TLDR;

- Dump due to many factors Mt. Gox, ETFs, halving, Germany, and interest rate cuts.

- Bitcoin has dropped from $71k to $57k, a decline of around 20%.

- If $57,800 levels are not sustained with good volume, then we would end up $45-55k zone.

- Social media ‘buy the dip’ calls on rise.

- As Trump being in favour of crypto, his win would result in greater good for crypto market.

- Feds have hinted that investors might see a rate cuts starting end of 2024.

Why is $BTC dumping?

1. Mt. Gox

- A hacking attack caused the crash of this cryptocurrency exchange in 2014.

- Last month Mt. Gox announced that it would payback its users who lost their investment during the attack.

- The clients of the exchange will receive 142,000 bitcoins, or 0.68% of total supply of BTC.

- A lot of people are afraid that if they receive some Bitcoins, creditors could sell them.

- Undoubtedly it would impact market, considering the amount of BTC they will have.

- Additionally, the pure fear that it may happen has led a lot of people to sell off BTC.

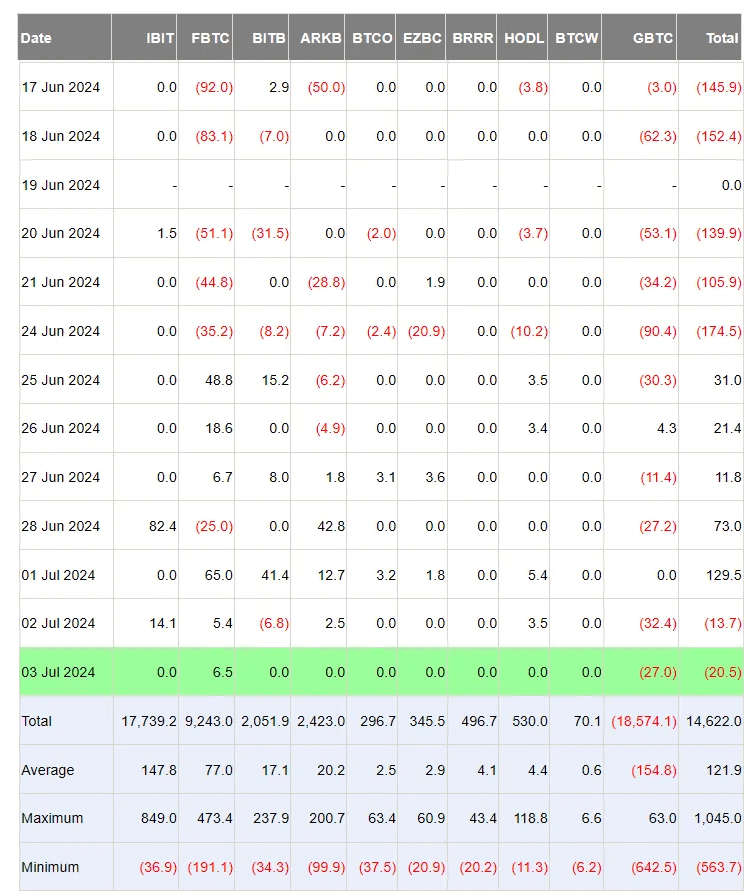

2. BTC ETFs

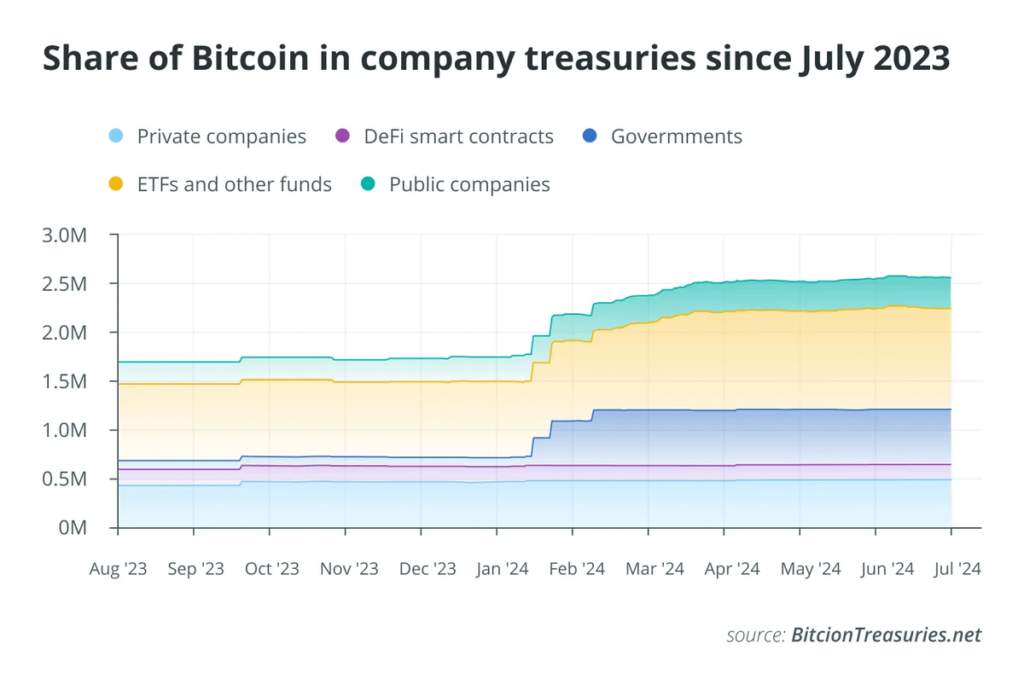

- Currently, BTC ETFs hold 5% of Bitcoin’s total supply.

- BTCs price is now highly dependent on sentiments of large investors.

- This is due to outflow of large investors from Bitcoin ETFs, which also cascades to BTC prices.

- Grayscale Bitcoin Trust GBTC has been exiting ETFs with avg $154M.

- BlackRock’s IBIT has went dark on inflows, whereas Fidelity’s FBTC and ARK 21Shares Bitcoin ETF(ARKB) consistently leading in terms of outflows.

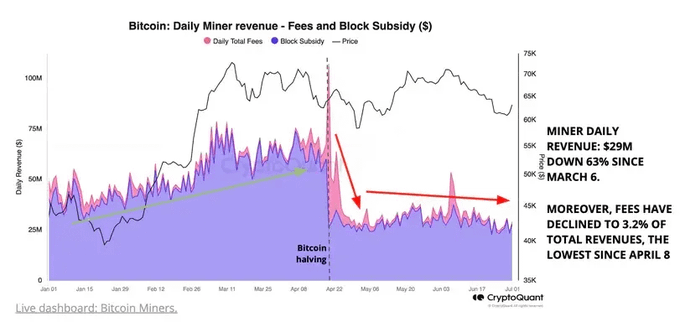

3. Miners

- Halving occurred on the 20th of April 2024, reducing rewards for miners from 6.25 to 3.125 BTC per block.

- For miners to stay motivated, it was necessary to see an increase in BTC prices; something which was awaited by most.

- It did not happen, so many miners are now necessitated to dispose of their BTC.

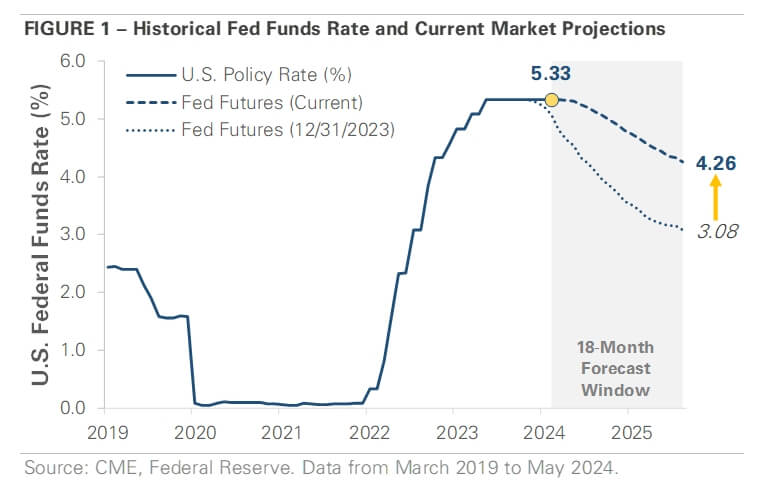

4. U.S. Interest Rates

- Lower is the interest rate, more appealing would be high-risk investments (like crypto).

- The minutes from the FRS meeting reveal a hesitance by policymakers to lower rates.

- Cuts would not happen until indicators shows if inflation is heading towards desired rate of 2%.(Current U.S. inflation stands at 3.27%)

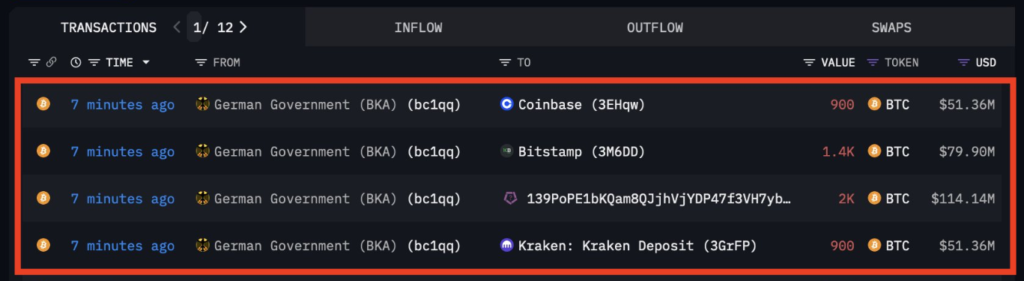

5. Germany

- The government of Germany held a large share($2.4B) in BTC and lately, began to sell off its asset.

- The German Government sent another 5200 BTC ($297.3M) to Kraken, Bitstamp, Coinbase and 139Po.

- That makes this the biggest day for them so far – over 16,000 BTC in total sell off on 8th July.

- As of 8th July 24, They hold 23,787.7 BTC ($1.35B). Less than half of the BTC originally seized from Movie2k remains.

Bright side of falling BTC

1. Major Investors still holding BTCs

- Bitcoin’s downturn, has allowed corporations to buy more BTCs assets instead of offloading.

- The largest miner, Marathon Digital Holdings, has not disposed of its assets, despite needing to free up capital.

- In the past, it has been noted that bitcoin prices begin to increase approximately four months after a halving in the mining reward.

- If the same thing happens again, bullishness will likely win over bearish sentiments before autumn begins.

2. Community

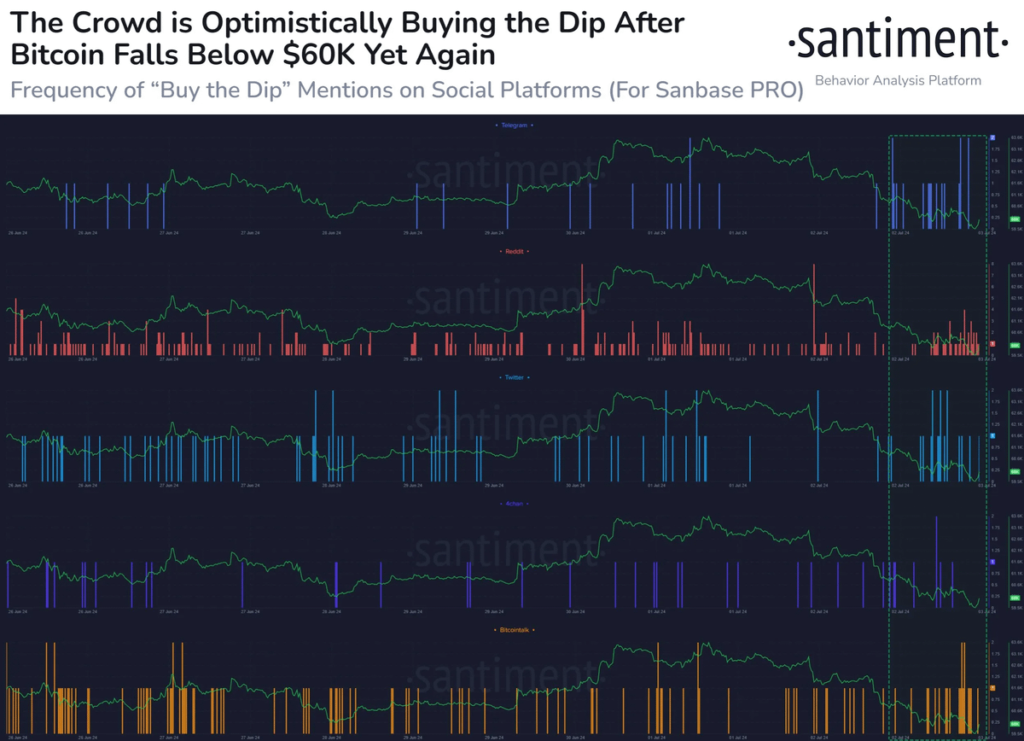

- “Buy the dip” demands in social media are escalating as reported by Santiment.

- When it is priced below $60,000, Bitcoin becomes more preferable over other currencies.

- Statistics on the calls to buy Bitcoin across various social networks is shown in below image.

3. U.S. Elections

- America’s crypto community is showing rapid growth and presidential candidates have not let go of the topic.

- Most recent debates, suggests that Donald Trump, who openly supports the growth of crypto market, will win the presidency.

- If Trump wins, the SEC might be headed by someone who supports cryptocurrency.

Conclusion

We looked at the bad as well as the good side of the present market. Let me not stand in your way, it’s better if you analyze it alone then come up with your own plan instead of me deciding anything for you.

What about me: In my opinion, BTC is an excellent long-term investment (at least 5 years). I am not worried about the future of cryptocurrencies; I believe the market is in good shape