TLDR;

- Undervalued based on financial metrics.

- Track record of CCP on anti-globalization and dismantling Deng Xiaoping’s economic reforms.

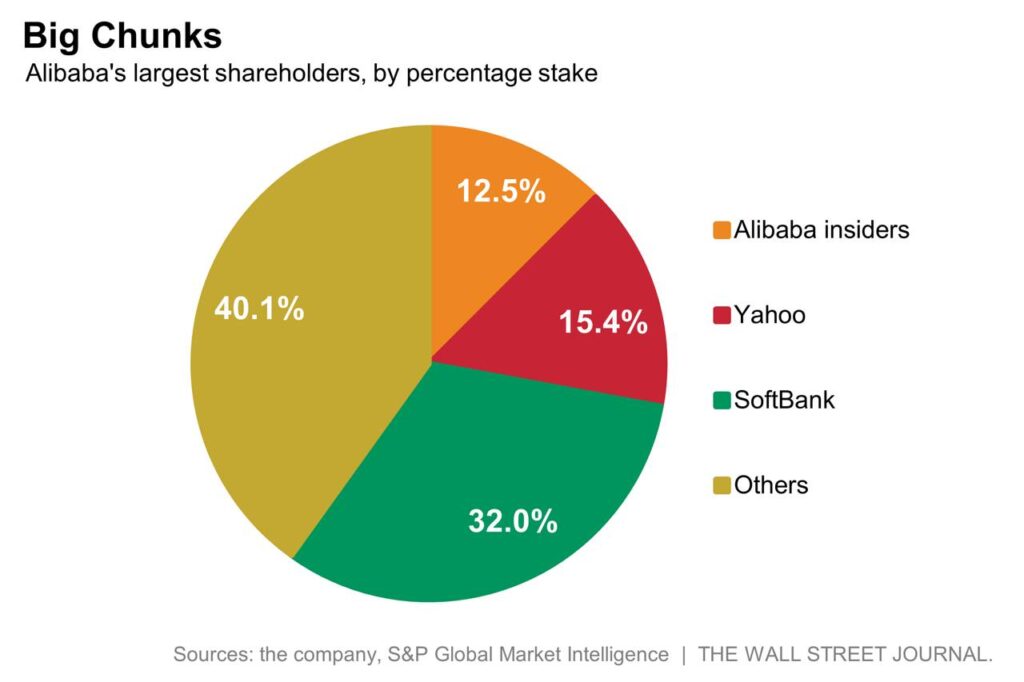

- Politicians are actively discouraging the leadership of the company from rewarding (foreign) shareholders.

- Uncertain long shot on economic policies pursued by China as its almost impossible to foresee political risks, and it would be best to stay away from this stock.

Traditional Metrics

- P/E ratio of 9x at the time of writing, compared to a P/E of 41 for Amazon.com and a 49 P/E for MercadoLibre, Inc.

- Revenue FY’24 : $130.4 B (+8% y/y)

- EBIT FY’24 : $15.7 B (+13% y/y)

- EBIT Margin FY’24 : 12.0%

- Free Cash Flow FY’24 : $21.6 B (-9% y/y)

- FCF Margin FY’24 : 16.6%

- Solid financials since 4 yrs, still its down 70% from its historical peak.

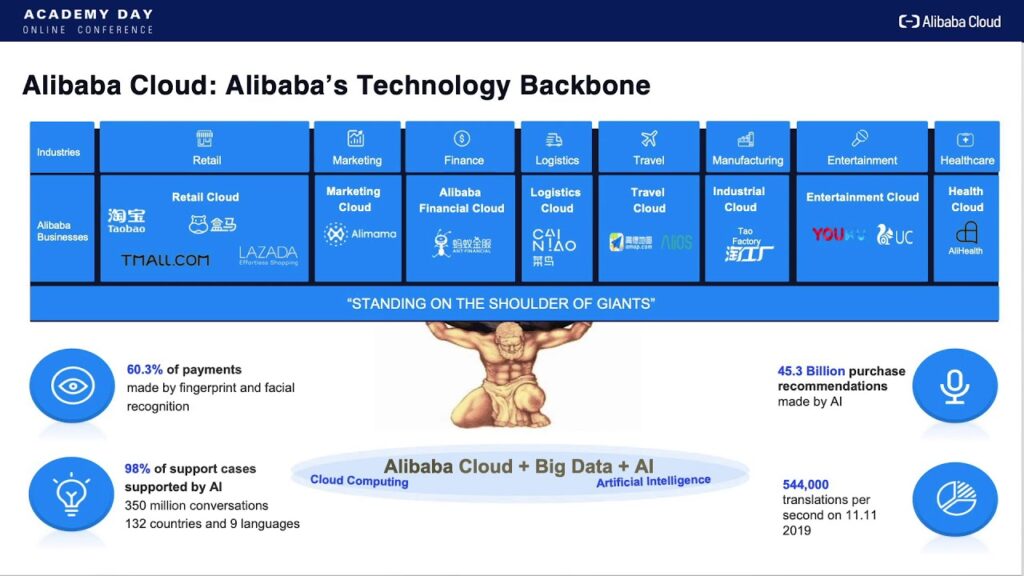

Alibaba Cloud’s AI Bet

- Free Cash Flow decreased by 52% YoY due to heavy re-Investment in Alibaba Cloud infrastructure.

- Since last year in June ’23, Alibaba Cloud’s Qwen LLM model has reached over 90,000 enterprise deployment.

- Xiaomi has included Qwen’s Q&A capability in its smart assistant Xiao Ai found in smartphones and the new SU7 electric vehicle.

- This year, in Singapore, The company released the PAI-Lingjun Intelligent Computing Service, a hybrid platform for high performance computing.

Political Risk

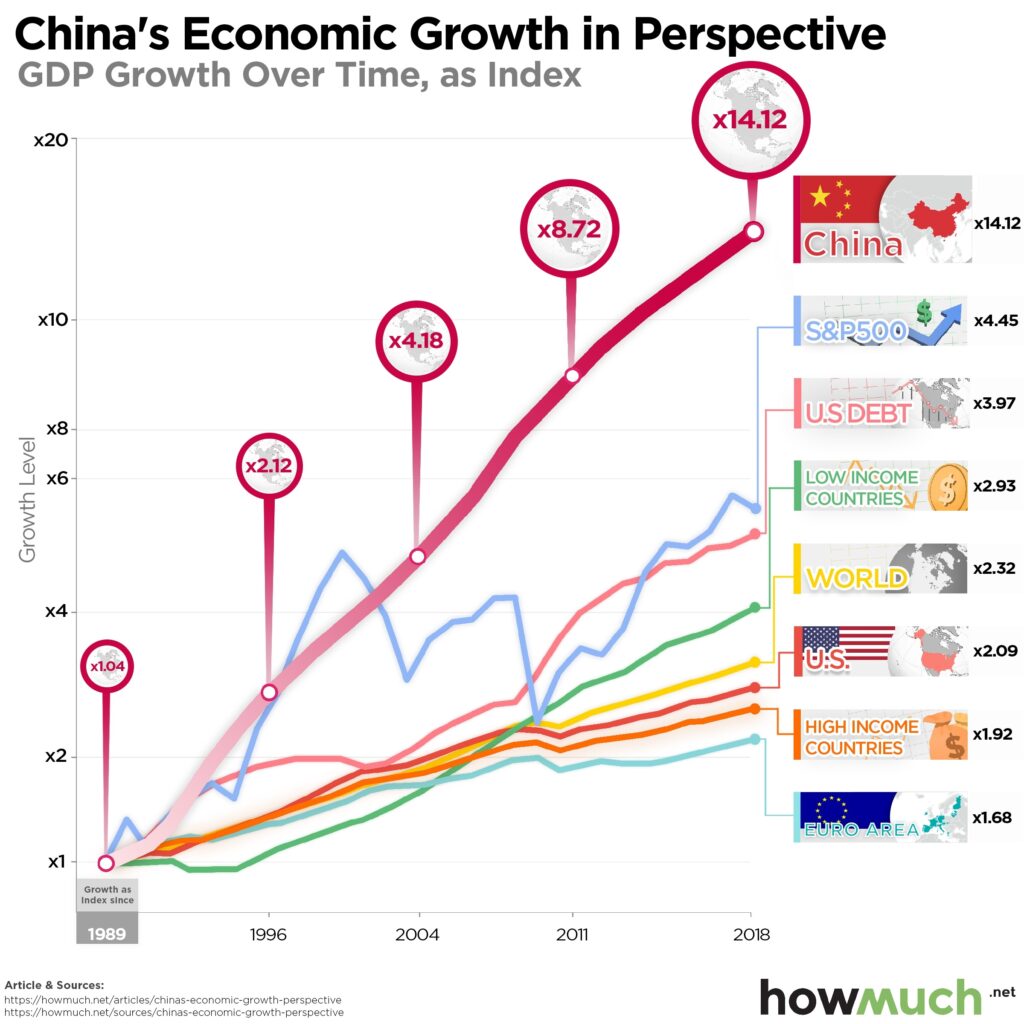

1. Dengism between 1980s and 1990s in China

- Under leadership of Deng Xiaoping, China prospered economically which later known as Dengism.

- Dengism = Socialist market economy + reforms and opening up for foreign investment.

- Result = More than ~700 Million people were lifted out of poverty during 1980s and 1990s.

2. China opening to west for investment

- For foreign investors to invest in the country, Variable Interest Entity (VIE) structure was introduced in 2003.

- A Chinese firm forms an offshore company under VIE structure, often in the Cayman Islands. This offshore entity is given control of profits and decision-making of the local company.

- Still to date west can invest via VIE structure only.

- There is no legal structure in China that permits foreign ownership of local assets. Local legislation does not protect foreign shareholders either.

- Risk of escalating tension between China and West + CCP turning away from Dengism.

3. Xi Jinping Era

- After 3 decades of economic growth, Xi Jinping came into power in 2013.

- In 2017 CCP’s leader emphasized on governmental intervention and refusal of Deng’s economic policies, indicating “new era” for China.

- Later using Covid 19 as a reason, govt became more aggressive to have control over private companies

- Starting 2020, Chinese stocks have lagged far behind than worldwide markets.

- In late 2023, Xi Jinping urged once again private firms to be “rich and loving” in pursuing prosperity for all.

- Biden administration also started to impose tariffs and sanctions on china.

Impact on Alibaba

- To start with “New Era” Alibaba was choosen to be made example due to its strong international backing.

- After an antitrust case on Alibaba, lasting for a brief period, the firm incurred a $2.8 billion fine and was made to split into multiple legal entities.

- Company’s management is mandated by CCP to contribute its profits to their “common prosperity” projects and not to prioritize foreign shareholders.

- Since 2020, Jack Ma, the maverick founder of BABA, has not been seen in public physically.

Contrarian Bet on BABA

- BABA with being profitable + Moat in cloud and e-commerce space in china = Solid.

- If CCP re-opens door for globalization, stock could do a 10X return.

- In FY 2024 Alibaba gave back to shareholders (Foreign + Local) about $16.5B via share buyback and paying dividends.

- Company paying juicer dividends to reward foreign shareholders without necessarily going against CCP can be considered.

- Due to unpredictable political landscape, investors can risk 2% of their portfolio with BABA.

2029 Valuation (Updated)

Assumptions :

- LTM Revenue: $129.48B

- 5Y Revenue CAGR: 7%

- 2029 Profit Margin: 15%

- 2029 PE Ratio: 14

- Shares outstanding: 2.378B

- Shares reduction: 6%/year

Valuation :

- Q2 2029 BABA SHARE PRICE = 129.48 * (1.07)^5 * 0.15 * 14 / [2.378 * (0.94)^5] = $219

- Discount rate for BABA as 12%. (China risks using an higher discount rate + quite conservative assumptions.)

- CURRENT SHARE PRICE: $75

- DISCOUNT RATE: 12%

- FAIR VALUE: $219 / (1.12)^5 = $124

- POTENTIAL UPSIDE: 65%

- EXPECTED RETURNS: 23.9%/year

- DIVIDEND YIELD: 1.34%

- MY RATING: Buy