TLDR;

- Opening doors for Ad tier accounts.

- Password cracking is boosting subscription + revenue.

- Pre-ping to build ad tech platform to meet ads demand globally.

- Export of local content globally.

- Netflix to start on live sports (WWE, NFL), with Netflix buying deal of $5B for 10 year period.

- Licensed content is competitive moat to bring returning subscribers.

- Fairly valued based on multiple of 25.

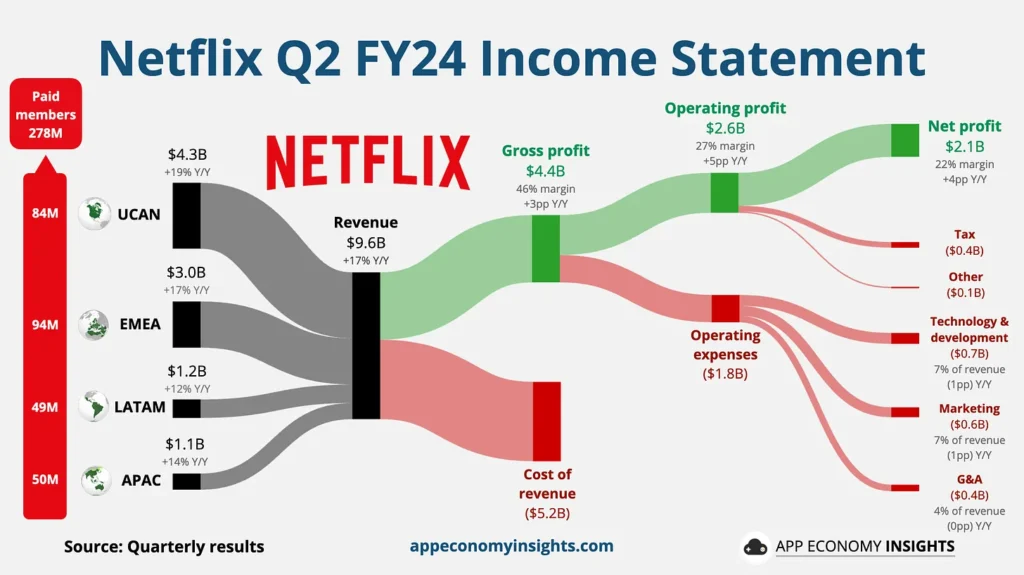

Netflix Q2 FY24 Results:

- Added +8M members Q/Q to 278M total.

- Fastest membership growth in APAC (+24% Y/Y) and EMEA (+18% Y/Y) regions.

- Ads tier membership +34% Q/Q.

- Revenue +17% Y/Y to $9.56B ($30M beat/+3.2%).

- Operating margin 27% (+5pp Y/Y).

- Free cash flow: $1.2B (13% margin)

- EPS $4.88 ($0.14 beat/+2.9%).

- $1.6B worth of shares buyback in Q2 ’24.

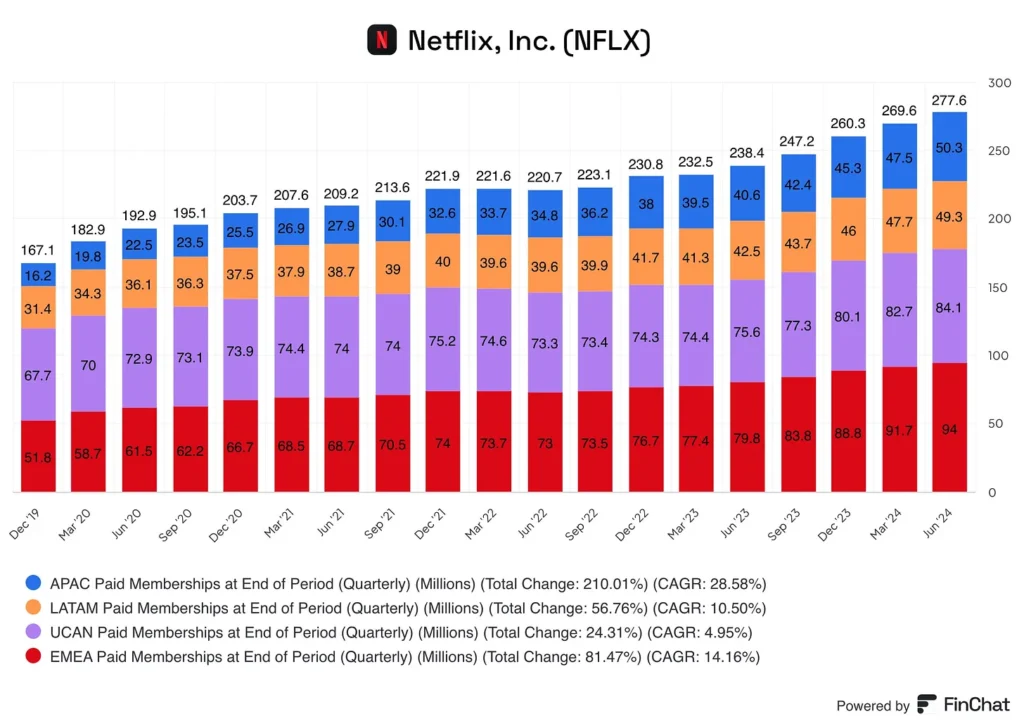

Paid Subscribers Growth

- Started in May 2023, Netflix crackdown password sharing in US + EMEA countries, a move which led to surge of new members.

- Fastest membership growth in APAC (+24% Y/Y) and EMEA (+18% Y/Y) regions.

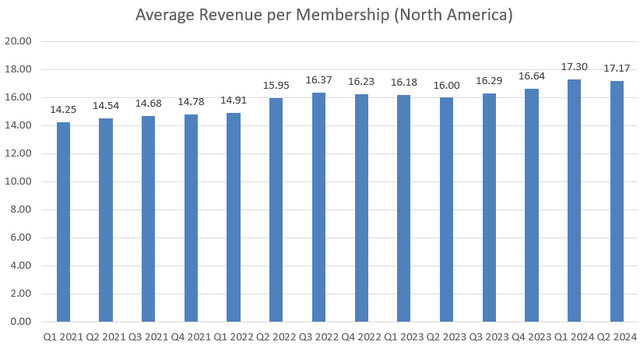

1. ARM (Average Revenue per Membership) Growth

- ARM was up 1% YoY (impacted by Argentina’s inflation).

- Soft growth due to price hikes in October last year.

- Rise in ARM shows new membership inclusion without compromising pricing.

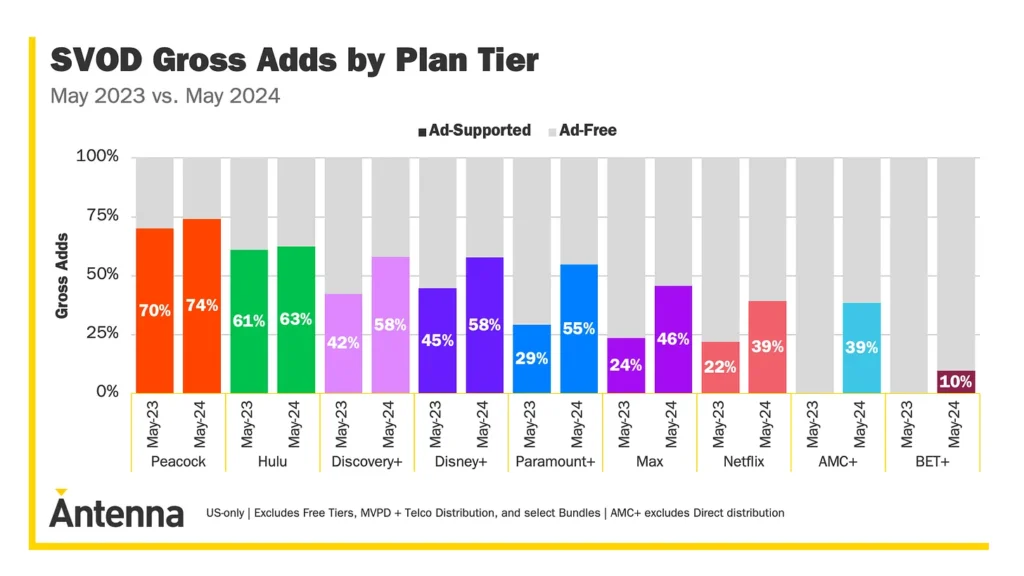

2. Ads Tier Membership

- Netflix launched low-priced ad-supported streaming services in several markets.

- $6.99/month ad-supported plan in US generates more revenue than standard $15.49/month plan.

- Ads revenue would make up for lower subscription price – win-win for both Netflix and budget-conscious subscribers.

- Booming adoption rate for ad-supported memberships – 39% of new sign-ups.

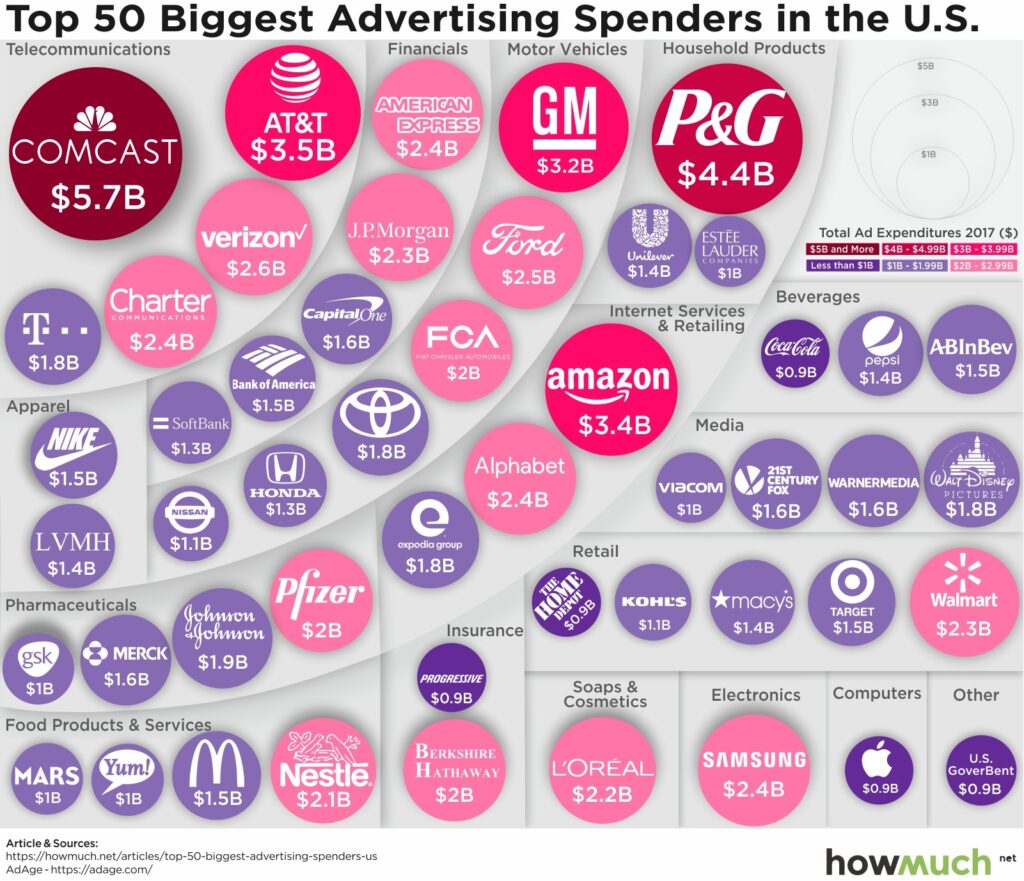

3. Ads Market

- Netflix to launch in-house ad-tech platform by 2025 globally.

- High demand by global brand to advertise on Netflix platform which currently cannot be offered.

- Company has been focusing on ads relevancy, targeting personalization and better measurement.

- This will take time, but considering Meta and Google have pulled-off ads revenue very well Netflix is not farther away.

- As soon as these features are in place and proved to be of quality for biggest ads spenders in the world, the ad inventory will fill up in no time.

North Star : Engagement

- 2hrs viewing per member per day across all plans.

- Great execution in creating local personalised content for different geography.

- Cracking the export of local contents globally would be super unique.

- Every region serves as a sandbox, which could be connected with other sandbox to allow decentralised export of content based on regions genre profiling.

1. High-performing non-english titles

- Korean, Spanish, and Japanese leading the way.

- Squid Game (Korean): 265 million views.

- Money Heist (Spanish): 286 million views.

- Under Paris (French): 91 million views.

- Lupin (French): 168 million views.

- Baby Reindeer (British miniseries): 88 million views.

2. Live sports

- The achievement of ad-supported tier has made live events a perfect option to attract a wider audience & boost advertising revenue.

- Christmas Day NFL games in 2024, 2025, and 2026.

- WWE‘s Monday Night Raw starting in 2025.

- Boxing match between Mike Tyson and Jake Paul.

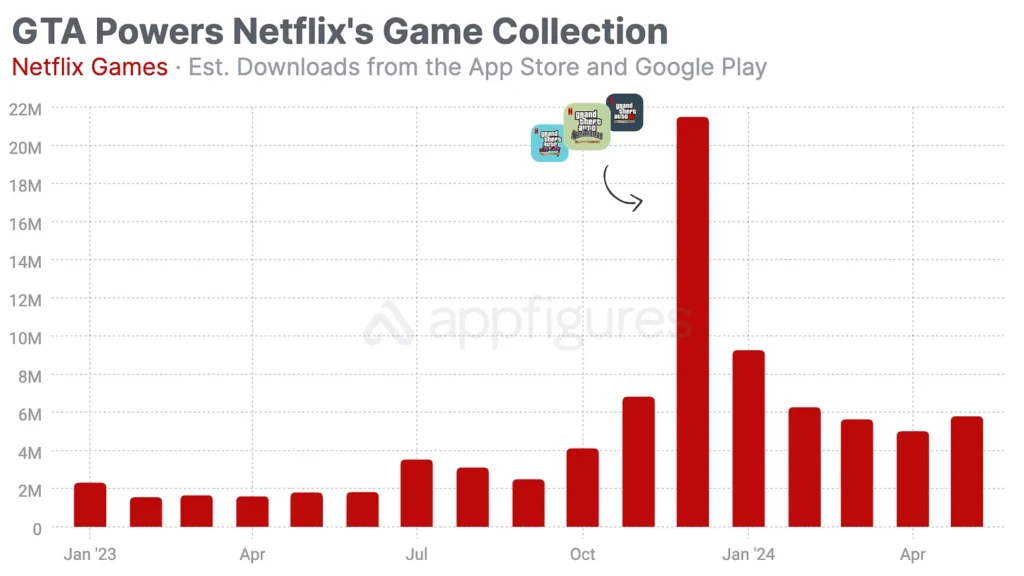

3. Netflix Games

- From App Store, Netflix subscribers can download exclusive games at no extra cost.

- In June 100 games have been added to Netflix’s catalog. 13 were released in 2024 only.

- Roughly one-third of May’s 6 million downloads were made for GTA San Andreas.

- Netflix is planning on releasing a multiplayer game based on Squid Game world when season 2 will be launched later this year.

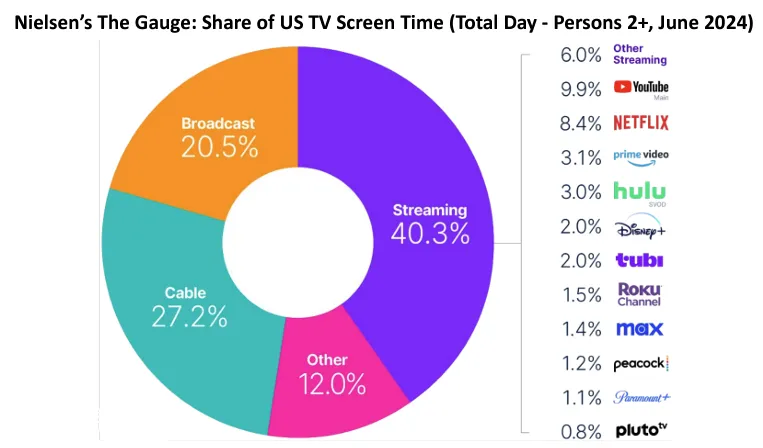

TV vs Youtube vs Netflix

- Netflix owns 8.4% of TV viewing, outmuscling Hulu, Prime Video, and Disney+ combined.

- YouTube increased its market share to 9.9%, eating away Cable shares.

- Youtube & Netflix compete for users attention but for different services & Netflix know’s this.

- The two giants can and will coexist; the question is whether others can keep their shares.

- One should not overlook Netflix’s ability to extend life of licensed content like Suits.

2029 Valuation

Assumptions :

- LTM Revenue: $36.304B

- 5Y Revenue CAGR: 10%

- 2029 Profit Margin: 26%

- 2029 PE Ratio: 25

- Shares outstanding: 0.440B

- Shares reduction: 2%/year

Valuation :

- Q2 2029 NETFLIX SHARE PRICE = 36.304 * (1.10)^5 * 0.26 * 25 / [0.440 * (0.98)^5] = $956

- Using discount rate for Netflix as 10%.

- CURRENT SHARE PRICE: $633

- DISCOUNT RATE: 10%

- FAIR VALUE: $956 / (1.10)^5 = $593

- POTENTIAL DOWNSIDE: 6.3%

- EXPECTED RETURNS: 9%/year

- DIVIDEND YIELD: –

- MY RATING: HOLD, for conservative buyers : Wait for few Qtr’s results