in 2025, following a fatal accident in San Francisco.

- Wayve Partnership: Uber partners with British start-up Wayve to develop AI technology for autonomous driving.

- BYD Partnership: Uber and BYD to offer autonomous-capable vehicles on the Uber platform, potentially competing with Tesla’s robo taxi fleet.

Competitors Risk Analysis

- Waymo (Alphabet subsidiary): Strong technical expertise, large-scale testing, and partnerships with automakers pose a significant threat to Uber’s robotaxi ambitions.

- Tesla: Autonomous taxi network plans, large user base, and vertical integration of autonomous technology pose a competitive risk to Uber.

- Cruise (GM subsidiary): Strong backing from GM, significant investment in autonomous technology, and partnerships with other companies pose a threat to Uber’s robotaxi plans.

- Argo AI (backed by Ford and VW): Significant investment in autonomous technology, partnerships with major automakers, and potential to partner with other ride-hailing companies pose a competitive risk.

Partnership Risks:

- Dependency on Partners: Uber’s robotaxi plans rely on partnerships with autonomous technology companies, which poses a risk if these partnerships are unsuccessful or terminated.

- GM owned Cruise: GM announced a refocus of its autonomous driving development on personal vehicles, which led to a decline in Uber’s stock price.

- Waymo Expansion: In Mami Waymo partnered with Moove for fleet management which was seen as setback for Uber.

- Uber-Moove Partnership: Uber is a strategic partner of Moove via two board seats, and provides its ERP system to Moove for fleet management which indirectly put Waymo as partner of Uber.

2029 Valuation

Assumptions :

- LTM Revenue: $41.96B

- 5Y Revenue CAGR: 16.70%

- 2029 Profit Margin: 9%

- 2029 PE Ratio: 25.50

- Shares outstanding: 2.11B

- Shares reduction: 5%/year

Valuation :

- Q3 2029 UBER SHARE PRICE = 41.96 * (1.17)^5 * 0.09 * 25.50 / [2.11 * (0.95)^5] = $91.81

- Using discount rate for UBER as 6%.

- CURRENT SHARE PRICE: $59.93

- DISCOUNT RATE: 6%

- FAIR VALUE: $91.81 / (1.06)^5 = $73.91

- POTENTIAL UPSIDE: (($73.91 – $59.93) / $59.93) × 100% = 23.3%

- EXPECTED RETURNS: ((($91.81 / $59.93)^(1/5)) – 1) × 100% ≈ 9%/year

- DIVIDEND YIELD: NA

- MY RATING

- Short Term (6-12M) : BUY ✅ | Accumulate only on red days.

- Long Term (3-5Y) : HOLD 🟡 | To wait for partnerships resilience and revenue outcome once its live in 2025