What does Palantir do?

Palantir is a provider of data analytics services which build tools for private and governmental structures with proprietary AI algorithms to find inefficiencies and streamline operations.

Palantir achieves revenue by providing subscription data solutions hence repeat transactions involved forming lasting relationships with clients hence a steady flow of income.

How They Got Here

They have achieved a number of significant milestones during the two decades they spent working with data

- An early boost from a venture capital fund by CIA known as In-Q-Tel.

- They exposed GhostNet, a spy network of around 1,300 affected computers which was operated from China with cells in Dalai Lama’s office, NATO system and some national embassies.

- They are in Medicare as well as Medicaid networks to identify any cases of fraud.

- Assisted in finding location of Al-Qaeda leader and 9/11 orchestrator, Osama Bin Laden.

- They helped get Bernie Madoff convicted, mastermind of largest known Ponzi scheme in history, worth an estimated $65 billion.

- Clients of the enterprise include the CIA, the Department of Homeland Security, the NSA, the FBI, the CDC, US Marine Corps, Air Force, and Special Operations Command; the FDA, Los Angeles PD, US ICE, the English NHS and others.

Revenue

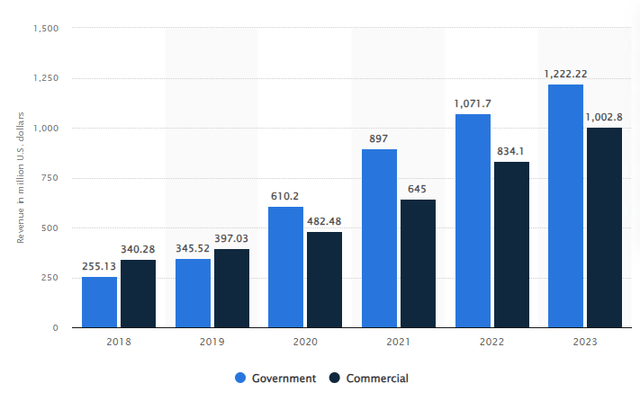

Revenue from both commercial and governmental sources has been increasing, and commercial revenue is again becoming the larger revenue source it was before 2020.

Palantir’s first quarter FY2024 profits suggest that it has two kinds of customers, businesses and governments, each of which have grown a lot since last year.

The market did not find Palantir’s income growth figure too appealing because they were below the targets set before. What was expected from them is around 30%+ increase in earnings, but PLTR only managed 21%.

Expenditures

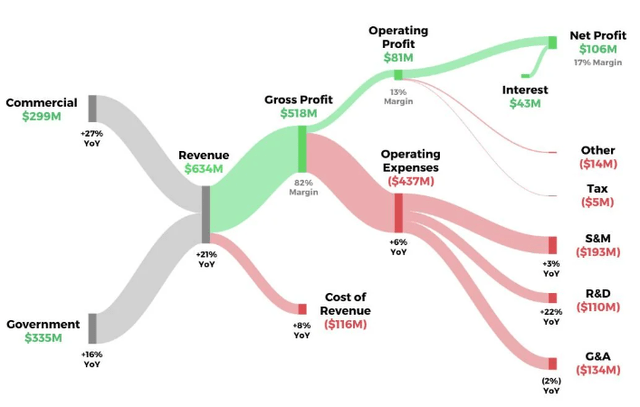

- PLTR’s operating profit income is at a 13% margin.

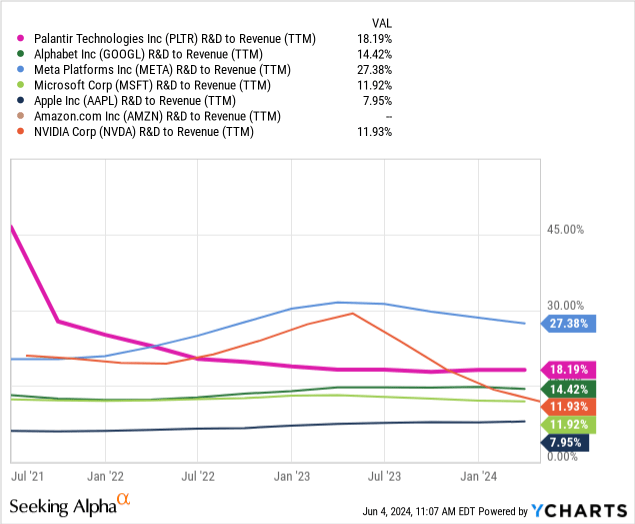

- PLTR spends 18.19% (TTM) of their profits in R&D which is fairly high for a small market cap company.

- This is currently a sensitive area, but one that a young company would tend to face.

- And especially a company that dwells on AI and software development that is research oriented.

Income

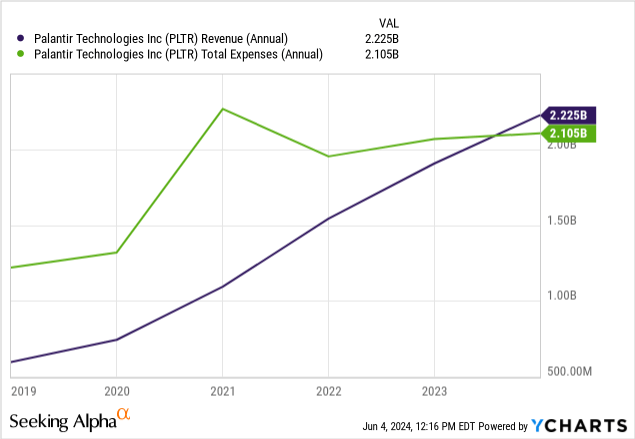

- PLTR this year managed to achieve its first-ever net positive margin and net income since the IPO this past year, which was a big milestone.

- Palantir’s consistent profitability gets it one notch higher to higher valuations and potential S&P 500 inclusion.

- Investors need the revenue line to stay above expenditure line just as it does now, with belief being that Palantir can go on increasing its income without having to raise its expenses in proportion.

Acquiring Customers

- Palantir’s fundamental problem lies in the fact that it has only under 500 customers. Out of which it mainly operates governmentally.

- It is worth noting whether Palantir should concentrate on either quality or quantity. They are presently following a quality strategy whereby they earn the bulk of their money from a few high paying contracts with very high returns that offers like this year’s half-a-billion dollar Army contract.

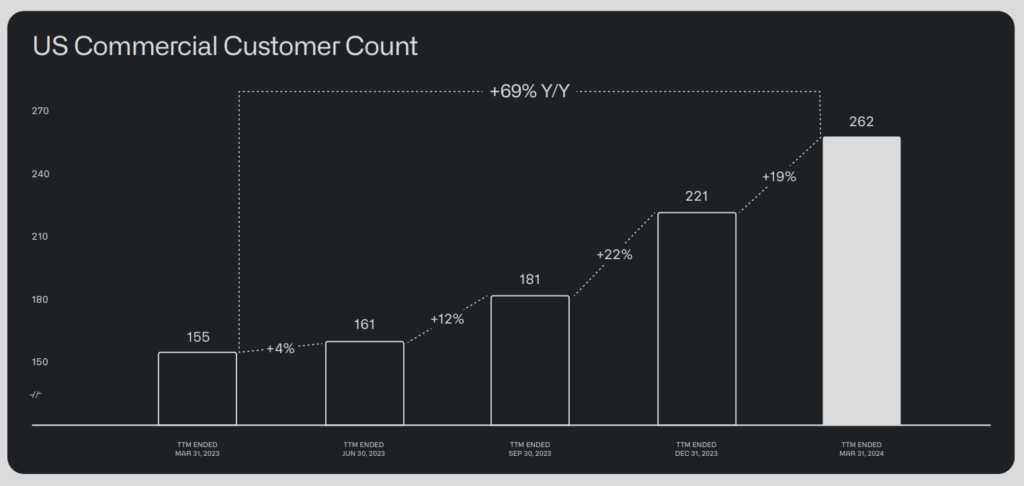

- Palantir is seeking to increase their commercial customer count in an endeavor to become a quantity based business

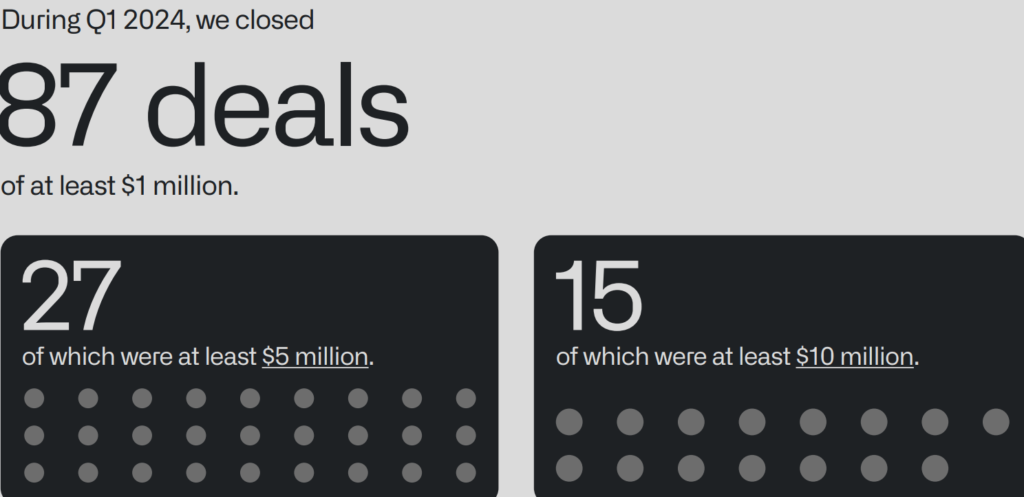

Deals

- Although it appears that Palantir intends to keep pursuing large projects involving the U.S. government, the current strategy of adding smaller customers in the private sector is working.

- Their recently released product known as AI Platform (AIP) works on one-size-fits-all model for its customers to scale and tweak while interacting with it.

Valuation

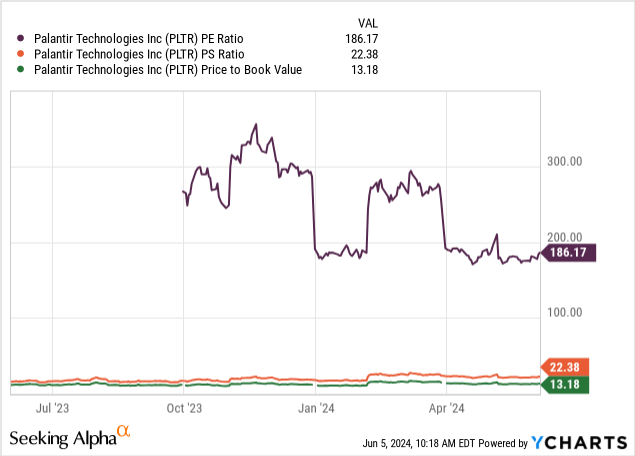

- When earnings are negative until 2023, it poses high valuation with its P/E is at 186x.

- While the earnings increased since 2023 to bring down their P/E from 300x to 186x keeping sales and book ratio steady.

- This is a good thing for PLTR as it shows that the real issue is earnings and not its sales or book value.

- However, provided if PLTR can sustain its revenue and earnings growth rates the P/E ratio should rapidly decrease towards end of 2024 which is good.

Risks

- Inability to attract new customers despite an improvement in sales & marketing spends and adoption of new strategies might result in a further failure to achieve revenue growth.

- Palantir’s R&D spending is relatively low, especially when compared with smaller competitors such as C3.ai in the field of AI. As of now, PLTR have one of the advance platforms in market.

- In case, the US government switched contracts with Palantir, for an instance with Booz Allen Hamilton (BAH), which could effectively half PLTR’s revenue.

- If Palantir does not get on top of AI systems that are considered as new standards, PLTR could be in trouble with business threats from leading companies like Microsoft and Google.

Conclusion

- Palantir’s OS acts as central nervous system for many businesses, which is not easy to decouple from, so many firms end up using Palantir for a very long time.

- It is hard (not impossible) for governmental entities to change vendors, so military has been contracting services from PLTR since 2019 with their expenditure on PLTR exceeding $50M/year .

- A 45% future growth target in commercial segment could lure larger institutions to invest in PLTR and add it into their funds, which could be great push for stock price.

- If the stock drops below $10 (as it had in 2022), Increasing position from 5% to 7.5% could draw ROI.

- Conservative investors should consider an allocation of 2% or less.