Revenue

During the last two fiscal years, fintech firm, InCred scaled 2.6 times, rising from revenues of Rs 488 crore in FY22 to revenues of Rs 1,267 crore in FY24. In addition, profit increased by over ten times during this time period.

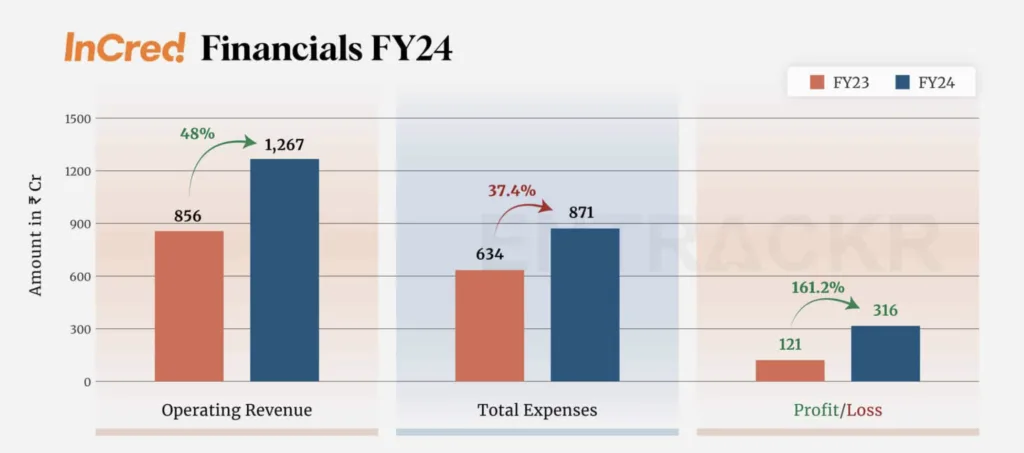

During the same financial year their operational revenues rose forty eight percent (48%) to reach Rs 1,267 crore (Rs 1,267,000,000) compared to Rs 856 crore (Rs 856,000,000) recorded in FY23.

Expenses

Started by Bhupinder Singh, InCred lends money to companies and people for homes, school, personal use, and bikes. Money made from the interest on these loans was 94% of all the money it made, going up by 45% to Rs 1,193 crore in FY24.

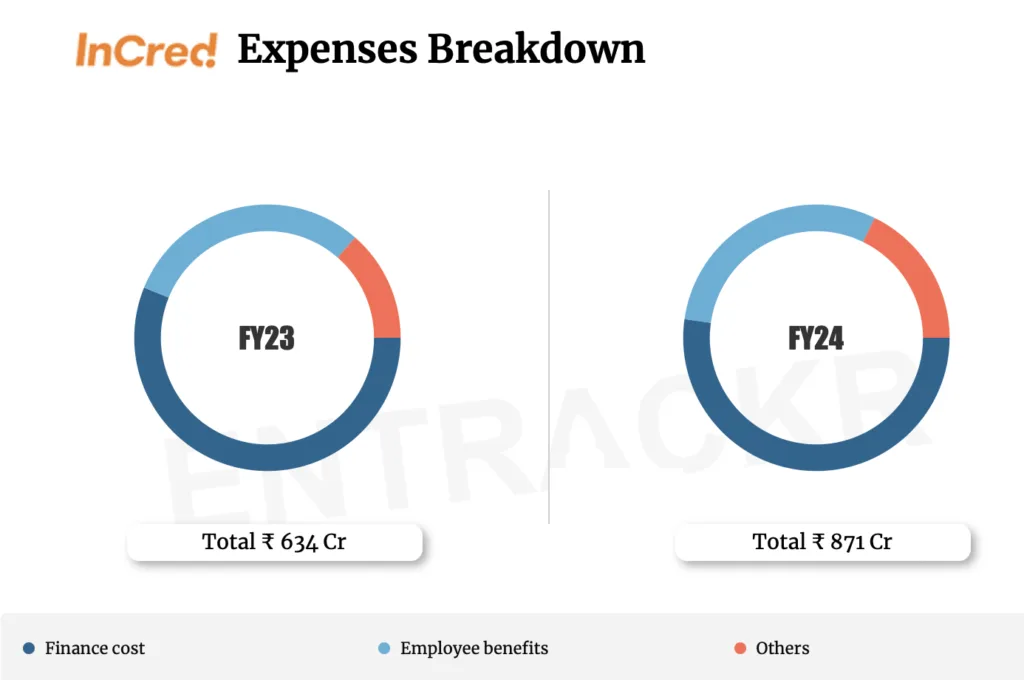

Finance cost accounted for 52% and rose by 27.8% in FY24 to Rs 455 crore while cost measured as a percentage of total cost was 37.4% higher at Rs 871 crore vis-a vis Rs 634 crore in FY23.

In FY24, maximum employee benefits expenses measured were 35.9% higher, in total company hired aggressively in order to keep up with the high growth in FY24.

Profits

In FY24, InCred registered a 2.6X increase in profits to Rs 316 crore from Rs 121 crore in FY23, thanks to a satisfactory scale growth and a regulated cost mechanism. Its ROCE stood at 5% while its EBITDA margin reached 34%. The company spent Rs 0.69 to earn a rupee in FY24 at the unit level.

MEMG Fund managed by Ranjan Pai made a $60 million investment in December 2023 which made InCred a unicorn while KKR held the largest external share at 31.5% after B Singh Holding.

Throughout the financial year FY24, InCred had Rs 8,120 crore in total financial assets that included Rs 173 crore in cash and bank balances. In FY24, it had an enterprise value to revenue multiple of 6.7X.

Thoughts

Though InCred is in a competitive market, it has been able to create its own niche and appears as one of the most stable companies within the sector. However it still leaves us with few questions for long term stability.

Is Founder Singh right about banks and other financial institutions not noticing this big market?

What will happen to the company after selling a big part to KKR? as healthy, well established financial firms are hunted by large conglomerates and this makes their numbers drop.