TLDR;

- AMZN Q4 FY24 results show strong growth with $187.79B revenue (+10.5% YoY)

- Cloud computing revenue expected to reach $690B by 2032, driving growth.

- E-commerce revenue expected to reach $1.1T by 2027, with AMZN’s 45% market share.

- Digital advertising revenue expected to reach $150B with 10% market share.

- AMZN expands into new areas: logistics, fintech, robotics, and automation.

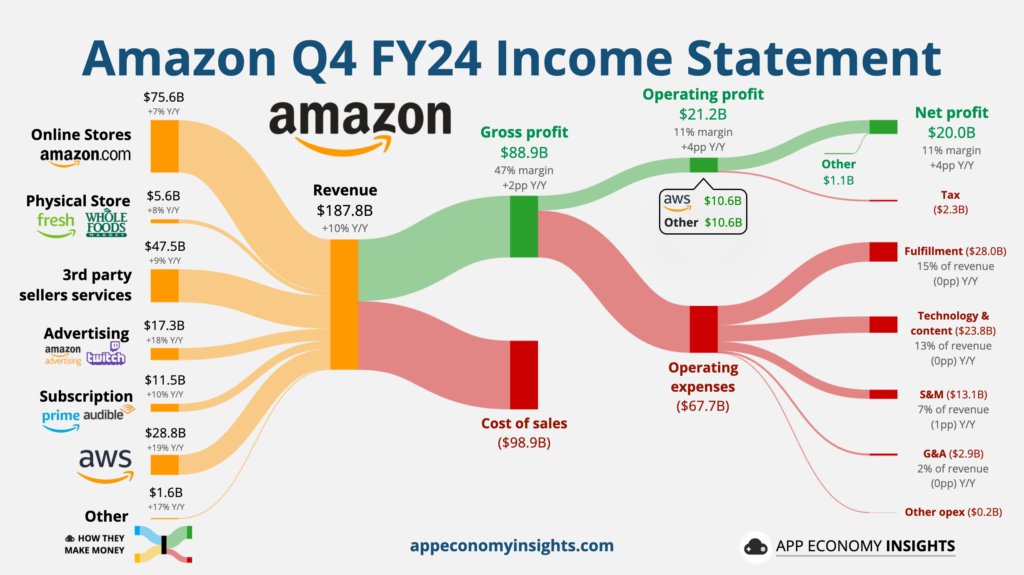

AMZN Q4 FY24 Results:

- Revenue: $187.79B (+10.5% YoY)

- Operating Margin: 11.3%

- FCF Margin, TTM: 6.0%

- Net Margin: 10.7%

Breakdown of $AMZN business segments

$AMZN has three businesses that make +$100 billion annual revenue:

- E-commerce: $247 billion

- Cloud Computing: $108 billion

- Third party seller services: $156 billion

- Despite their size, growth of these businesses will accelerate

Market research firms expect cloud computing to reach $2.3 trillion in size by 2032.

- According to 2024 measures, Amazon has 47% revenue market share in this market.

- Even if its market share reduces to 30% over time, $AMZN will generate $690 billion cloud revenue in 2032.

$AMZN also has 37% operating margin in the cloud business.

- Though this is already very high, it can further expand this margin through adoption of its custom ASIC chips.

- It’s making its custom chips for training AI models that are 40% more cost efficient than $NVDA GPUs. This will also reduce capex over time and boost margins.

- Even if the operating margin expands to 40% this will be $276 billion operating income only from cloud.

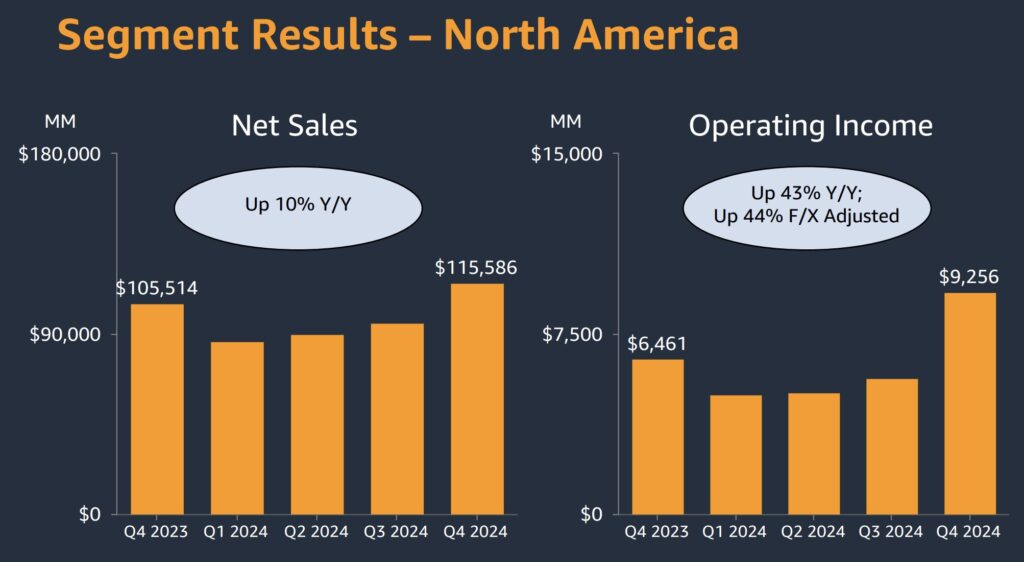

$AMZN stores and third party sellers combined now generate $403 billion for Amazon.

- In the last quarter, revenue grew 10% YoY while operating income grew 43%.

- It has 8% operating margin in North America segment which is double that of Walmart’s. That will expand as ads and logistics businesses grow.

- Its operating margin will further improve as scale of this business ever grows and cost to serve per unit declines.

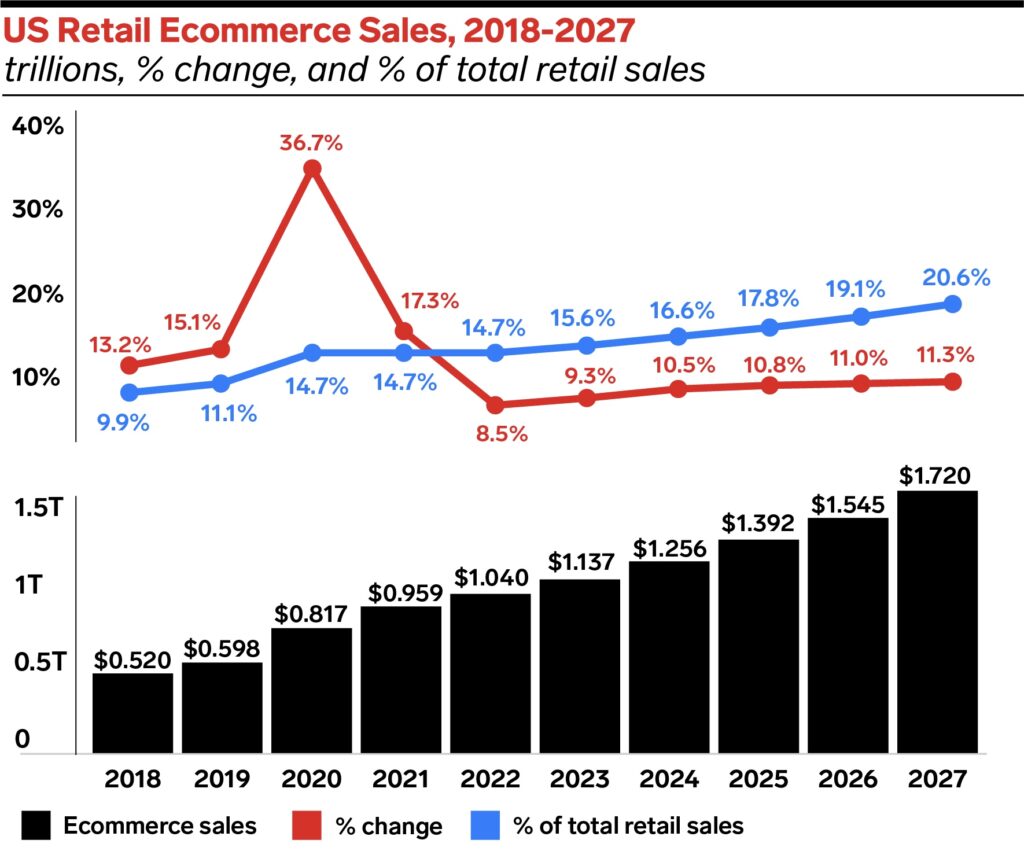

US e-commerce is expected to grow around 10% annually in the next 3 years and reach $1.7 trillion by 2027.

- Even if it grows only 7% annually between 2027-2032, the market will reach $2.4 trillion.

- $AMZN has 49% share in this market.

- Even if only keeps 45%, this will be a $1.1 trillion revenue channel.

$AMZN is growing its market share in digital advertising.

- It expanded its global market share from 3.8% in 2019 to 7.1% in 2023 and 7.4% now.

- This is a huge market growing still very fast.

- US digital advertising market is expected to become a $1.5 trillion market by 2032.

- If $AMZN can expand its market share to only 10% in this segment, it will generate $150 billion ad revenue.

On top of all these businesses $AMZN has many other bets.

- One of them is Amazon logistics where Amazon hire with independent contractors for delivery.

- It’s rapidly gaining market share from UPS and FedEx only by delivering Amazon packages.

- That will also be a massive revenue channel if it opens it for third party businesses at some point.

- It’s preparing to bet big on Fintech and create its own digital bank.

- Amazon store card was the first step of this expansion.

- It can easily reach +$200 billion payment volume if it only processes 50% of the payments on Amazon marketplace.

$AMZN is also the largest robotics company in the World.

- It’s betting heavily on robots from humanoids to drones to boost automation.

- It currently has over 750,000 robots deployed in its distribution centers.

- This is by far the largest workforce that any company has in the World.

- Humanoid packaging robots cost $1 million each, replace 25 human workers, and return investment in just 2 years.

- E-commerce margins will expand significantly thanks to them.

- Imagine what this will do to its operating margin once they achieve near full automation.